Summary:

- Shares, ETFs. funds and investments trusts negotiable

- ISA and Junior ISA available

- Six growth portfolios available of varying risk levels

- CFDs and crypto trading not available

![]() Pros:

Pros:

- No setup, cash withdrawal or account closure fees

- Monthly share dealing for £1.50 per trade

- Account fees remain competitive as your portfolio grows

- Highly awarded as best UK broker in 2021 & 2022

![]() Cons:

Cons:

- Web platform not suitable for advanced technical analysis

- Third-party support for charting or trading software is unavailable

- Forex and leveraged CFD products not offered

AJ Bell YouInvest review

AJ Bell YouInvest is a leading UK online brokerage firm offering share dealing, funds and currency transactions to retail investors.

Launched in 1995 as one of the UK’s first discount brokers, AJ Bell’s YouInvest online platform has since attracted over 398,000 clients and £75 billion of assets. It now employs almost 1,000 staff and is ranked as the second or third largest UK broker on several measures.

In 2018, AJ Bell’s shares were admitted to trading on the London Stock Exchange. Due to its size and maturity, AJ Bell Plc is a member of the FTSE 250 index of large-cap companies.

The firm is fully authorised and regulated in the UK by the Financial Conduct Authority (FCA). The YouInvest platform trades through its subsidiary AJ Bell Securities Limited, which is listed on the FCA register of authorised firms with reference: 155593).

As an FCA-authorised broker, AJ Bell YouInvest clients are covered by the Financial Services Compensation Scheme, which may cover £85,000 of losses if AJ Bell became insolvent. However, the firm also ring-fences client assets from its own, which limits the risk of losses in the event that AJ Bell ceases to trade.

In this expansive review, we’ll share our opinion and rating on AJ Bell YouInvest as an investment platform.

Safety

AJ Bell YouInvest is fully authorised to provide brokerage services to UK retail investors by the Financial Conduct Authority (FCA).

The YouInvest service is provided through AJ Bell Securities Limited, which is listed on the public FCA register of authorised firms as firm #155593.

The regulated status of AJ Bell affords investors with several protections and assurances; namely the right to take complaints to the Financial Ombudsman Service, and access to the Financial Services Compensation Scheme, known as FSCS.

FSCS protection is completely free and is automatically extended to all UK investors who deposit money with an authorised bank, insurance or investment firm. The scheme is designed to compensate investors for up to £85,000 if they lose monies as a result of their service provider collapsing or ceasing to trade. The FSCS was established in 2001 and has successfully compensated victims of several corporate failures that occurred during the 2007 - 2009 financial crisis.

The £85,000 limit is available on a per person, per institution basis. This means that a couple with individual accounts at the same financial institution would each receive up to £85,000 of cover.

AJ Bell YouInvest also commits to applying best practice client money processes. This includes ring-fencing client assets from its own business assets. This type of segregation should limit the risk of losses to investors in the event that AJ Bell Plc ceases to trade.

The publicly available financial statements of AJ Bell Plc underline the safety of the firm. Its latest balance sheet indicates a strong financial position and AJ Bell continues to enjoy year-on-year growth in its core business. On 31 December 2021, the firm reported net assets of £130.7m, and in the year 31 December 2021, it generated £47.7m in cash from operating activities. The firm is not reliant upon external financing or bonds to remain liquid and solvent.

AJ Bell Account

AJ Bell YouInvest offers a range of accounts to suit different investor profiles and confer different tax advantages. The number of account types to choose from is industry-leading.

It offers two standard accounts:

- Dealing account (main brokerage account)

- Cash savings hub (cash-only)

AJ Bell also offers the complete range of tax-friendly ISA and pension accounts for adults and juniors:

- Stocks & shares ISA

- Lifetime stocks & shares ISA

- Self-Invested Personal Pension (SIPP)

- Junior ISA

- Junior Self-Invested Personal Pension (SIPP)

Standard dealing accounts are subject to income tax and capital gains tax and are accessible to all UK residents.

ISA accounts are a tax-efficient product that completely exempts the assets within from income tax and capital gains tax. This makes them a ‘no-brainer’ for most investors looking to open a trading account with AJ Bell.

ISAs do carry some restrictions which means they may not be suitable for everyone. An investor may only open one of each type of ISA account each year across all providers. Investors may only deposit up to £20,000 into a stocks & shares or cash ISA each year, and this ISA allowance is shared across any other ISA accounts an investor may have.

In practice, these rules mean that wealthier investors with over £20,000 to invest annually will deposit the first £20,000 into an ISA product, and use a general dealing account or a pension account to invest the remainder of their funds.

AJ Bell minimum deposit

To open an AJ Bell dealing account or stocks and shares ISA you’ll need to deposit a lump of £500 or set up a regular investing direct debit of at least £25 per month.

AJ Bell demo account

AJ Bell does not currently offer a demo account or other trading features that would allow investors to experience their platform without investing real money.

Products and Markets

AJ Bell YouInvest allows investors to buy a range of securities and collective investments in the domestic and 24 overseas markets.

All of the instruments below are available in the complete range of accounts:

- Individual share equities

- Close-ended funds such as UCITS Unit Trusts and investment trusts

- Open-ended investment companies (OEICs) and Exchange Traded Funds (ETFs)

Using one group of investments or a combination of the above, investors can craft an investment portfolio that suits their risk tolerance, outlook and investing strategy. Active traders and passive investors are catered for alike.

AJ Bell YouInvest does not facilitate trading on margin (also known as leveraged trading) of Contracts for Difference (CFD) products.

Trading Fees and Costs

AJ Bell fees can be grouped into three categories; dealing fees, custody charges and other fees.

Dealing fees

Dealing fees on the YouInvest platform are very straightforward. Fund transactions are £1.50, share transactions are £9.95, reducing to £4.95 if you dealt shares 10+ times in the previous month.

Investors may deal over the telephone if this is their preference, however, a dealing charge of £29.95 will apply.

YouInvest’s popular regular investment service charges dealing fees of just £1.50 if investors create a regular direct debit & investment instruction. Regular deals are executed on the 10th of each month.

Finally, investors can opt to reinvest their dividends for a fee of 1% or £9.95, whichever is lower. This provides a cheap way to take advantage of compound returns by ensuring all money is actively invested. This service has a minimum charge of £1.50, so is not very suitable for reinvesting trivial dividend sums of £10 for example.

Custody charges

Custody charges are the annual fees charged against the assets you hold in your portfolio. When comparing brokers, you may find that other providers call their equivalent charge an ‘administration fee’, ‘platform fee’ or ‘account fee’.

The following fee example applies to the standard dealing account, charges for other account types may vary but this is a representative illustration.

You would pay 0.25% annually on the value of shares held in your account, capped at £3.50 per month. The charge for funds is tiered as follows:

- First £250,000 of funds - 0.25%

- £250,000 - £1m - 0.1%

- £1m - £2m - 0.05%

- £2m + - no fee

No custody charge applies for cash held in your YouInvest account.

Other charges

AJ Bell YouInvest will charge a fee when converting money between currencies, including for the purpose of buying shares or funds that are priced in a foreign currency.

You’ll be charged 1% on the first £10,000, 0.75% for the next £10,000, 0.5% for the next £10,000 and beyond £30,000 the fee is 0.25%.

AJ Bell YouInvest charges nothing to open an account, deposit funds or close your account should you choose to leave.

For a full list of fees and charges for all account types, visit the AJ Bell YouInvest platform.

Promotions

AJ Bell makes it easy to transfer your existing stockbroker holdings into the YouInvest platform with their offer to pay your exit fees for you.

That’s right - AJ Bell will cover up to £35 per investment and £500 in total for transfer and exit fees you incur to leave your current broker.

Finally, if you fund your account with £4,000 you will qualify for free online access to Shares Magazine, a leading UK publication packed with UK company analysis and financial markets commentary. The perfect resource for trading inspiration.

Trading Platform

The AJ Bell YouInvest platform is a simple, browser-based interface and a mobile investment app.

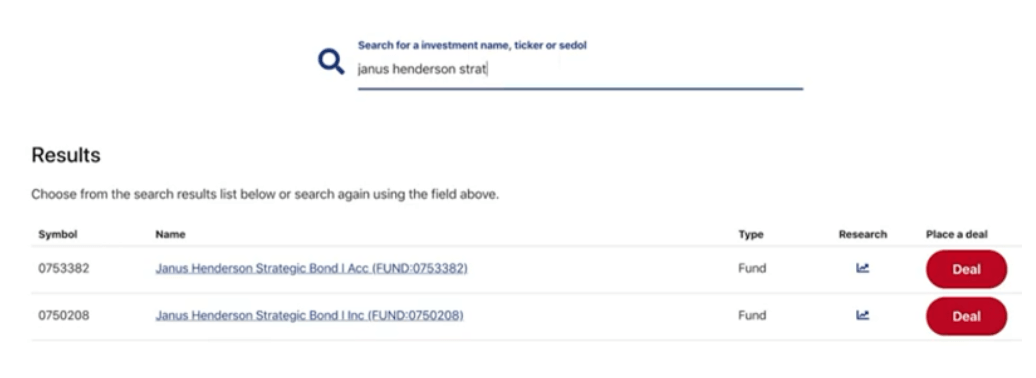

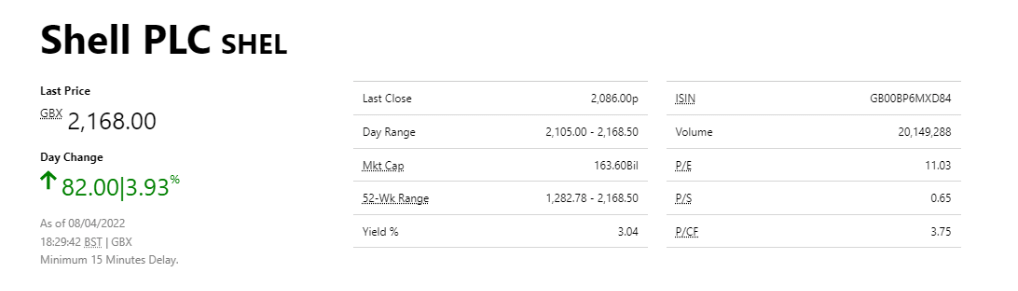

Using their search functionality, you can find any security by name, ticker symbol or ISIN code.

Alternatively, you can browse by the market if you’re researching investment options.

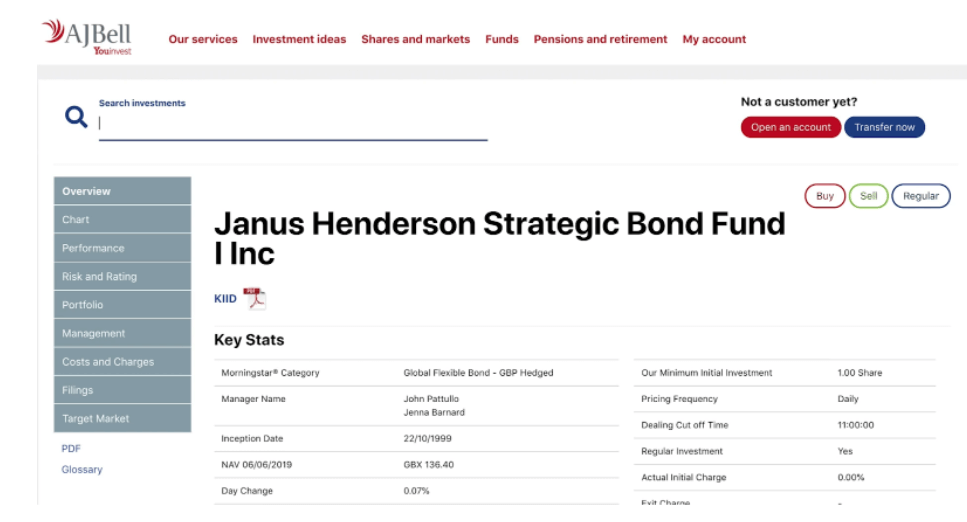

Once on a specific investment page, you’ll be shown key financial metrics such as annual management and initial charges, and provided with the Key Investor Information Document as a PDF file to download.

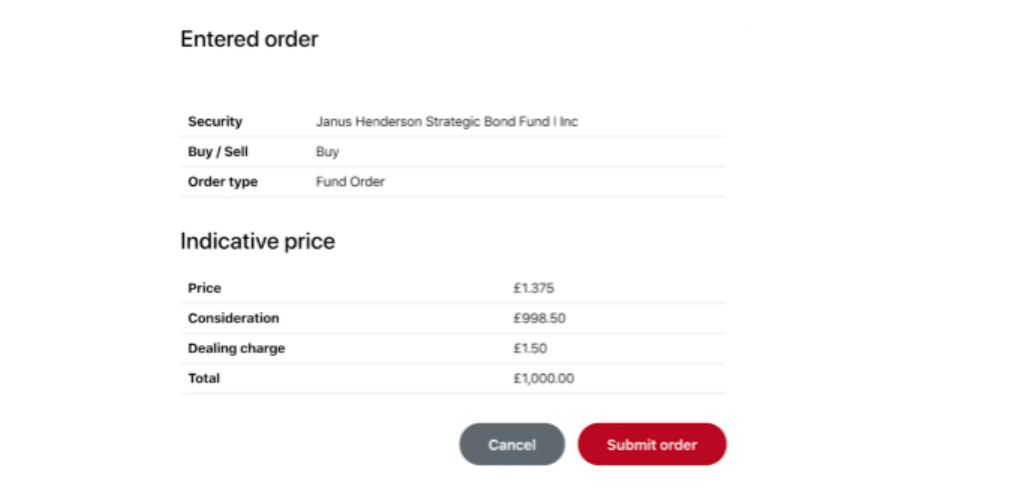

» How to place a trade

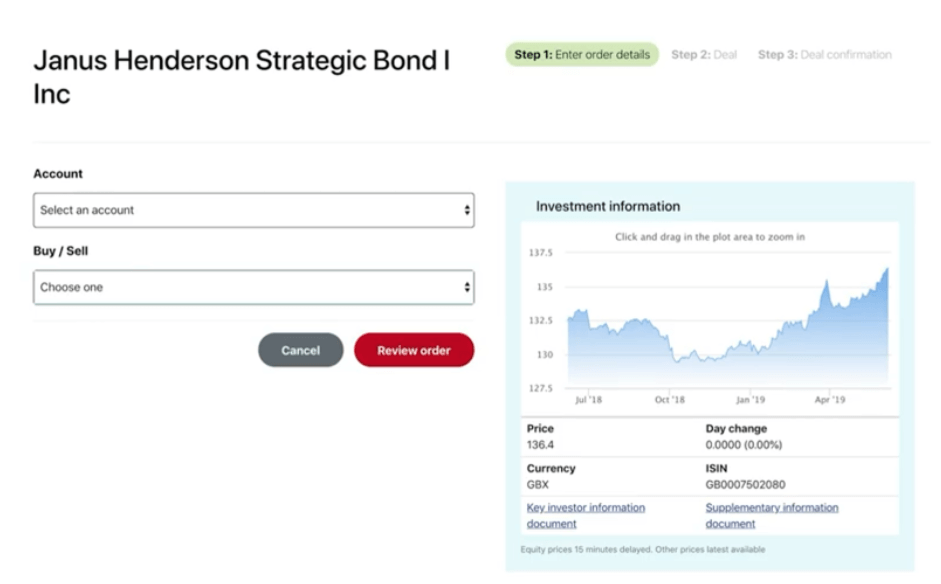

Clicking ‘buy’ will take you to the dealing page, which provides a snapshot of historical price performance and allows you to confirm whether you wish to buy or sell shares.

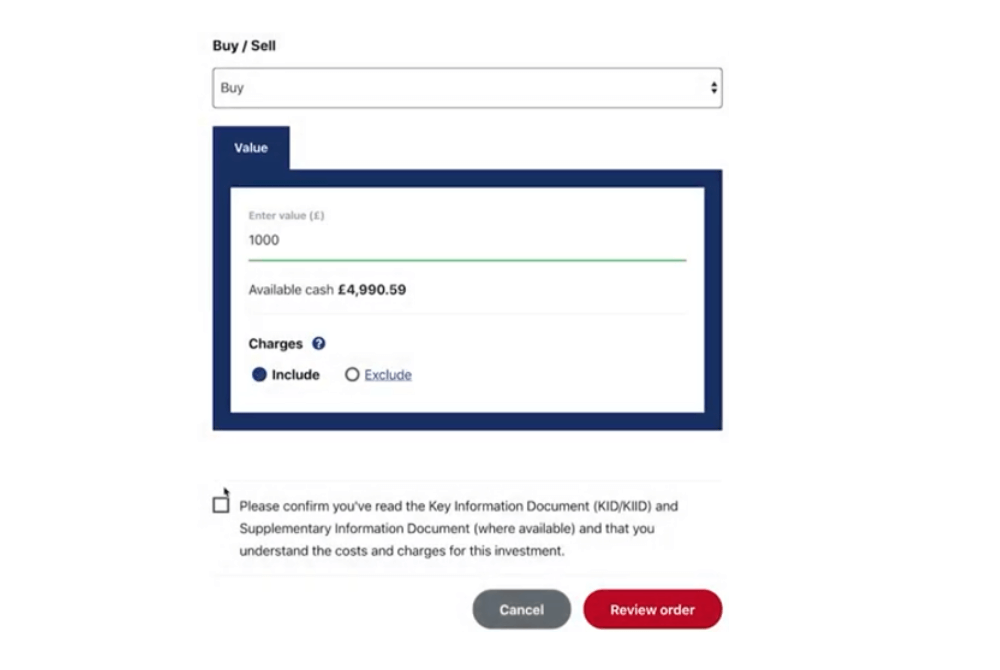

After selecting ‘buy’, you’ll be asked to input the value (in local currency) that you wish to buy and can toggle between this amount being inclusive or exclusive of dealing fees.

After clicking ‘review order’, you’ll be presented with a live quote from the stock market together with a summary of the fees that will apply. In this illustration, we chose to purchase the asset as a regular investment, so the dealing charge is only £1.50.

The trading platform is not particularly modern but is simple and easy to use, so won’t trip investors up when making their first trades.

Customer Support

AJ Bell customers can ring their UK-based support team via phone, or alternatively can send an email if this is more convenient.

AJ Bell YouInvest has received a 4.5 / 5.0 rating on TrustPilot after 2,421 reviews at the time of writing. This reflects many positive customer interactions over the years they have been trading. Many of the reviews have kind things to say about the personal attention and care they were given by the AJ Bell customer service representatives.

As a well-known and established stockbroker, AJ Bell has a reputation to protect and clearly has invested in the manpower needed to provide timely support to its clients.

Education

AJ Bell has a standard amount of information available about investments available for trade.

The information and insights on the platform are similar to that available through Google Finance or Yahoo finance. Data includes:

- Instrument market data, such as dividend yield, market capitalisation and trading volume

- Financial performance information such as revenue and profit by year

- Historical share price history

- Recent trades by directors of the company

Elsewhere on the website, AJ Bell has published an extensive FAQ to guide investors through the nuances of how to place a trade and to clarify fees and charges.

The AJ Bell investment team also publishes articles in the research section of the platform to provide some high-level commentary about topical events moving the markets.

Other useful education features include:

Financial diary - a calendar that announces upcoming investor presentations, dividend payments, stock splits, IPOs and other key corporate actions that might move prices.

Share quickrank - a bespoke AJ Bell stock-screening tool that allows investors to filter companies by industry, sector or market based upon various measures of financial performance. We found this to be a handy starting point to generate company ideas based upon a single KPI (such as YTD price movement).

Dividend dashboard - a quarterly report produced by AJ Bell’s analysts which includes UK dividend forecasts for the FTSE 100 and individual companies. An excellent companion for any UK dividend investor who doesn’t want to over-rely upon historical dividend yield information.

Overall Rating

AJ Bell is an established UK stockbroker with a large existing base of satisfied clients. It retains investors, without gimmicks, through a competitive fee structure that provides options for low-cost regular trading of shares and funds.

Its annual custody charge is very competitive against its peers Hargreaves Lansdown and Interactive Investor, particularly for investors with mid-sized portfolios of £10,000 - £100,000.

While its web-based trading platform is utilitarian and no-frills, the YouInvest offering includes access to excellent educational materials such as Shares Magazine and quarterly dividend forecasts.

We conclude that AJ Bell YouInvest is an excellent choice for ‘buy-and-hold’ investors with mid-sized portfolios.

*Investments in securities and other financial instruments always involve the risk of loss of capital. Past performance does not guarantee future returns.