Summary:

- CFD trading

- Financial leverage up to 30x

- Virtual account ideal for practising

- 7 tradable asset classes

![]() Pros:

Pros:

- Numerous assets and products tradable on the platform

- Regulated and listed broker

- Minimum deposit of only £100

![]() Cons:

Cons:

- CFD only trading

- Platform lacking advanced features for sophisticated traders

- Not much teaching material on the site

4.9

4.9

Plus500 is an internationally renowned online CFD broker. Founded in 2008, it boasts millions of active customers worldwide. This broker allows you to trade across 7 asset classes, either via a web-based platform or via a state-of-the-art mobile app.

With Plus500 you can trade CFDs on shares, commodities, currencies etc.

You can find all the relevant information about Plus500 in this official review.

Plus500 Trading Review: Pros and Cons Uncovered

Plus500 is an internationally renowned online broker (Market Maker). Headquartered in Israel, it was founded in 2008 and offers CFD trading. It holds various licences to serve customers globally. Plus500 is authorised and regulated by regulators in Estonia, the UK, Australia and Singapore.

It is also listed on the London Stock Exchange in the FTSE 250.

In this review, we have looked at the services of Plus500, tested the platforms and analysed the costs.

Is investing with Plus500 the right choice or are there better alternatives? Find out our unbiased and professional thoughts on Plus500.

Safety

What authorisations does Plus500 have? The reliability and transparency of a broker are fundamental aspects in choosing one. Operating with an unregulated or poorly supervised broker could put clients' assets at risk due to possible misconduct by the broker.

For Plus500, by virtue of its corporate structure and the regulatory regime in which it operates, we define it as a regulated broker.

Plus500 headquarters is in Israel. In addition to the license of its own country, it is in possession of those issued by other regulatory bodies around the world such as the Financial Conduct Authority (FCA) of the United Kingdom and the ASIC of Australia.

Plus500 is one of the few brokers to be listed on the stock exchange (ISIN: IL0011284465). Companies listed on the stock exchange are obliged to make their financial statements and financial statements public, thus ensuring a high level of transparency to their clients and the general public.

In the UK it serves clients through its London-based subsidiary, Plus500UK Ltd., which is registered as a UK investment firm and is authorized and regulated by the Financial Conduct Authority (FRN 509909).

UK users trading with Plus500 will therefore be subject to UK investment financial regulations. In practical terms, this regulatory environment establishes the following three pillars for the protection of Plus500 trading accounts.

Each client is protected by the Financial Services Compensation Scheme (FSCS), which is a compensation fund that compensates clients up to a maximum of £85,000. This scheme protects against various negative events such as the occurrence of account hacking cases or the possible default of Plus500.

Client assets are kept separate from those of Plus500. In other words, liquidity is not included in the broker's balance sheet. Client funds are kept in third party banks and, in the event of the broker's default, no third party creditor can retaliate on clients' liquidity.

Being a Plus500 Market Maker, financial instruments are kept in the broker's balance sheet and this makes the customer exposed to counterparty risk.Each account is protected against a negative balance. This is a regulatory requirement that applies to all licensed brokers in the UK, which means that clients cannot incur a loss in excess of what they have deposited into the trading account.

This may happen very frequently, especially when using leverage or taking short positions.

Plus500 Account

Plus500 offers a single type of account. Within it, you can switch from virtual mode to a real money account (and vice versa) at any time.

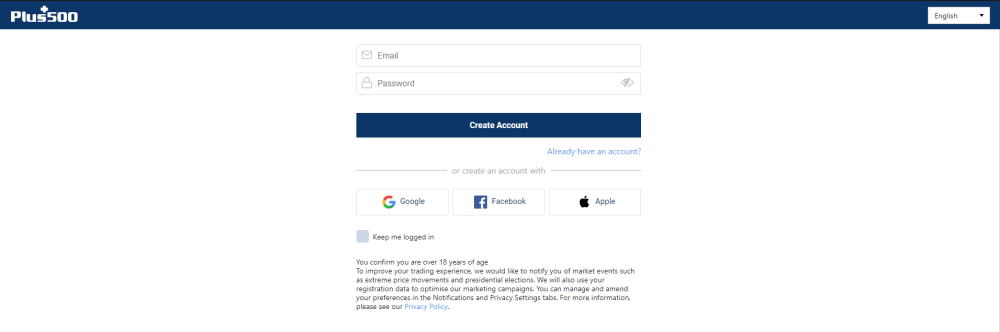

» Account Opening

The procedure for opening an account with Plus500 is entirely online. Filling out the online forms is quick and the steps to be completed are as follows.

- Register an account on the plus500.co.uk website

- Enter your personal data

- Fill out the appropriateness test to establish your financial skills (mandatory test imposed by regulations)

- Verify the account by uploading a form of identification and proof of residence (such as a utility bill or bank statement)

To be able to use the demo account it will be sufficient to complete the first 2 steps. If you want to use the real money account, you will have to complete all 4 steps.

Once you have completed your registration and verified your account, you can make a deposit and start trading.

» In which currencies can the account be opened?

By opening an account with Plus500, the base currency of your account will be GBP. However, you may later request the broker's Customer Support to change the base currency of the account if you have not traded on your real money account. With the GBP account you can only deposit GBP into your account.

For example, if you want to carry out a trading operation in US dollars (for example trading on American stock CFDs), Plus500 will convert the desired amount from GBP to USD, with an increase of 0.7%.

Therefore, if you trade more frequently on instruments denominated in a foreign currency, you may find it more convenient to request to rename the account in another currency and deposit funds in that currency into the account.

Ideally, one would connect a multi-currency card such as Revolut to their trading account. This way you can deposit any currency you want without incurring conversion costs.

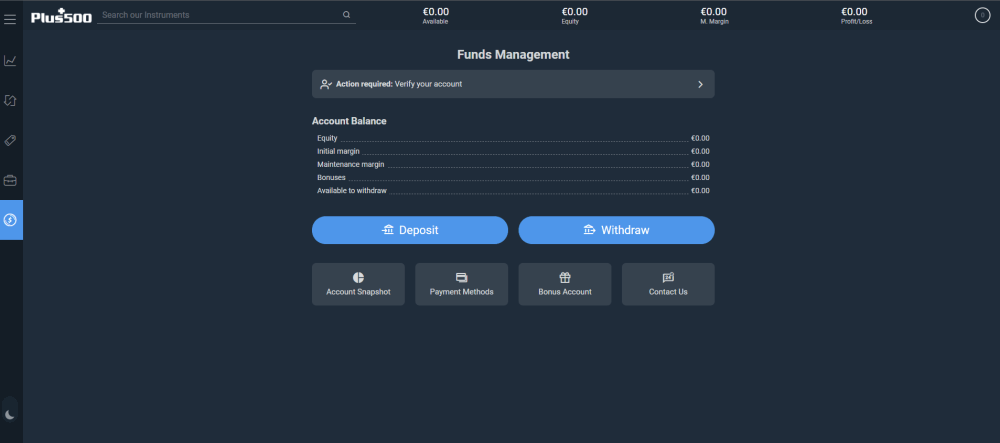

» Deposits & Withdrawals

Plus500 allows you to transfer funds through the following methods:

- Credit/debit card (only Visa and MasterCard are accepted)

- Wire transfer

- PayPal

- Skrill

- Trustly

- Klarna

Money deposits are instant if you use credit cards or electronic wallets (PayPal and Skrill). The bank transfer, on the other hand, can take up to 48 hours before being credited to the trading account.

Money withdrawals take up to a maximum of 2-3 days if you use credit cards or electronic wallets, while with wire transfers you can wait up to 3-4 days before receiving the funds in your bank account.

What is the minimum deposit to open an account with Plus500?

To open a Plus500 real money account, the minimum deposit required by Plus500 is 100 GBP. This amount is well below the industry average, with other brokers requiring a minimum deposit of at least £500.

Products and Markets

Plus500's biggest limit is that it only offers CFD trading. Stocks, ETFs, investment funds, futures, bonds and many other instruments are not available on Plus500.

Some competitors such as eToro, also born as CFD brokers, have been able to, over the years, modify to offer trading of real shares, ETFs and innovative services such as copy trading and Copyportfolios.

CFDs are by their nature limiting and obscure instruments. They are derivative products that are limited to replicating the price trend of an underlying asset. In order to perform this replication, there are huge costs which, although they may be bearable for daily operations, are not for long-term operations.

In light of this, Plus500 can only be considered for “hit and run” speculative transactions. If we hold an open position on Plus500 for multiple days, the costs of holding CFDs will severely negatively impact our trading activity.

Plus500 is therefore not a suitable broker for medium-long term investments.

Plus500 allows you to trade exclusively through CFDs. There are seven asset classes that can be traded through CFDs:

- Forex: 72 currency pairs divided into major, minor and exotic are tradable

- Commodities: 22 products are tradable including commodities, energy and soft commodities

- Indices: 37 European and non-European indices are tradable

- Stocks: stocks from 23 world markets (including the London Stock Exchange) and a handful of cannabis stocks are available

- ETFs: Approximately 90 ETFs from various issuers such as iShares, Lyxor, Vanguard can be traded

- Options: Options on shares of the securities listed on the FTSE Mib, Dax, S&P 500, EuroSTOXX 50; we also find options on oil, EUR / USD and options on some indices

- Cryptocurrencies: 10 cryptocurrencies (Bitcoin, Ethereum, Litecoin, Cardano etc.) and an index composed of the 10 most capitalized cryptocurrencies can be traded

Although limited to CFDs, Plus500 allows you to trade on a wide choice of products, divided into various financial assets.

The depth of this offer can be used for short-term speculative transactions, possibly daily because, as explained above, the costs of CFDs have a negative impact on long-term transactions.

» Financial Leverage

Like all British brokers, Plus500UK Ltd also operates under ESMA constraints. Among these constraints there is a limit on the maximum leverage brokers can grant to retail clients.

This limit varies depending on the underlying asset traded.

Plus500 limits are below:

- For CFDs on stocks and ETFs the maximum leverage is x5

- For CFDs on commodities and indices the maximum leverage is up to x20

- For Forex CFDs the maximum leverage is x30

- For cryptocurrency CFDs the maximum leverage is x2

- For option CFDs the maximum leverage is x5

Trading Fees and Costs

In this section, we have analyzed Plus500 with costs in mind. Specifically, we analyzed:

the cost structure for trading and

the account-related costs

Plus500 Trading Fees

When trading with Plus500, no fee is charged on either buying or selling. If you are new to trading, you may think that the absence of an explicit cost means that the transaction will be carried out without incurring a cost.

Plus500 does charge an implicit cost, i.e. a cost that you will not see charged on your account statement but which is included in the price of each security. We are referring to the bid-ask spread.

For the uninitiated, the bid-ask spread is the differential between the best price to buy (for the buyer) and the best price to sell (for the seller).

A broker who widens the bid-ask spread will ensure that traders can buy at a higher price and sell at a lower price.

If a position is held for more than one day, overnight costs must be calculated. This is a cost due to holding positions and is calculated and charged daily. The longer you hold an open position, the higher the financing costs will accumulate on a day-to-day basis.

If you trade in a currency other than the base currency of the account, Plus500 applies conversion costs. Specifically, if you have an account denominated in GBP and deposit funds in another currency, Plus500 will deposit the funds into the GBP account and you will suffer a 0.7% increase on the exchange rate.

Plus500 account costs

After analyzing the trading costs, we reviewed the account maintenance costs. Opening and closing an account with Plus500 is free.

There is a monthly inactivity fee. The cost of inactivity is $10 per quarter if no logins have been made for at least 3 months. To avoid this cost, at least one login on the platform per quarter will suffice.

Money deposits are always free. The first five withdrawals in the calendar month are also free; from the sixth withdrawal onwards there is a cost of $10.

Plus500 therefore offers a trading account at little or no cost. This feature makes Plus500 a convenient broker for those who want to start trading with an account that has low management costs.

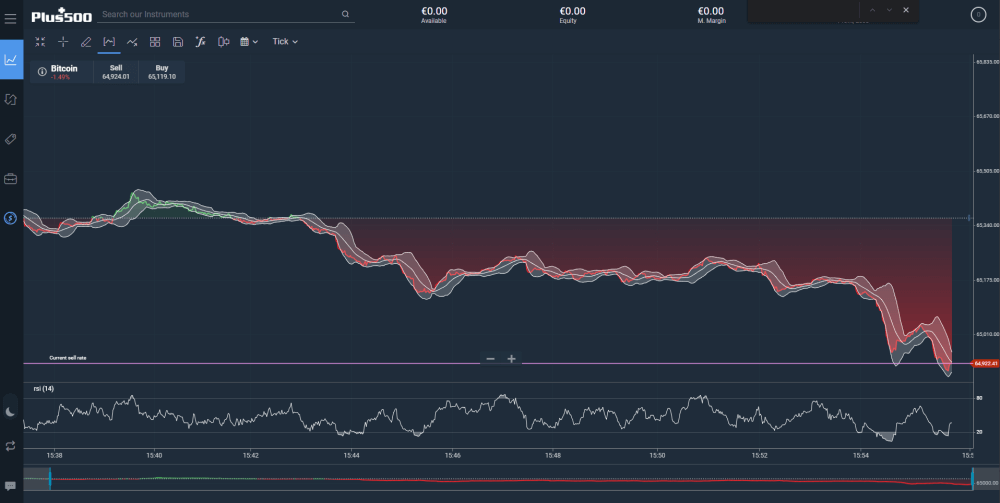

Trading Platform

Plus500 allows you to trade through a proprietary web platform. A mobile app is also available for those who want to trade from a smartphone or tablet.

The web platform, on the one hand, has the advantage of being launched from a browser and does not require any installation, yet, on the other hand, it presents itself as a basic solution without any customisation elements.

At first glance, the Plus500 trading platform appears modern and intuitive. At its core, tools and functionality are kept to a minimum. This is to reproduce a simple and user-friendly trading environment.

For beginners, Plus500 allows you to open a demo account with virtual money. It also provides the Trading Academy, where you can learn how to use the trading platform.

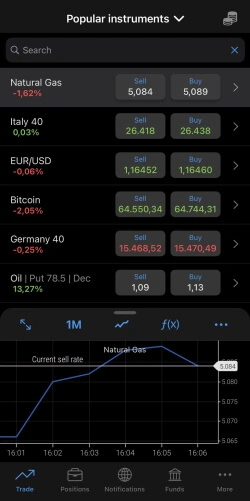

On the main screen, you will find the most popular products. By clicking on the info icon, you will open the product sheet where you will find a summary of the instrument's costs (overnight financing, required margin, maximum leverage and spread).

You will not find much information on the product, such as fundamental and macroeconomic data.

*Illustrative prices

By clicking on the star icon, instead, you can add the product to your Watchlist, where you can create a list of favourite financial instruments to be constantly monitored.

By clicking on the bell icon you can set a price alert, upon reaching a price that you will establish among the parameters.

The graph section at the bottom of the main screen is minimal. The first problem is that you cannot load more than one chart at a time. The quality of the graph is then obsolete. It is also impossible to enter orders from the chart.

Both indicators (100+) and drawing tools (21) are available but being able to apply them on the graph to make technical analysis is cumbersome.

*Illustrative prices

» Research and Analysis

The search for products takes place from the search bar at the top of the platform. Here you can enter the name of the instrument or its Ticker. If you enter the ISIN of a product, the search will not give you any results.

Alternatively, you can search for a product by going to the list where it is shown. The lists are divided by assets (commodities, crypto, options, etc.) or by market (LSE, Dax, etc.).

The only screener present within the platform is the one with the list of the Market Movers of the day. Here you will find the products with the highest rise/fall of the day.

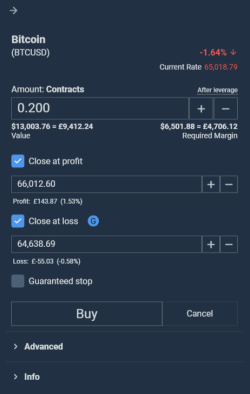

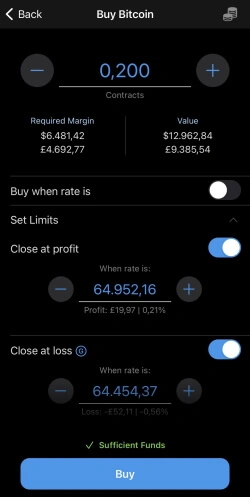

» How to Place an Order

Placing an order on Plus500 is fairly intuitive. The various technical terms - typical of trading platforms - are replaced by terms that most can understand.

For each product you will find the Buy and Sell buttons. Once you click on one of these two buttons, a pop-up window will open to enter the order.

Here you can choose between the Market Order and the Limit Order.

*Prezzi illustrativi

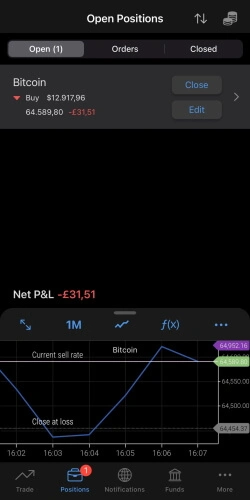

On the main order you can set the closing in profit (Take Profit), the Trailing Stop and the closing at a loss (Stop-Loss).

For the stop-loss, Plus500 allows you to set the guaranteed close. In practice, by setting the guaranteed close, if the price of the traded security moves against you, you are certain that the stop loss will be executed at the value you have set.

This happens even if there is a gap and therefore no prices are hit around the stop loss value. Guaranteed close allows you to place an absolute limit on the maximum potential loss for each position.

However, consider that the choice of guaranteed closure entails a further widening of spreads. In the Plus500 platform it does not appear that there is a one-click trading function

» Two-Factor Authentication

With two-factor authentication (2FA) there is an increased level of security on the Plus500 account. By activating 2FA, the login on the platform will consist of two steps: first you will have to enter your username and password; then you will have to enter a code provided by Plus500. Alternatively, you can use Google or Facebook 2FA.

» The Plus500 App

The Plus500 mobile app is available as an alternative to the web platform. The app is available for both iOS and Android. The app reproduces all the features of the web platform. Here too you will find a basic trading environment in which anyone can carry out their operations and manage their portfolio.

Customer Support

Plus500 Customer Support works via two channels:

- Live chat

Chat assistance is an excellent tool for receiving support quickly. During our service tests, the average waiting time was in the one-minute threshold. In some circumstances, however, responses came with some delay. This may be due to the operator having multiple chats open at the same time. It should be noted that the chat service is available 24 hours a day, 7 days a week.

With assistance received via email, however, the waiting times have lengthened, up to 24 hours for an answer. Despite the wait, the quality of the answers seemed standard for the industry.

As an alternative to live chat and email customer support, some questions may be answered in the FAQ section of the website. Here you will find more than 80 frequently asked questions covering topics such as opening an account, deposits, withdrawals and the operation of the platform.

The educational material on the website is lacking. Here you will find a few video tutorials. The topics covered in the videos are varied and generic, such as the explanation of the financial instruments tradable on Plus500, popular trading strategies, etc.

Overall rating

In conclusion, Plus500 is an online broker that has a few downfalls and has room for improvement. The platform features a more basic functionality than that of other brokers. After some review, it becomes clear that the trading services offered are inferior to others. In fact, the platform lacks any type of analysis tool. You can only trade CFDs with Plus500, whose costs are inconvenient instruments to be negotiated due to the bid-ask spread and the financing rate, especially in medium-long term investing.

The strengths of Plus500 are its security, as it is a regulated and listed broker, and the presence of more basic functionalities than other similarly structured platforms.

It might make sense to start practicing on Plus500 with the virtual account, and then once you have the right skills it would be recommended to trade with a broker like eToro that offers more trading options and has a more elaborate platform.

Plus500 Opinions and Reviews

At the end of our analysis, our views on Plus500 are average. It is not an ideal broker for a trader with intermediate to high level experience. Trading costs are too high, especially if you operate with medium-high capital. On the other hand, the account has low costs and can be suitable for those who trade with small amounts of capital.

Discover the trading tools of QualeBroker: