Summary:

- 3 account types offered

- 6 tradable asset classes

- Favourable commission structure for active investors

- Interests on uninvested cash with no lock-in period

![]() Pros:

Pros:

- Authorised and regulated by the FCA

- Broad access to global markets

- Powerful, cutting-edge proprietary platform

- Offering educational tools for clients

![]() Cons:

Cons:

- Uncompetitive commissions for some markets

- Inactivity fees

4.9

4.9

Reviews and insights: online broker SAXO Markets

Saxo Markets is a Danish investment firm founded in 1992 by Kim Fournais, the current CEO and shareholder. The major shareholder is Geely Financials based in Denmark. The company holds more than 876.000 clients worldwide and it’s fully regulated and licensed in 15 countries such as the UK, Japan, Hong Kong, Singapore, France, and Italy just to mention some.

More than 100 institutional financial service providers use Saxo Markets services and that makes the company soundly reliable.

Safety

Saxo Markets is registered as Saxo Capital Markets UK Ltd (SCML) and is authorised and regulated by the Financial Conduct Authority (FCA) with the Firm Reference Number 551422. It is a security and commodity contracts dealing activity service.

Segregated accounts are protected by the Financial Services Compensation Scheme and are separated from the bank's balance sheets/own money. In the unlikely event of a default by Saxo Markets, retail clients will have their funds returned from the client account rather than become creditors of the firm.

The Financial Services Compensation Scheme (FSCS) covers up to £85,000 in client compensation claims against it, including where there is a client money shortfall. The claim should be submitted to the Financial Services Compensation Scheme (FSCS). Saxo Bank also signs up the FX Global Code of Conduct that improves integrity and transparency.

The company has a BBB rating with a positive outlook.

The company has a deep commitment to protecting and safeguarding the information and funds of clients. The firm has a standard procedure for events like phishing of data, scam calls, and malware. In the support section, there is a page on “how to secure your Saxo Markets account” that will provide all the information needed to protect accounts.

Saxo Markets account

Saxo Markets offers 3 types of individual accounts: Classic, Platinum, and Vip.

The Classic has tight entry prices, best-in-class digital service and support, and 24/5 technical support on accounts. Min funding requirements £500

The Platinum has up to 30% lower price than the classic account, best-in-class digital service, and 24/5 support with a priority local language customer service. The Platinum account allows the opening of additional currency sub-accounts. Min funding requirements £200,000

The VIP account gives the best price, best-in-class- digital service, 24/5 support, and additional currency sub-accounts. The VIP accounts guarantee a personal relationship manager and also exclusive event invitations. Min funding requirements £1,000,000

Saxo UK allows the creation of Joint accounts in line with the majority of UK brokers.

The bank allows the creation of an ISA account for UK residents over 18 years for the sum of £20,000 and the profit will be free from capital gains tax and free from income tax on dividends either.

SIPP account with Saxo will grant access to a personal account manager that will help in the creation of a personal pension scheme for different asset classes

The account has a sort of easy-to-open, easy-to-deposit, and easy-to-withdraw policy. One of their popular topics on the website is “Opening an account” which vastly covers the process of opening an account.

Also the “funding and withdrawals” and “using our trading platform” gives an easy explanation to fulfil all the info needed to open an account and link it to the proprietary platform.

US citizens cannot subscribe to Saxo Markets products and services to financial regulations constraints.

» What is the minimum deposit to open an account with Saxo Markets?

The minimum deposit with Saxo Markets varies depending on the type of account.

With the Classic account, the minimum deposit is £500.

With the Platinum account, the minimum deposit is £200,000.

With the VIP account, the minimum deposit is £1,000,000.

Products and Markets

Saxo Markets boasts a variety of Stocks from FTSE, NYSE, and Hang Seng just to mention some. It is possible to trade the majority of stocks available in the financial markets.

The online broker also provides Bonds and Options on listed products.

The leveraged products consist of FX products such as Forex pair trading and Futures.

Commodities and Indexes Options are also available.

The no lock-in policy allows the trader to earn interest, on uninvested cash on the account balance, without “locking” the capital.

Fees and costs

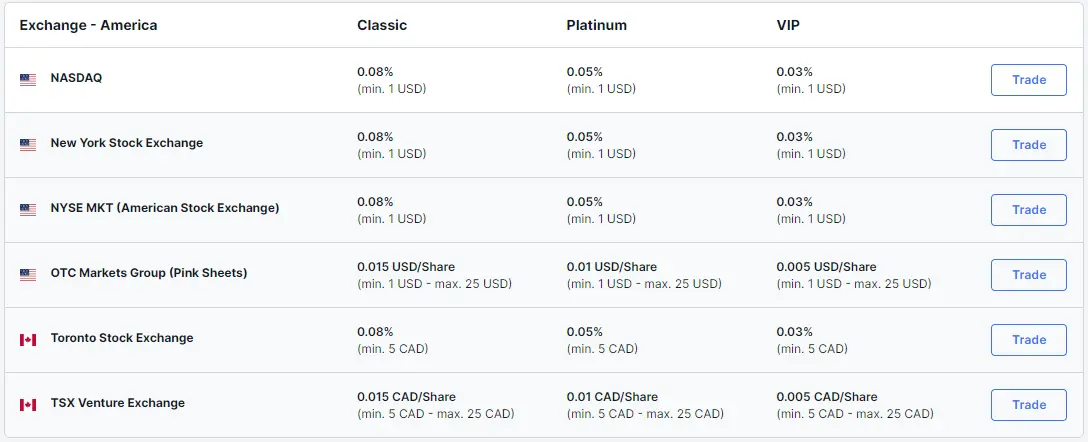

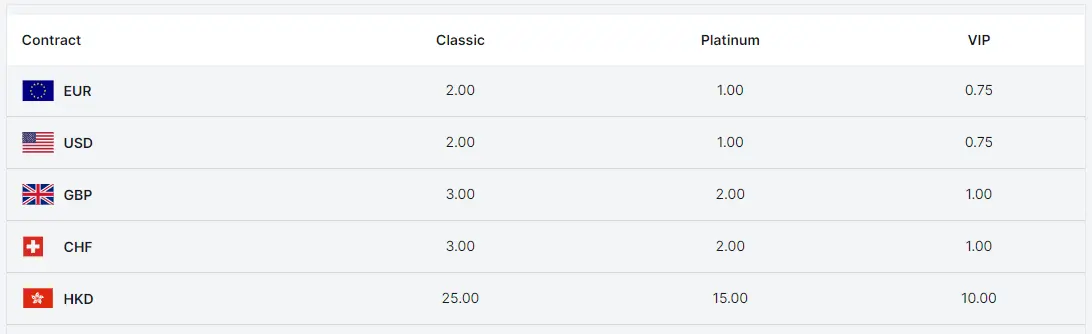

Saxo Bank offers 3 types of accounts Classic, Platinum, and Vip with different deposit requirements starting from £500.

US stock pricing starts from 1 USD commissions but depends on the tier holding and volumes traded.

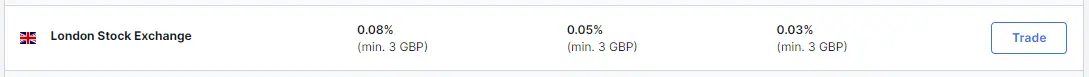

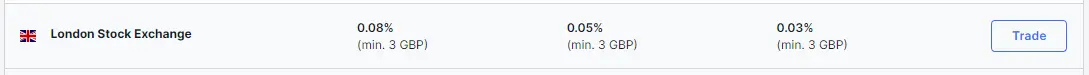

London Stock Exchange listed stocks start from 3 GBP commissions but depending on the tier holding and volumes

Euro Exchanges listed stocks min 2 EUR commissions but depending on the tier holding and volumes

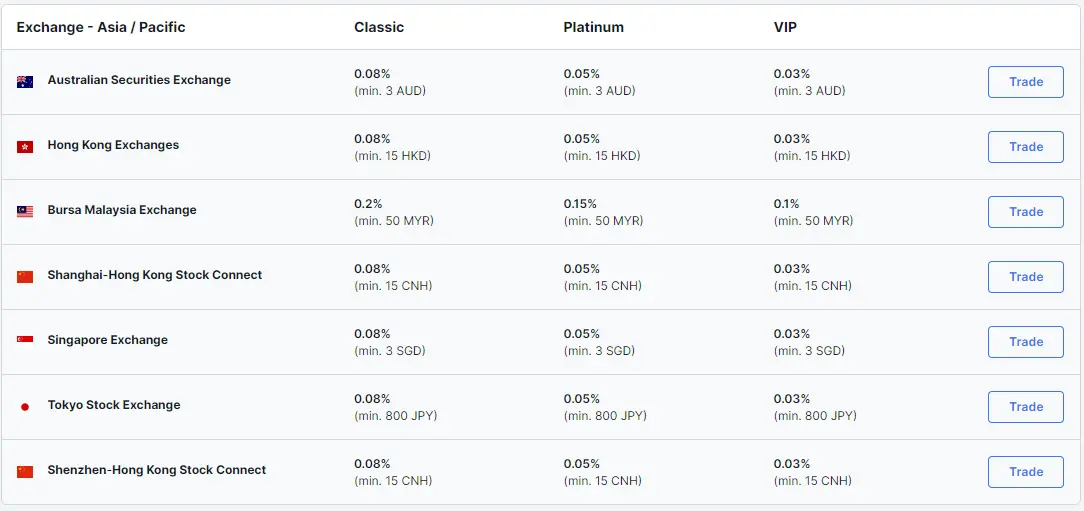

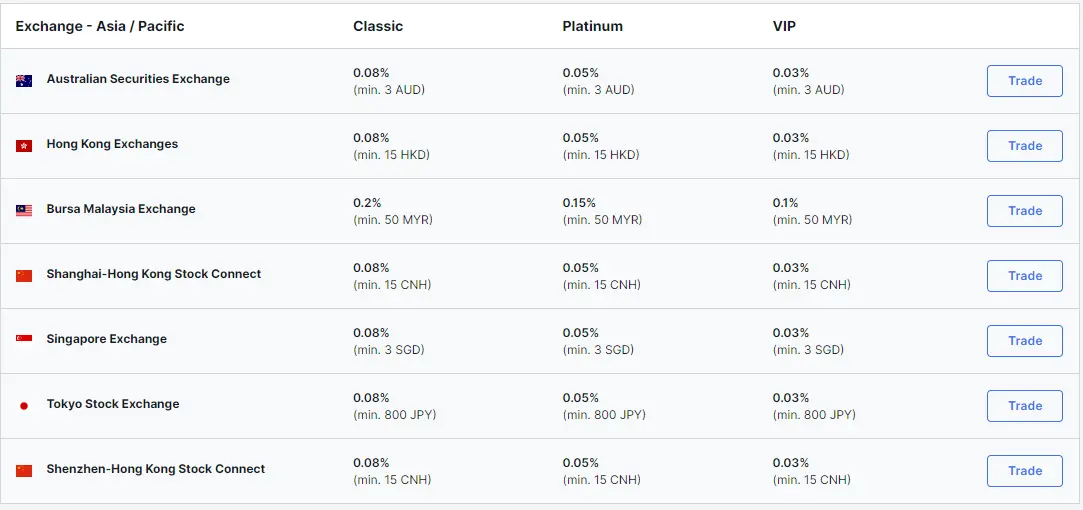

Hong Kong, Japanese, and Australian stocks:

As we can notice from our fee calculator, commissions and fees applied by Saxo Markets are not competitive.

ETFs are priced based on the product type, volumes trades, and account tier

As we can see from our ETF fee calculator, Saxo Markets is not a favourable choice from a commission and fee side.

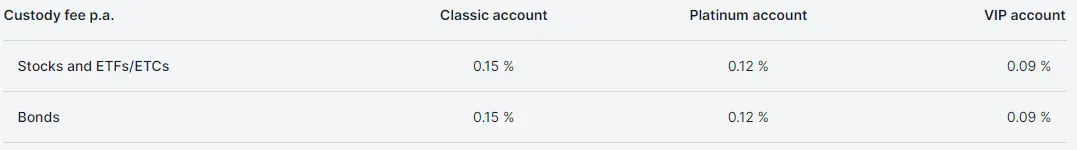

Custody fees on listed stocks are calculated depending on tier level.

There are no inactivity fees.

If orders are placed manually over the phone, chat, or email there will be a fee of 50 EUR.

All the accounts have to bear the conversion fee of 0,25% when operating in a different currency.

For Classic Account there is a fee for requesting reports.

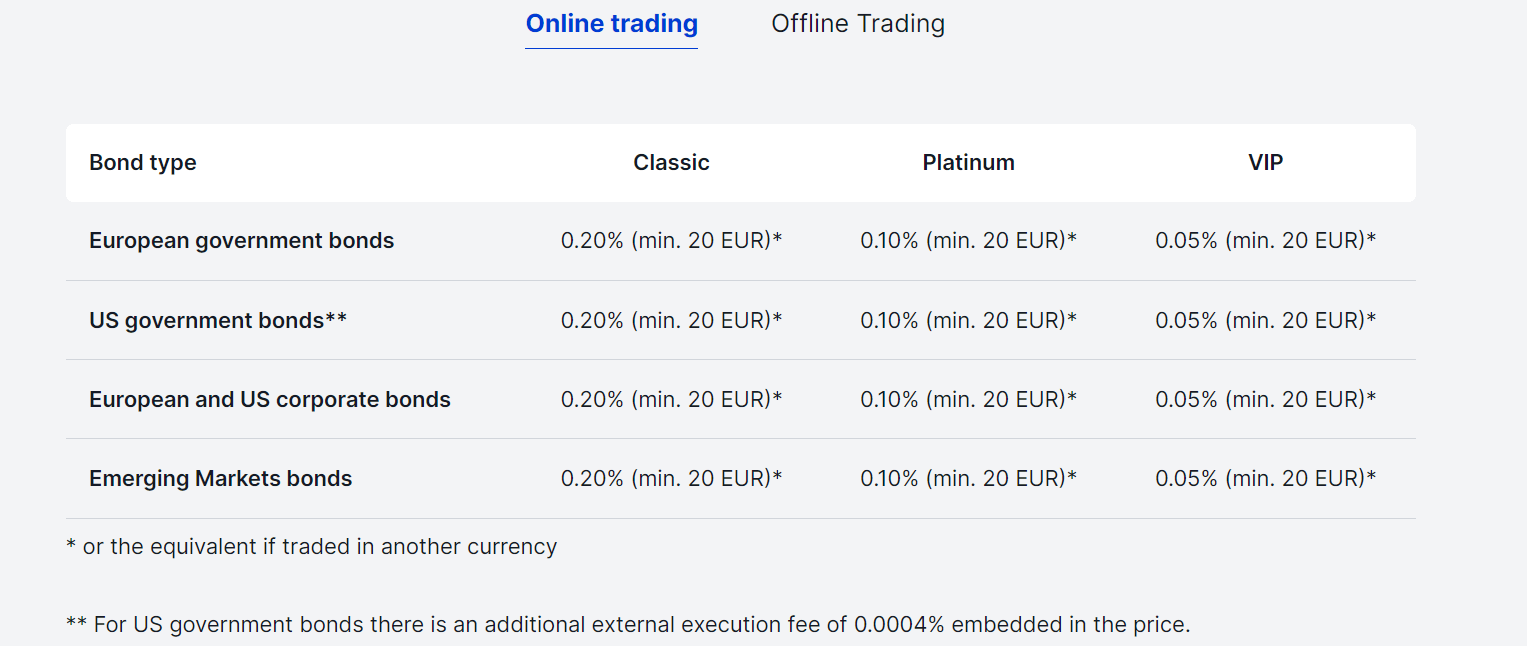

Bonds on Saxo UK are traded online and offline. Saxo offers more than 3,000 bonds offline, please contact the Bond Desk for more information.

Price structure information here below:

Options on listed products start from $0.75 per single lot and vary on the type of account

Commodity trading is priced depending on the type of account

Fx spreads GBP/USD 0.8, EUR/USD 0.7, USD/JPY 0.7, price structure is built up on top tier 1 liquidity providers. Fx spreads start from 0.04 pips, 3 pips for index options, and $1 on commodities per lot as the futures.

The online broker also provides trading on CFD instruments like Stocks, Indexes, and FX pairs.

Carrying cost overnight is calculated daily with margin requirements and charged end of the month. For Futures, the fee is 2.5% (classic accounts), 1.5% (platinum accounts), or 0% (VIP accounts). Overnight on FX depends on the ratio Price x No. of CFDs x (Saxo Offer financing rate + markup) x (Day count convention*) on long or short positions kept open overnight after 1700.

For derivative products is 1% circa and for FX Options is 0.1%. FX Options are liable to a 10 usd min fee if trades are relatively small

Investors can also opt for a managed portfolio built by SaxoSelect Portfolio depending on their risk appetite (Defensive, Moderate, Aggressive)

Trading platform

Saxo Group has been a pioneer in creating retail trading platforms since 2015 when the group launched its first version of the current platform structure. For Institutional investors, a platform has been active since 1998.

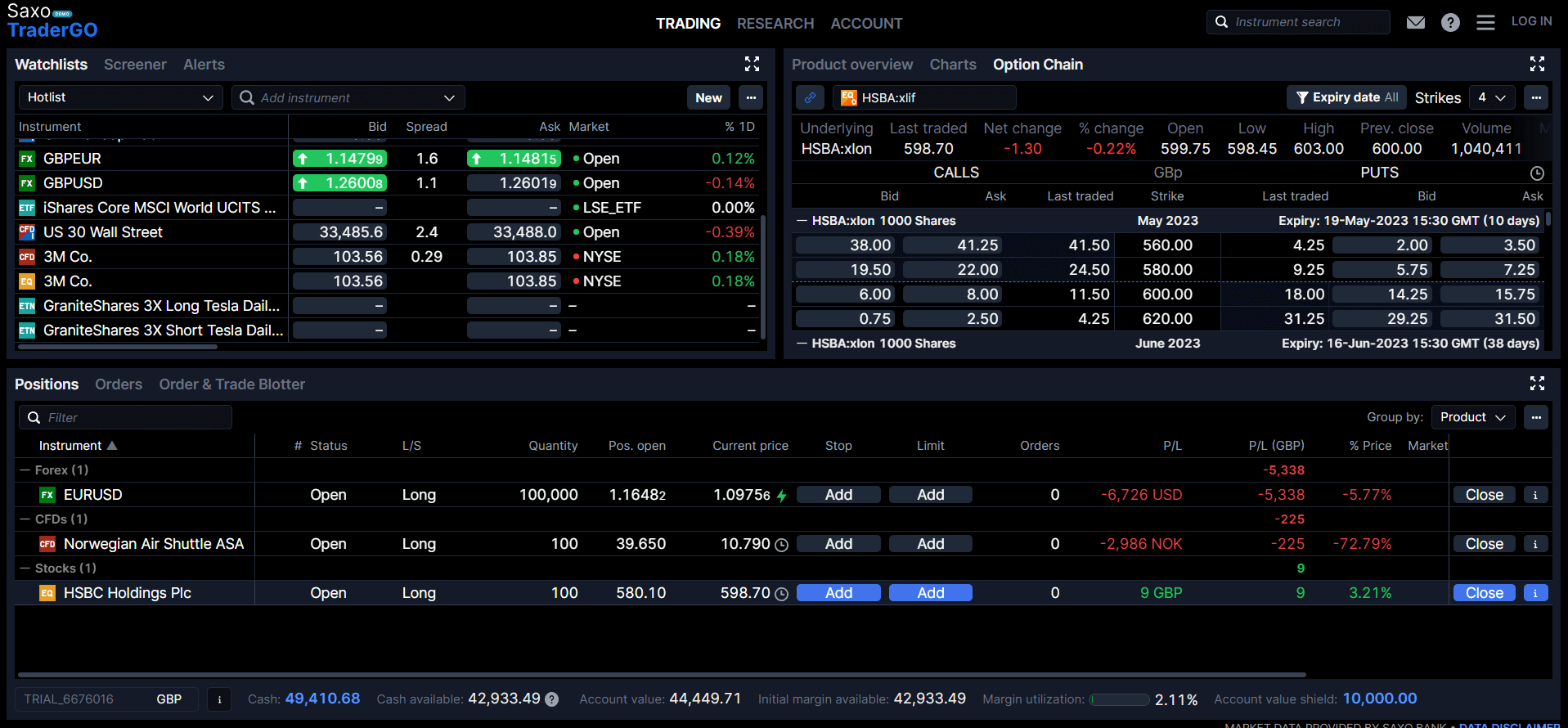

SaxoTraderGo is the Saxo Markets property trading platform for retail users. There is also a fully customisable and professional platform called SaxoTraderPro for professional purposes. Both platforms allow trading tool extension.

Saxo Markets will enable traders to operate on its own documented electronic infrastructure FIX API and OpenAPI, thanks to the 20 years of creating liquidity pools and execution tools to create a good execution flow for clients flow. Saxo accounts cannot be linked to the MetaTrader platform.

The proprietary platform has an appealing interface that creates a pleasant environment for a fully immersive trading experience.

It offers an extensive watchlist and a position recap with a single product overview.

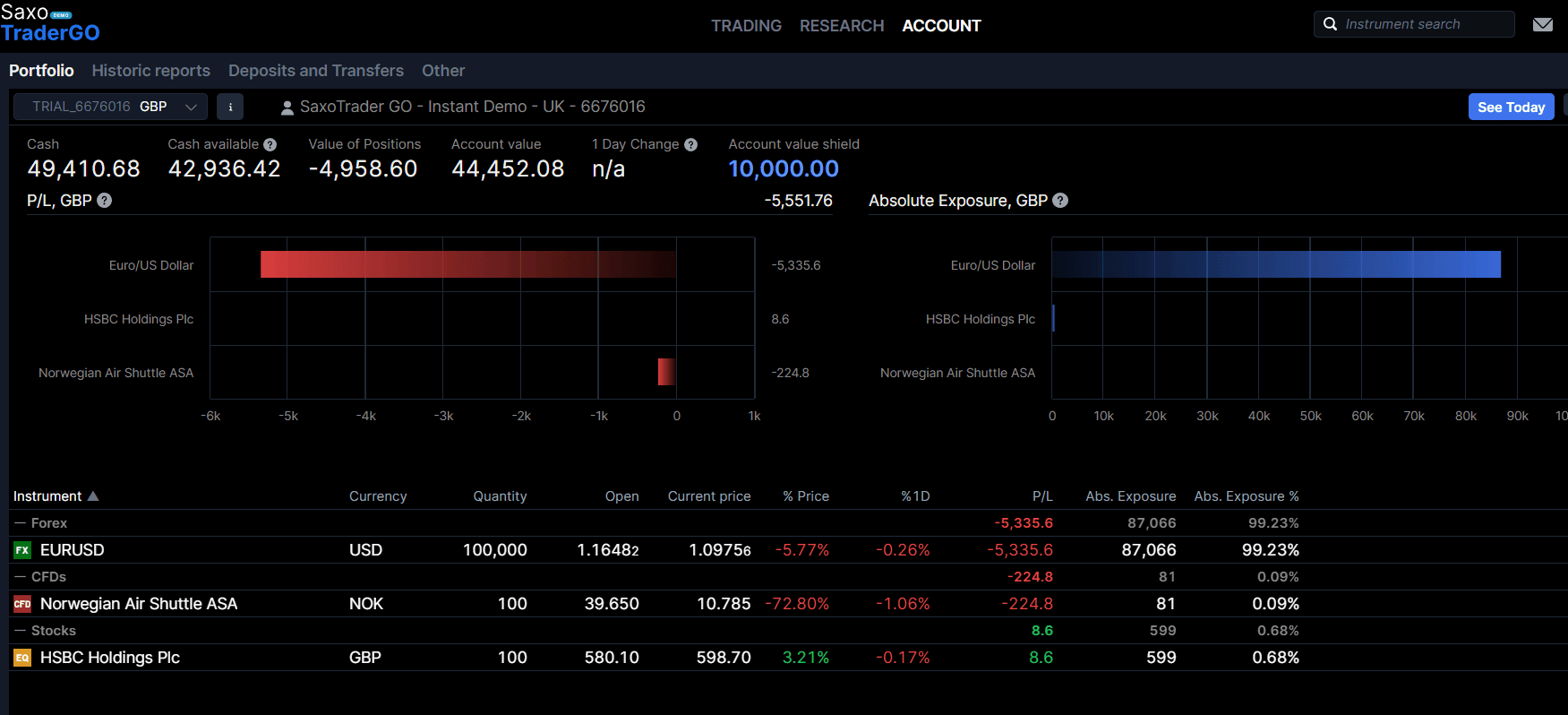

Saxo TraderGO allows to monitor the whole portfolio and of course the singles products.

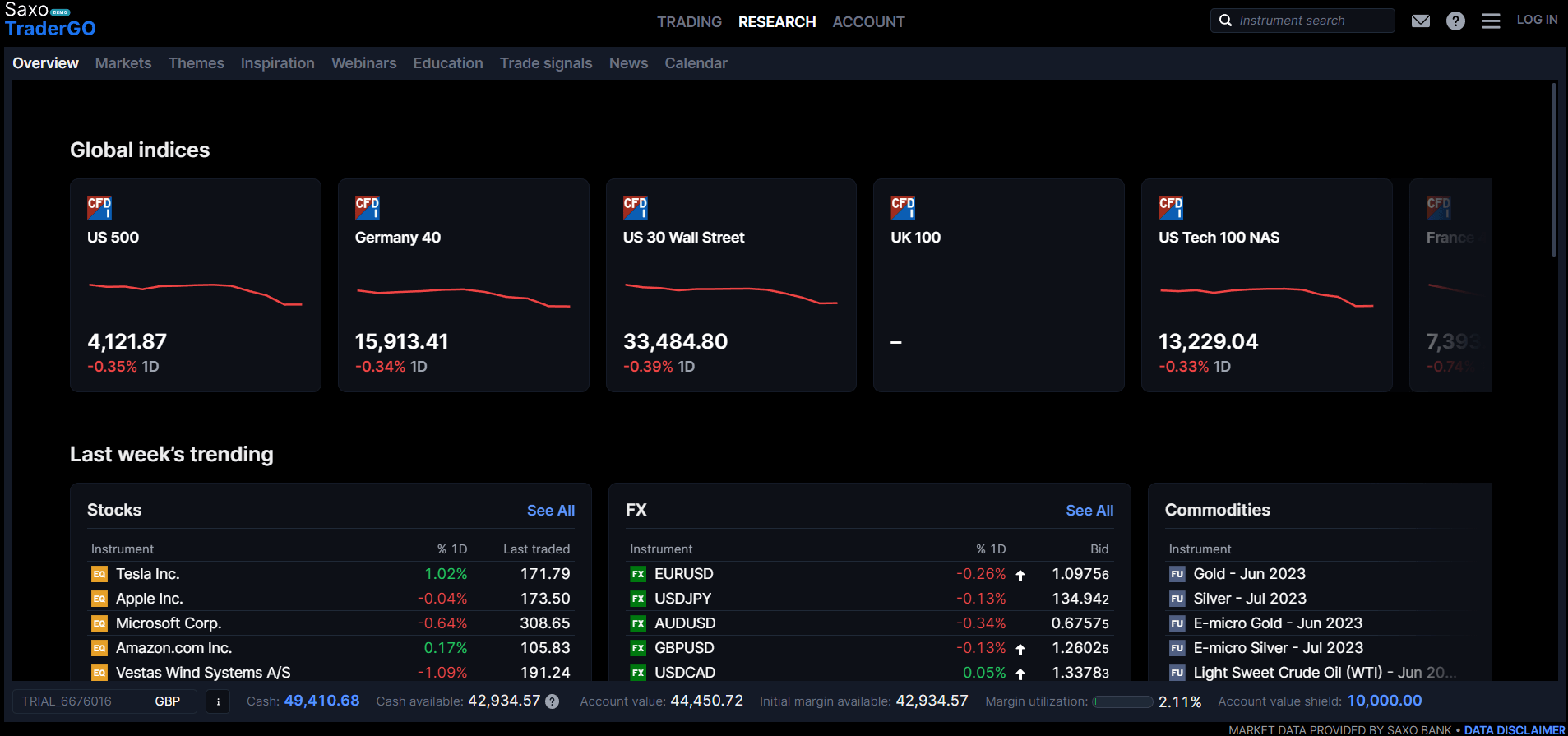

The platform is well integrated with the content section of the main website. The overview will enable the investor to monitor and discover many trading products and new ideas.

The platform offers tools for the fundamental approach, and 40 technical analysis instruments, and delivers tips for sentiment analysis. It also provides a comprehensive option chain for listed, vanilla, index options, and futures. The platform is free to use as long as paired with a Saxo Markets Account.

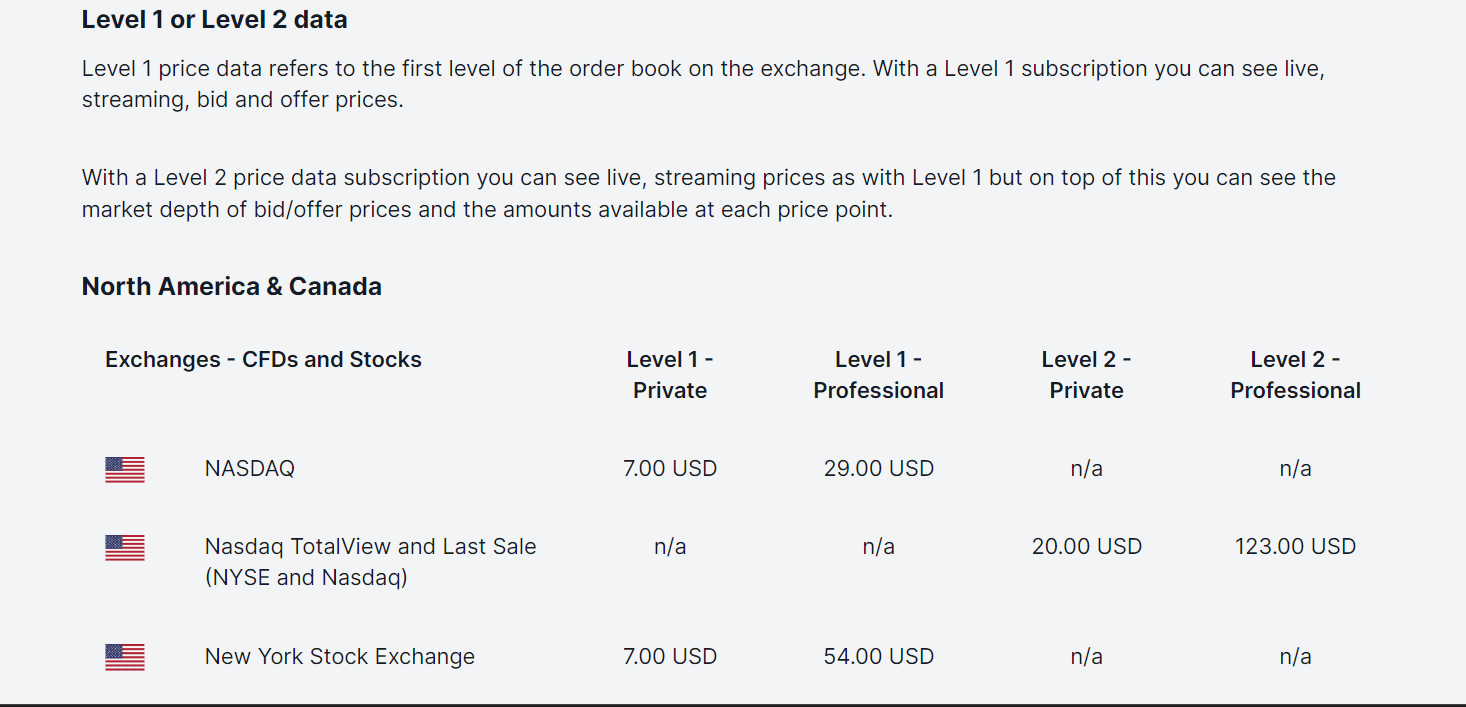

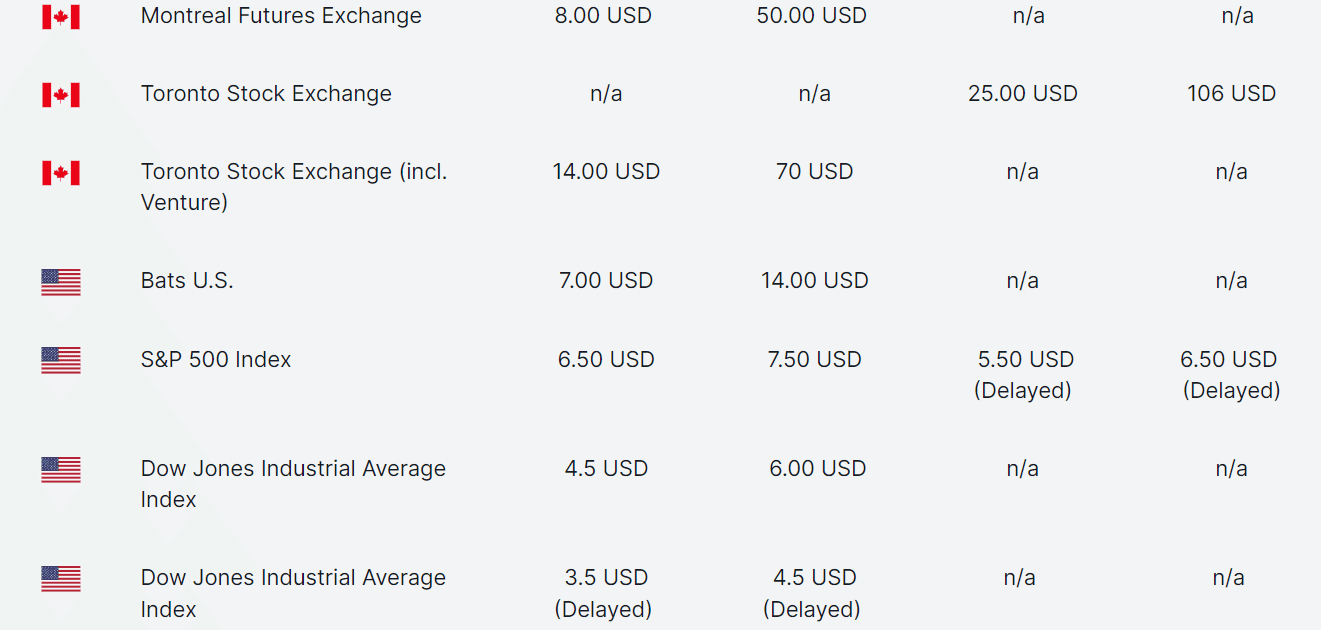

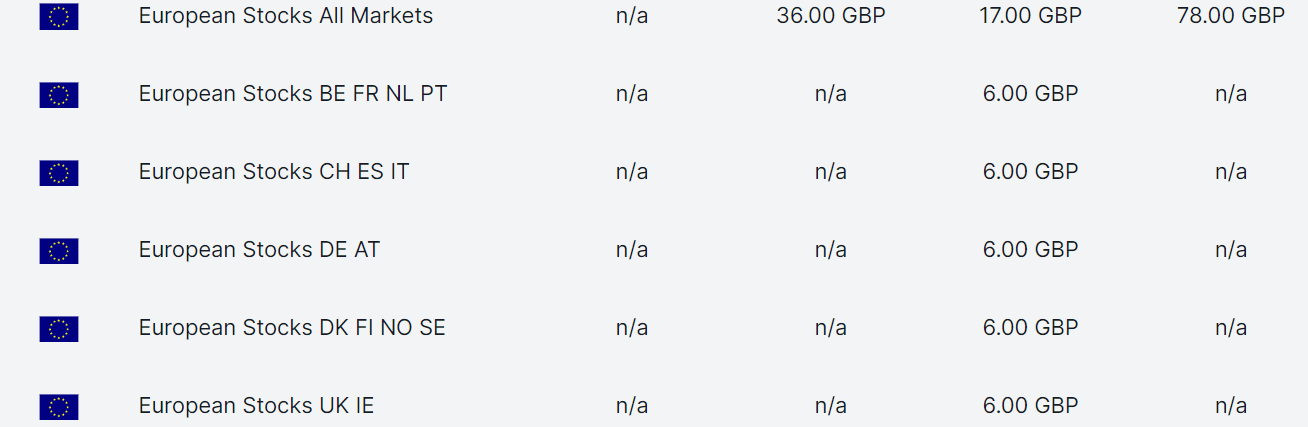

Real-time and market volumes data are divided per package depending on the level of market data. Every index has its own price, and all-inclusive packages are not available but Saxo has introduced a refund scheme if 4 operations per month are placed (6 operations if traded in the Australian security exchange)

Education

The website of Saxo Be Invested offers an “Inspiration” section with many trading ideas and tips that will help in the creation of a trading plan. The trade inspiration page covers topics like equity, forex, bonds, and commodities. It will also help the user to discover the features of the trading platform.

Saxo Bank UK provides many articles covering macro analysis delivered by the SaxoStrats and other analysts. The company provides a wide range of educational content, videos, and webinars.

The Market Call podcast is a unique instrument to enhance the analytical skills of traders.

Customer Support

Customer support is improving also for retail traders and has a support team 24/5. There is an integrated digital support system that enables the client to use the self-service support centre and an email helpdesk.

The Saxo Support Centers offers many suggested articles like a detailed FAQs page and much detailed content.

Promotions

Saxo Bank has created a loyalty program based on points that allows scaling up the accounts depending on products and trading volumes that match the position's size.

The no lock-in period funds now are at 3.91% for both GBP and non-GBP.

Final verdict

Saxo Markets creates an easy environment for retail and institutional traders.

They offer great educational tools like articles, videos, webinars, and podcasts held by professionals.

Some financial instruments like US stocks seem a little bit pricy compared to other brokers.

FX is quite cheap compared to competitors but the price structure is baffling.

Lastly, we firmly believe that Saxo Markets is a transparent and trustworthy online broker. The access to a wide range of stock exchanges and the cutting-edge platform makes trading with Saxo Bank a unique experience. Unfortunately, commissions and fees are too high making this broker more suitable for active and high-net-worth investors.

What is the next step now?

Open an account with Saxo Markets:

Discover the trading tools of QualeBroker: