The QualeBroker.com evaluation methodology uses a combination of 148 qualitative and quantitative metrics to assign a final judgment to over 20 banks and online brokers.

Each metric is converted into a score based upon a series of well-defined criteria. QualeBroker.com analyzes and evaluates only the brokers authorized to operate in the United Kingdom by FCA. Therefore, unauthorized companies have been excluded and to collect data we are in direct contact with the brokers to be evaluated. We open live accounts to test trading platforms and apps.

Every investor has different needs. Novice investors may need a user-friendly platform and educational material. Conversely, options traders may need sophisticated tools. We are confident that our methodology for reviewing and ranking brokers meets the needs of all types of investors at any level, saving them valuable hours of research and study.

How does it work

The scores for each category were aggregated to generate a cumulative total score. The maximum score is 100.

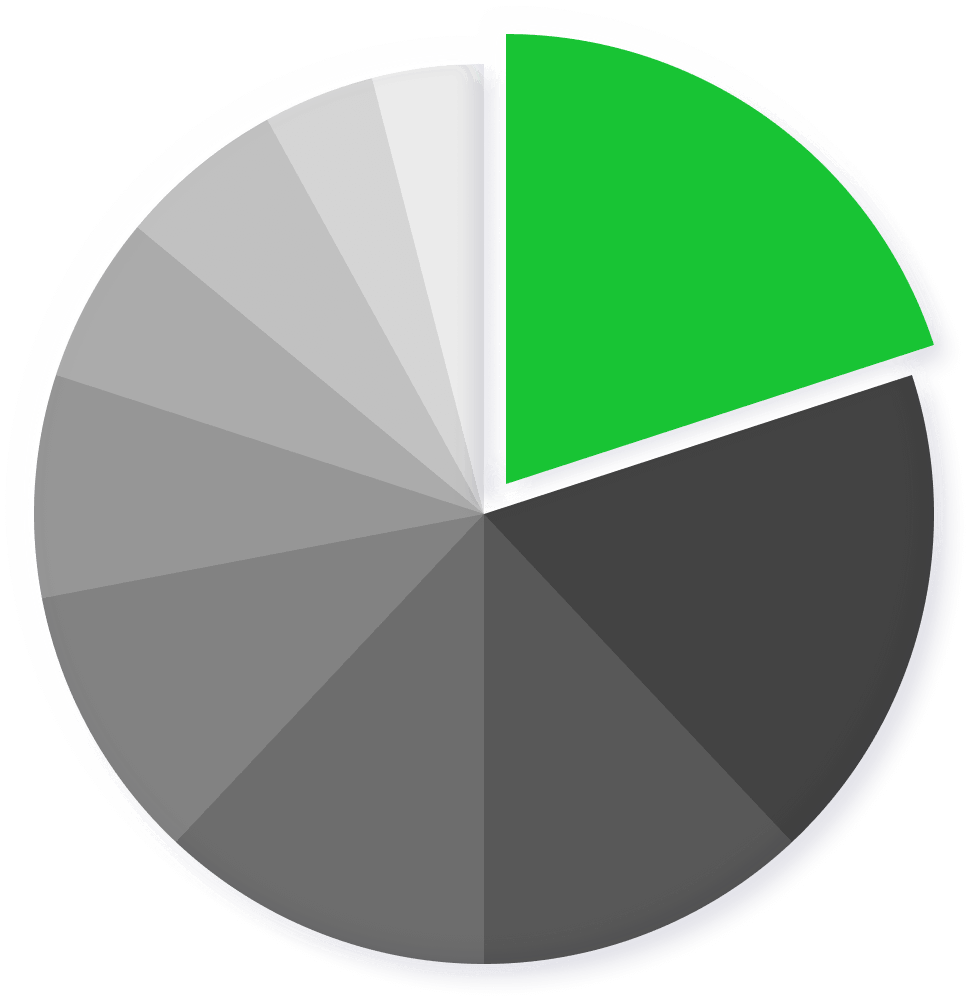

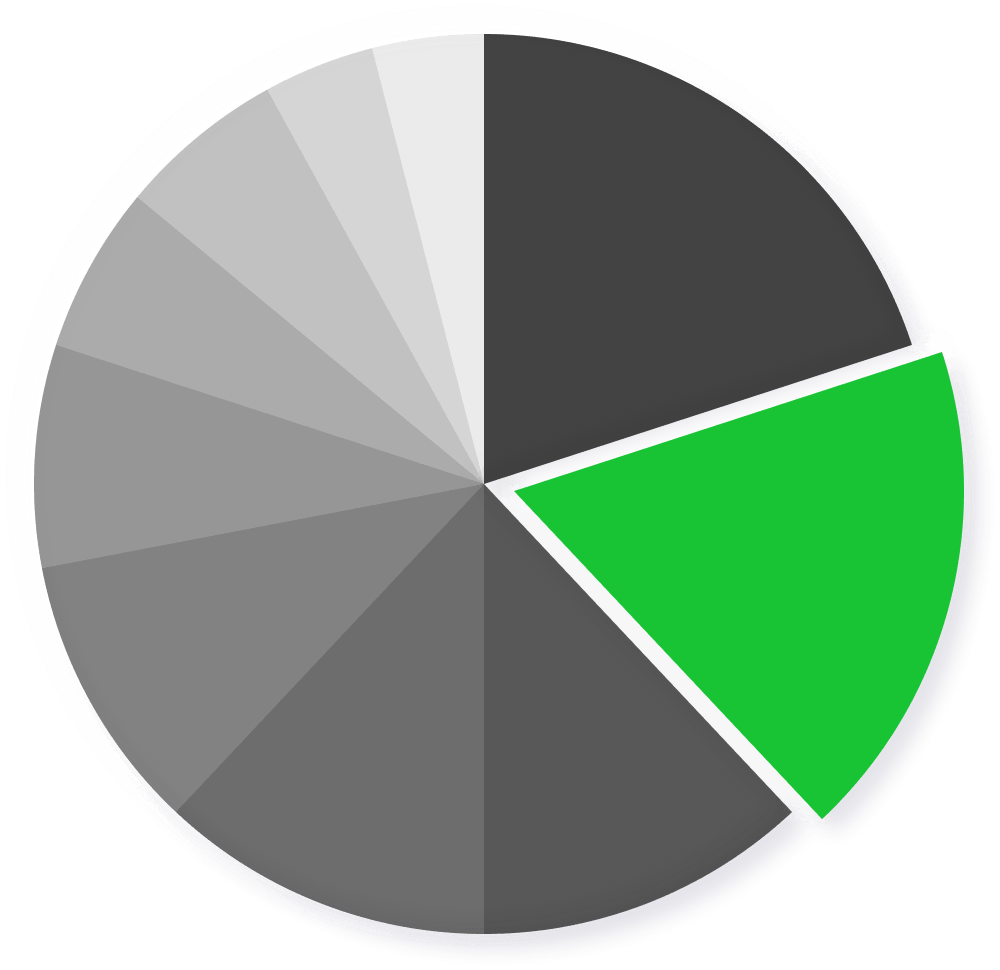

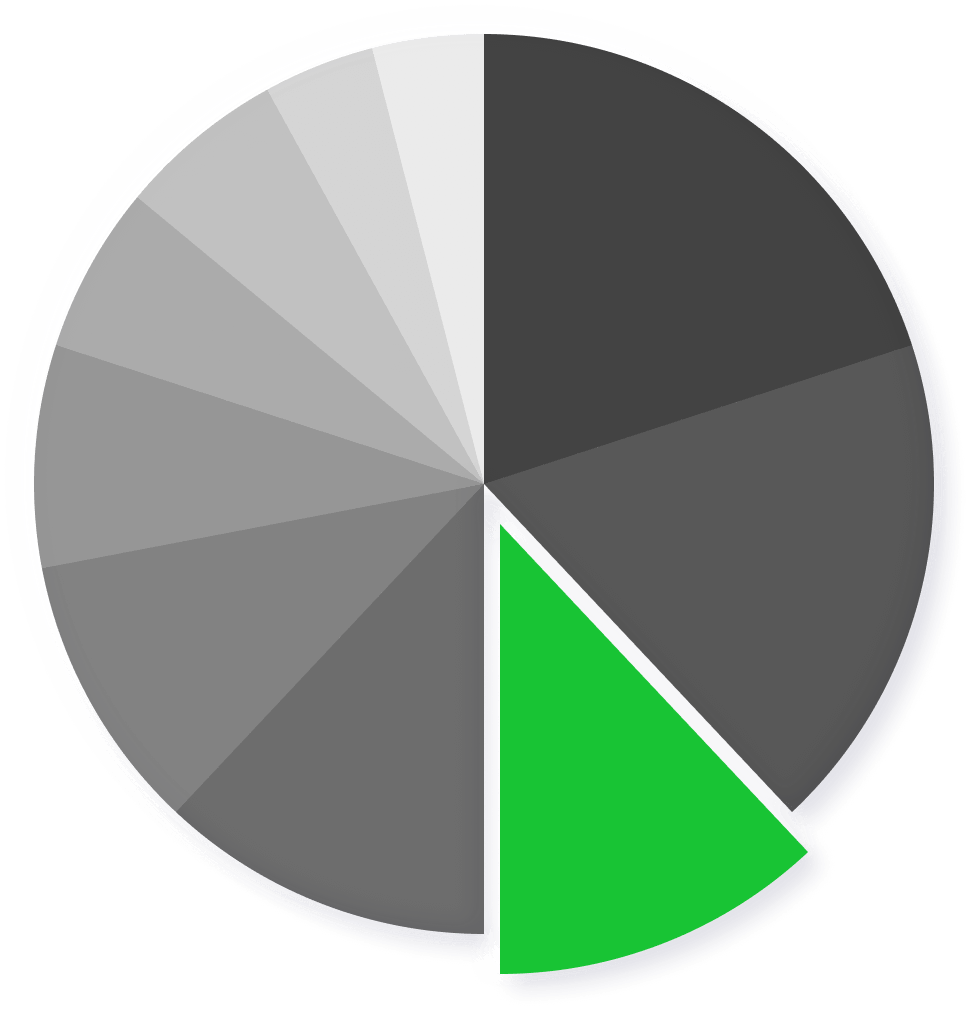

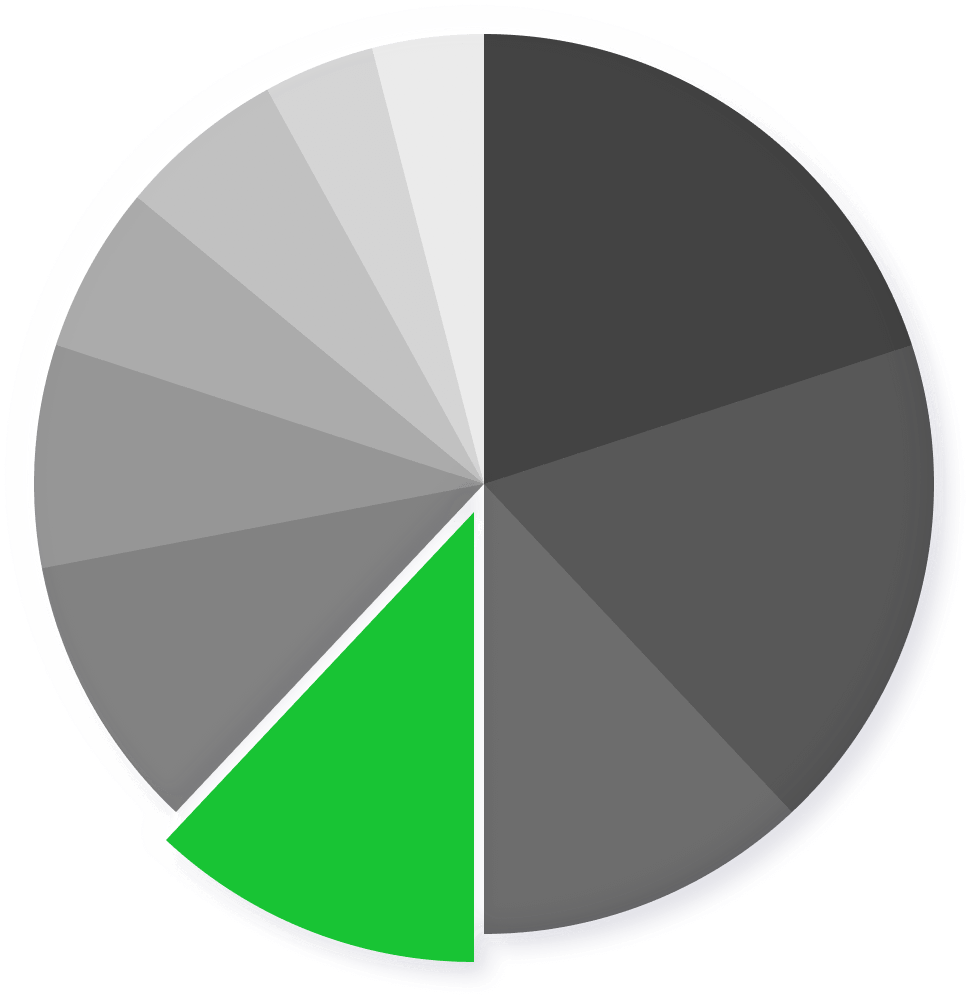

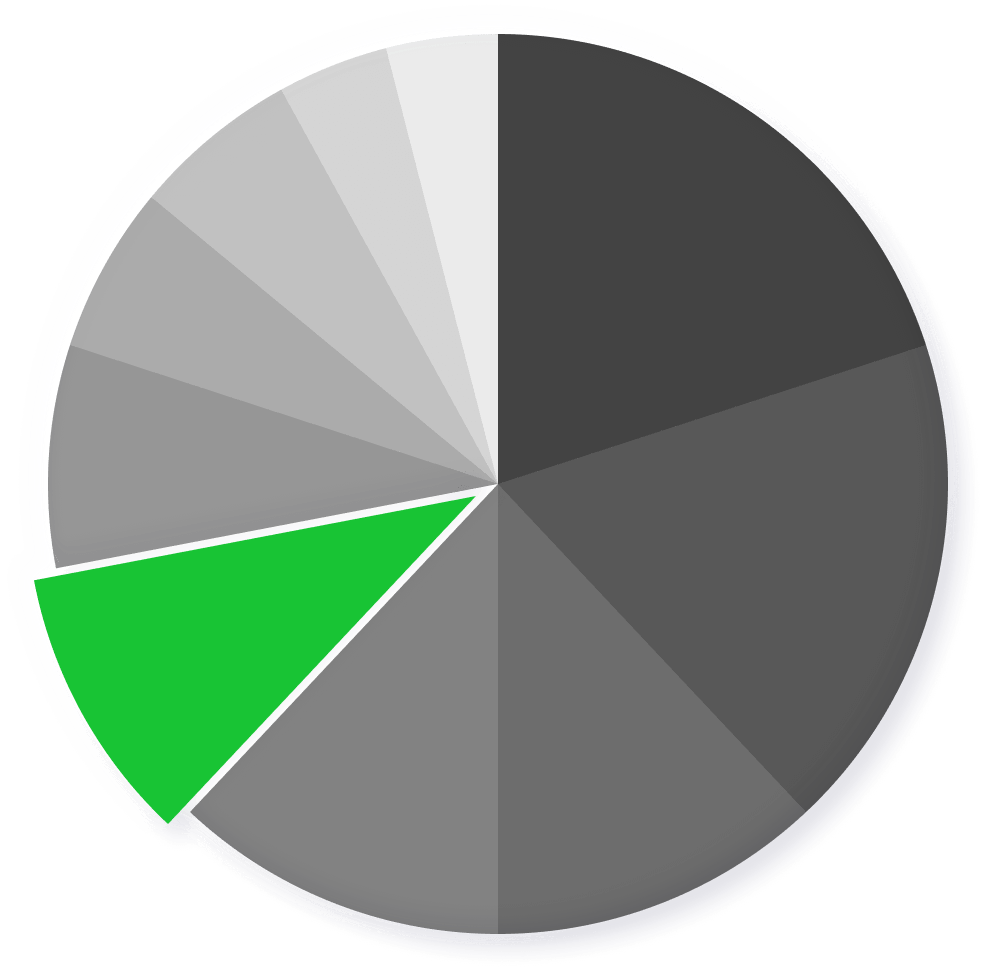

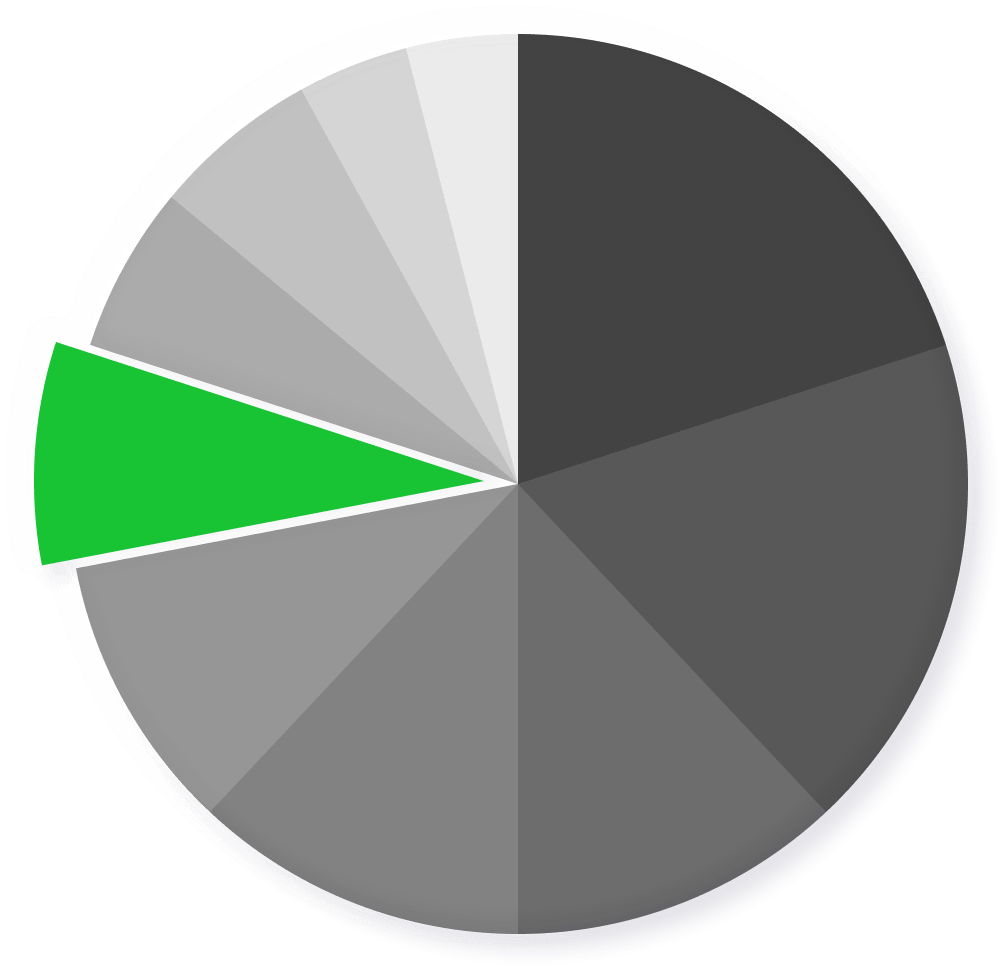

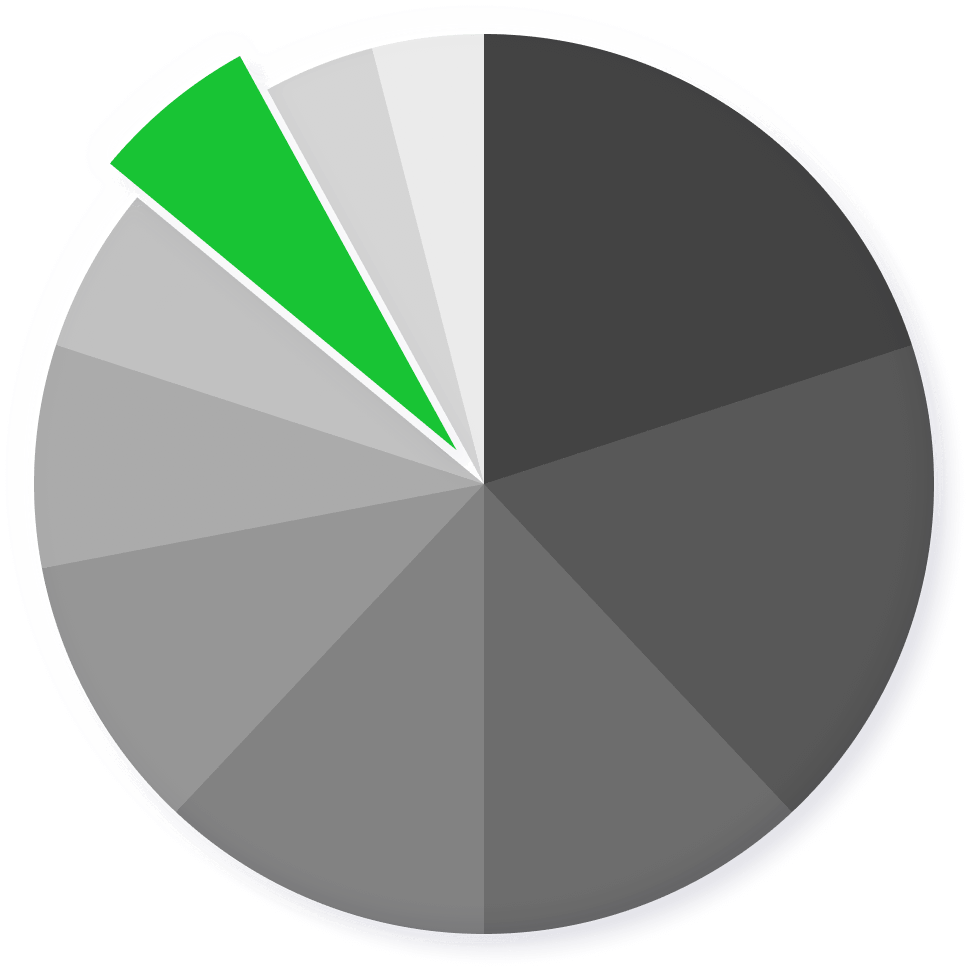

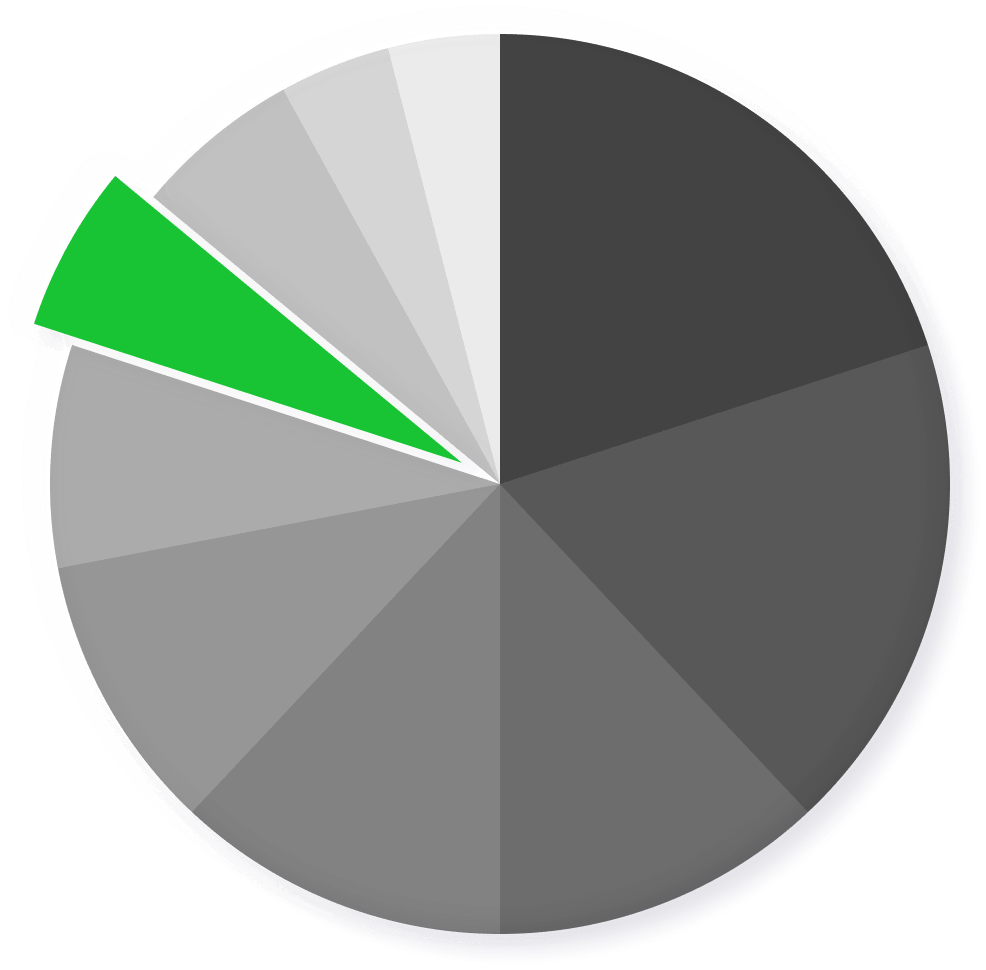

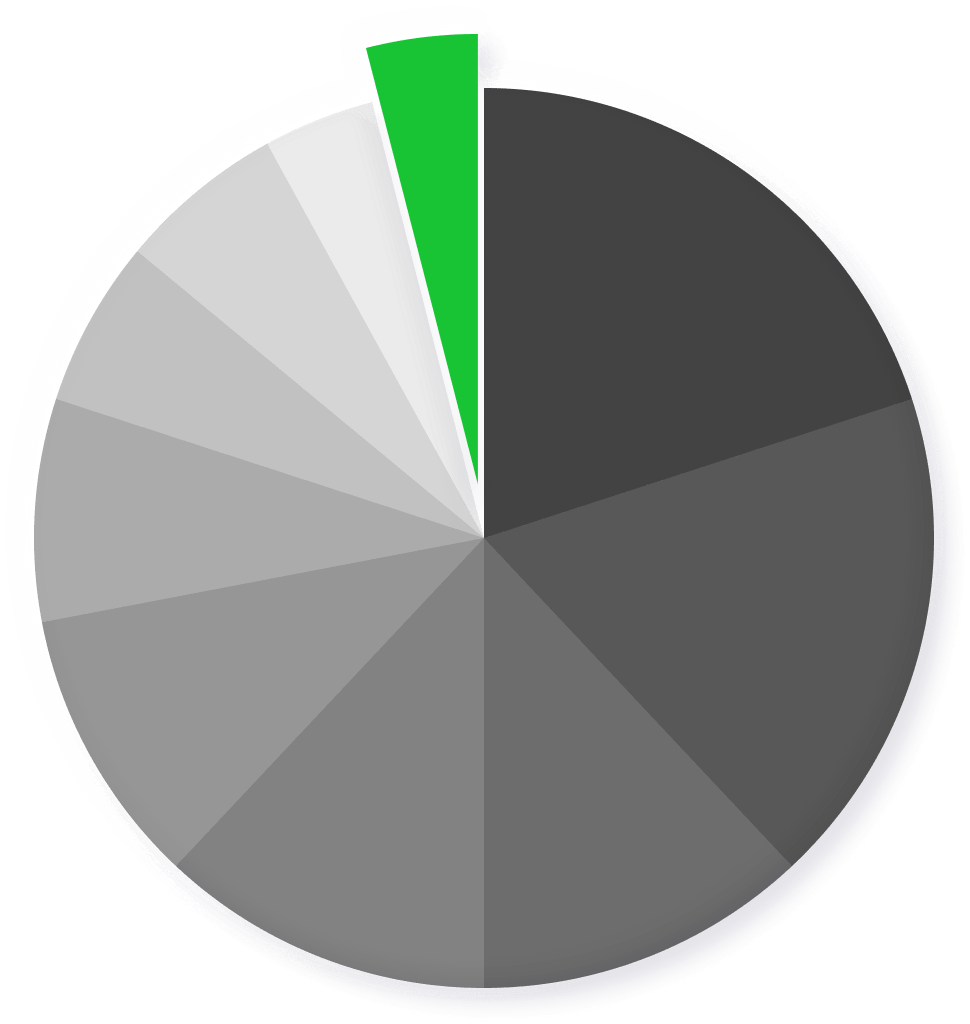

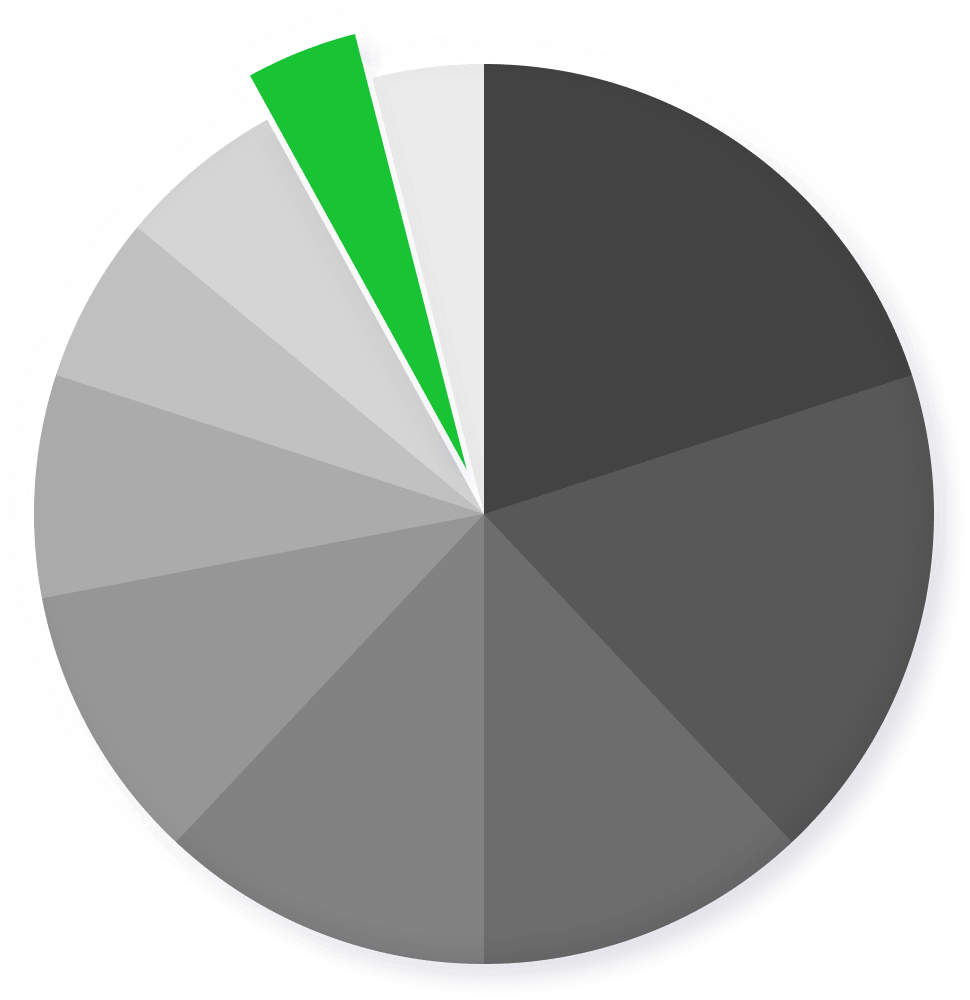

The ranking of brokers is defined by the following components and their relative weightings.

- Regulatory body

- Investor Protection Scheme

- Client liquidity management

- Client asset segregation

- Negative Balance Protection

- Two-factor authentication (2FA)

- Hacker attacks in the last 12 months

- Website Safety Certificate

- Trading fees

- Account maintenance costs

- Financing rates (margining)

- Platform fees

- Real-time quotes

- Currency Conversion Costs

- Inactivity Fees

- Spreads

- Swap rates

- Phone orders

- Web-based platform

- Desktop platform

- Research and analysis tools

- Trading from charts

- Technical and fundamental analysis tools

- Customisation of platforms

- Order execution speed

- Crash detected

- Available order types

- Automated trading

- Additional tools

- Connecting external software and APIs

- Number of financial instruments offered

- Number of available markets

- Trading hours

- Access to non-regulated markets

- Access to exotic markets

- Pre-market and after-hours trading

- Types of tax regimes offered

- Quality of tax forms

- Taxation of dividends

- ISA account

- Junior ISA account

- SIPP account

- Is it suitable for beginners?

- Intuitiveness of platforms

- Are the conditions and costs clearly explained?

- Is the account opening process smooth?

- Is the website user-friendly and does it contain all the necessary information?

- Channels through which customer service is offered

- Quality of client assistance

- Speed of problem solving

- Waiting times

- 24/7 active support

- Presence of a FAQ section on the website

- Proprietary app

- Mobile experience

- Research and analysis

- Technical and fundamental analysis tools

- Customisation

- Order types available

- Charts

- Offering a bank account and credit cards

- Financial advisory services

- Salary/pension credit

- Wealth management

- Loans/mortgages

- Learning material on the website

- Organisation of events and seminars

- Tutorials on the use of platforms

The final score is then converted into stars (from 0 to 5) within the reviews.

| Category | Maximum score |

| Safety | 20 |

| Fees and Costs | 18 |

| Products and Markets | 12 |

| Platforms and research | 12 |

| Mobile Trading | 6 |

| Ease of Use | 8 |

| Tax Management | 10 |

| Customer Service | 6 |

| Education | 4 |

| Banking Services | 4 |

| Total cumulative score | 100 |

| Final score | Grade |

| Above 95 |

|

| 85-95 |

|

| 75-85 |

|

| 60-75 |

|

| 50-60 |

|

| 40-50 |

|

| 30-40 |

|

| 20-30 |

|

| 15-20 |

|

| 10-15 |

|

| <10 |

|

| Categoria | Punteggio massimo |

| Sicurezza | 20 |

| Commissioni e Costi | 18 |

| Offerta di prodotti e mercati | 12 |

| Piattaforme e ricerca | 12 |

| Trading da mobile | 6 |

| Facilità d’uso | 8 |

| Gestione fiscale | 10 |

| Servizio Clienti | 6 |

| Formazione | 4 |

| Servizi bancari | 4 |

| Punteggio cumulativo totale | 100 |

| Punteggio finale | Voto |

| Sopra 95 |

|

| 85-95 |

|

| 75-85 |

|

| 60-75 |

|

| 50-60 |

|

| 40-50 |

|

| 30-40 |

|

| 20-30 |

|

| 15-20 |

|

| 10-15 |

|

| <10 |

|

What investor are you?

Find out with our test which are the best brokers and banks in line with your investor profile.