Summary:

- Access to 26 markets to trade equities, ETFs, derivatives and CFDs

- Zero fee and no minimum deposit required

- Fixed commission structure on equities, ETFs, funds and futures

- Margining for leverage trading

![]() Pros:

Pros:

- Solid and reliable listed banking group

- Modern, content-rich website

- Free Multicurrency Service

- £500 in trading commissions for new clients

![]() Cons:

Cons:

- Sometimes slow customer service

- Access to some European and exotic stock exchanges not offered

4.8

4.8

Reviews and opinions: Fineco Bank

Fineco Bank was founded as the online bank of the Italian banking group Unicredit (which later exited Fineco's share capital in 2019). Founded in 1999, to date it has more than 1,490,000 clients, over 1,100 employees and a dense network of financial advisors throughout the territory.

With a capitalisation of EUR 5 billion and an annual turnover of more than EUR 700 million, Fineco is considered one of the most solid banking institutions in Italy.

FinecoBank is listed on the Italian stock exchange (ISIN: IT0000072170).

In this review we analysed Fineco Bank mainly from the side of trading services, taking into consideration 8 categories and developing our opinions on Fineco in the final part of the review.

Here s what we found out.

Fineco account

Fineco Bank allows clients to trade a wide range of financial instruments with a trading account and allows also to opt for a long-term investment with an ISA and investment account.

Fineco offers a trading account to operate as a day trader, swing trader, or position trader.

ISA account is a tax-efficient investment method with an allowance of £20,000 per year in line with the broad market. The most significant advantage of this option is that it's unnecessary to record any profits in the taxation form because gains are tax-free.

On Fineco it is possible to transfer an existing ISA account.

Fineco provides multi-currency choices in the “Account Management” section. On Fineco Bank it is possible to trade GBP, EUR, USD, and other 20plus currencies with the possibility of creating multiple sub-accounts.

Fineco allows every trading account holder to trade directly in the base currency and convert it with no additional fees except a tiny variable spread. Basically, it is possible to convert from one currency to another, for example, EUR to USD, and then purchase stocks listed in US markets with US Dollars.

These are the currencies available on the Fineco Trading Platform.

There is a decreasing spread structure for converting any currency depending on capital maintained in the balance of the account. Starting from £500,000 there is a 40% reduction in spreads and starting from £1,000,000 there is a reduction of 50% in spreads.

Fineco has created a product named Regular investment plan that helps the investor to accumulate a capital bundle with a pre-set monthly investment starting from $£E/50.

» Account opening

Opening an account is free as it is closing it. It is possible to open all the accounts via the website and Via Fineco app. We will recommend using the App on the Smartphone.

To open an account, it is necessary to provide an ID like Passport, Identity Card, or UK Driving License. It is necessary also to provide the Tax Identification Number (TIN) and proof of a UK permanent and mailing address.

American citizens cannot open an account with Fineco Bank.

» Deposits and Withdrawals

With Fineco it is possible to fund the account just through a bank account wire transfer.

Fineco provides a Debit Card with no annual fees for the first card, and the second £9.95. Shipping costs £2.95. Free withdrawals in the UK with the GBP and free withdrawal in the Eurozone for the EUR card.

The card will allow the investor to withdraw cash from every ATM. It is possible also to transfer funds to a bank account but this is upon request.

It's possible to transfer existing ISA accounts with no fee.

» What is the minimum deposit with Fineco?

Fineco requires no minimum deposit to activate the account. One can therefore register an account and deposit £0.01 to have it active.

» Is there a Fineco demo account?

Yes, Fineco offers a simulated account but without virtual money. The usefulness of this demo account is to get a quick overview of the main features of the account and the platform. All this without being able to simulate transactions.

Products and Markets

There are 26 markets in which it is possible to invest with Fineco, and the financial instruments that can be traded are as follows:

- Shares

- ETFs

- Bonds

- Futures

- Options

- Covered Warrants and Certificates

- CFD Forex

- CFDs on Indices, Equities and Commodities

The coverage of markets in Italy and Europe is good, as is the access to non-European markets such as Canada, Japan, Australia, Hong Kong and Singapore.

With reference to the US markets, the NYSE, Nasdaq, Amex, OTC US (only for sale after transferring in OTC US shares without Fineco commissions) and CME are available.

On the CME, not only indices and commodities are available, but also a hundred options on US equities.

Fineco's Forex offering, on the other hand, is not particularly advantageous, due to spreads and swaps that are too high compared to brokers with tighter spreads such as Pepperstone.

Trading Fees and Costs

Fineco Bank divides the activity with a different price structure that can be perceived as confusing if you are a newbie.

Fineco Bank separates the trading activity from the investment activity. The online broker also has a Banking Branch that offers banking accounts.

Below Trading Activities:

Live data and news are free for US, UK, and Italian markets.

The platform fee for ISA accounts is a maximum of 0.25% of the investment with a monthly cap of £2.95 for Shares, ETFs, and Bonds. The amount will be calculated on the last day of the month depending on the amount of funds available in the account.

Below are Trading activities prices for financial products:

Euronext Stock has a 9€ trading fee.

Below CFDs price for a trading account:

As we can see there is no commission on CFD shares but Overnight fees are applied as follows:

- CFD on Shares Long Euro Euribor 1m 360 + 2.50%

- Long non-Euro Mid-TOM Next rate + 2.50%

- Short position on all 2.50% flat

For CFD indexes the commissions are structured as follows:

CFDs on Forex long/short position 2.95% + TOM Next Rates

CFDs on Commodities is as follows:

- Long Euro traded Euribor 1m 360 + 2.50%

- Long non-Euro Mid-TOM Next rate of the relevant currency + 2.50%

- Short Euro traded Euribor1m360 – 2.50%

- Short non-Euro Mid-TOM Next rate of the relevant currency – 2.50%

Prices for CME Futures are as follows:

Price for EUREX and IDEM Futures are as follow:

Fineco Bank uses a decreasing price structure for Options contracts:

- Up to the whole commission generated in the month of $499, the cost is $3.95 per single contract

- Up to the whole commission generated in the month of $500 to $9.999, the cost is $2.95 per single contract

- Up to the whole commission paid of $10.000, the cost is $1.95 per single contract. All the Fees expressed in USD or EUR are converted into GBP at the official exchange rate at the time.

Fineco prefers to adopt ETFs as a saving instrument bundling in packages named Regular savings plans ETFs.

- The One plan allows to hold just 1 ETFs for the monthly fee of £2.95

- The Silver plan allows holding 4 ETFs for the monthly fee of £6.95

- The Gold Plan allows holding 10 ETFs for the monthly fee of £13.95. It is possible to include additional ETFs at a monthly cost of £2.95 per single ETFs

European Bonds are available for trading from £6.95 per contract

Fee for the trading platform:

The platform fee is calculated monthly for each last day and can be max 0.25% of the investment. Funds dealing is free of any charge. Stocks, ETFs, and Bonds are charged as in the “trading section” starting from 0.25% with a cap of £2.95 per single stock.

Fineco Bank boasts a Banking service and offers current accounts linked to the trading account and Isa account. The account offers a wide variety of free operations like free debit cards in GBP or EUR, free withdrawals in UK and Eurozone, UK and Sepa Bank transfers, Eur SEPA direct debit, and a funny budget tracker instrument.

With the Fineco UK account, it is possible to send and receive money instantly, pay bills, and extra-large shopping platfond up to £10,000.

Trading Platform

Fineco offers its clients the following platforms:

- FinecoX

- PowerDesk

- Web Trading and Investing

- Mobile Trading App

All the trading platforms are free of charge and no minimum deposit is required to start using them.

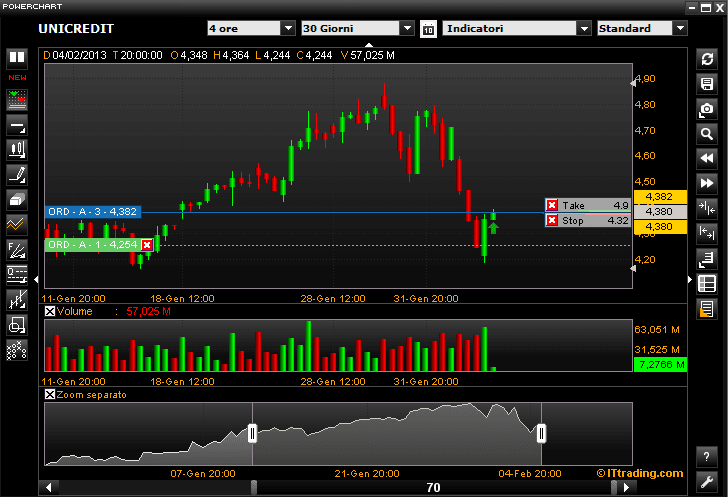

PowerDesk can be launched either from the web or from the desktop by installing it on your PC.

The main PowerDesk tools are:

- Watchlist: to keep track of your favourite titles.

- Alerts: to be notified via popup, email or SMS when an alert is triggered.

- Market Bar: the new ticker on stocks where you can choose which content to display

- PowerChart: an advanced package of indicators for technical analysis

- News: a data feed of news from Reuters, MF Dow Jones News and Websim

- Best&Worst: a list of the best/worst of the day.

In order to trade CFDs and Forex, Fineco provides a free platform: CFD Logos Time.

Order types

Fineco supports the following order types:

- Limit order

- Market order

- Stop order

- Stop limit order

- Trailing stop

- Bracket order

- OCO order

Servizio clienti

Fineco provides assistance to clients and potential clients via telephone and email. On its official website, Fineco boasts that it processes client contact requests with some speed and professionalism.

From our series of cross-tests via phone and email, however, we were less than enthusiastic about the support service we received.

We made 10 calls and sent 10 emails and the results were as follows: 7 calls were answered within the first 5 minutes while for the remaining 3 the waiting time varied between 5 and 15 minutes. Of the emails, however, one was answered within the first 6 hours, 6 emails between 6 and 12 hours and 3 emails between 12 and 48 hours.

For both emails and phone calls, we believe that we often received inadequate answers from not very knowledgeable customer care employees.

Promotions

Fineco offers an entry promotion for new clients of £500 that will forfeit the same amount in the usage of the platform. The amount of £500 in platform fees should be used within 3 months.

Zero ISA platform fee if you open an Isa account for tax balance 23/24 within 29.09.2023. This promotion will be valid till 05.04.2024.

Banking Services and Safety

Fineco is an online bank specialising in online trading but whose traditional banking services are comprehensive and competitive.

Credit and debit cards are available, with a choice of EUR or GBP currency.

With the Fineco bank account, you can make bank transfers, convert currency with favourable exchange rates and much more.

Bank transfers are free and unlimited. Withdrawals in the UK and Europe are also free.

Turning to safety, Fineco is authorised and regulated by the Bank of Italy and operates under the supervision of CONSOB. Fineco Bank is also subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority.

It can be said that Fineco is among the top banks in Italy in terms of safety and soundness. The bank's modern business model cuts a deep furrow compared to that of traditional and popular banks

As a result, all of Fineco's health indicators are among the best by far.

Fineco Bank is a member of the bank deposit guarantee scheme (FITD), which guarantees each account holder coverage up to a maximum of EUR 100,000 (EUR 200,000 in the case of an account jointly held by two people).

Education

Fineco Bank offers a whole section named Learn to Trade and Invest. Fineco offers Live Events, in-depth webinars, and a collection of videos that can be useful to enhance the knowledge of the markets.

The news section is structured in a way that is very easy to comprehend and also for beginners.

The broker provides a YouTube Channel with a whole series of videos that include conversations with top market players, trading education, and tutorial on the platform.

Final verdict

Coming to the end of this review, we can say that Fineco is not only a bank at the forefront of online banking services but also with regard to investments and online trading.

The platforms offered are suitable for both intermediate and advanced users. Access to markets is extensive, both in Europe and the USA. The Multicurrency service offered with some of the most advantageous exchange rates is interesting.

Commission costs are cheaper when compared to the main competitors in the UK.

Being a bank, traders may find it advantageous to combine both banking and trading services in one institution.

Our opinions on Fineco are therefore on the whole positive. According to our methodology, it passes our tests on Safety, Platforms, Products and Markets and Training with flying colours.

(£500 in trading commission for new clients)

Disclaimer: This website and all its contributors are not liable, nor should they be held liable for any loss or commercial damage suffered in reliance on the information contained on this site. The data contained on this site is not necessarily provided in real-time and are not necessarily accurate.

All references to individual financial instruments should not be construed as investment advice nor as an invitation to purchase the products or services mentioned. Investing carries the risk of losing your capital. Only invest if you are aware of the risks you are taking.

Fineco assumes no responsibility for the accuracy or completeness of the information on this site. For more information about Fineco please visit https://uk.finecobank.com.

What is the next step now?

Open an account with Fineco Bank:

Discover the trading tools of QualeBroker: