Summary:

- More than 250+ tradable assets via CFDs

- Advanced platform and next-generation app

- Leverage up to 1:500 (for professional clients)

- Extensive educational offering

![]() Pros:

Pros:

- Two platforms, including the powerful MT5

- Leverage up to 1:3000

- Spreads from 0PIP on EURUSD (with Raw account)

- Demo account

- One-Click Trading

- Islamic accounts

![]() Cons:

Cons:

- Not regulated in solid and reliable jurisdictions

- Very limited asset offering

- Unclear relationships with banks

- Customer support phone number in Mauritius

Reviews and opinions about the online broker IUX Capital

IUX is an online broker that offers CFD trading services on a limited number of assets through two platforms, IUX WebTrader and MT5, both also available in mobile app version.

The broker's headquarters are located in Mauritius, a country that since 2020 is no longer classified as a non-cooperative jurisdiction. However, IUX also has companies registered in Saint Vincent and the Grenadines (considered a tax haven by many Latin American countries such as Argentina, Brazil, Chile and Mexico), as well as in South Africa and Australia.

IUX does not provide services to residents of Australia, Canada, Ukraine, European Union countries, United Kingdom, United States or Malaysia.

It is therefore a broker not regulated in solid and reliable jurisdictions and with a limited offering, but which provides robust trading technology and market-competitive spreads.

Security

For client protection, IUX declares the implementation of the following security standards:

- Two-factor authentication (2FA) – Access with password and mobile device verification code

- Device monitoring – Access control and notifications in case of login from a new computer or mobile device

- Session timeout – Automatic disconnection after prolonged inactivity

- Suspicious activity alerts – Monitoring and instant notifications in case of suspicious access attempts, unusual trading operations or changes in account settings

- Data encryption on IUX servers with 256-bit SSL protocol

- Compliance with international requirements for payment data management (PCI DSS)

Regarding client funds, IUX declares keeping them in segregated accounts (that is, in accounts separate from the company’s).

It also states that it “collaborates with top-tier global banks” and “Tier-1 Banks”, but in this case IUX does not specify what kind of collaboration it maintains nor with which banks; moreover, the reference to Tier-1 (level of financial strength of the banks in question) does not clarify the exact level.

IUX also guarantees negative balance protection, meaning the impossibility of losing more money than is available in the account, as well as offering on some instruments a guaranteed stop loss (closing of the position at the pre-set level).

Regarding the funds deposited by clients, IUX declares that it keeps them in segregated accounts (that is, in accounts different from those of the company).

It also declares that it “collaborates with top-level global banks” and “Tier-1 Banks”, but in this case IUX does not specify what kind of collaboration it has nor with which banks; furthermore, the reference to Tier-1 (i.e. the level of financial solidity of the banks in question) does not specify its degree.

IUX also guarantees negative balance protection, meaning that one can never lose more than the money available in the account, in addition to offering on some instruments guaranteed stop loss (closing of the position at the pre-set level).

Join IUX Markets: open your account online and discover its advantages.

Account types

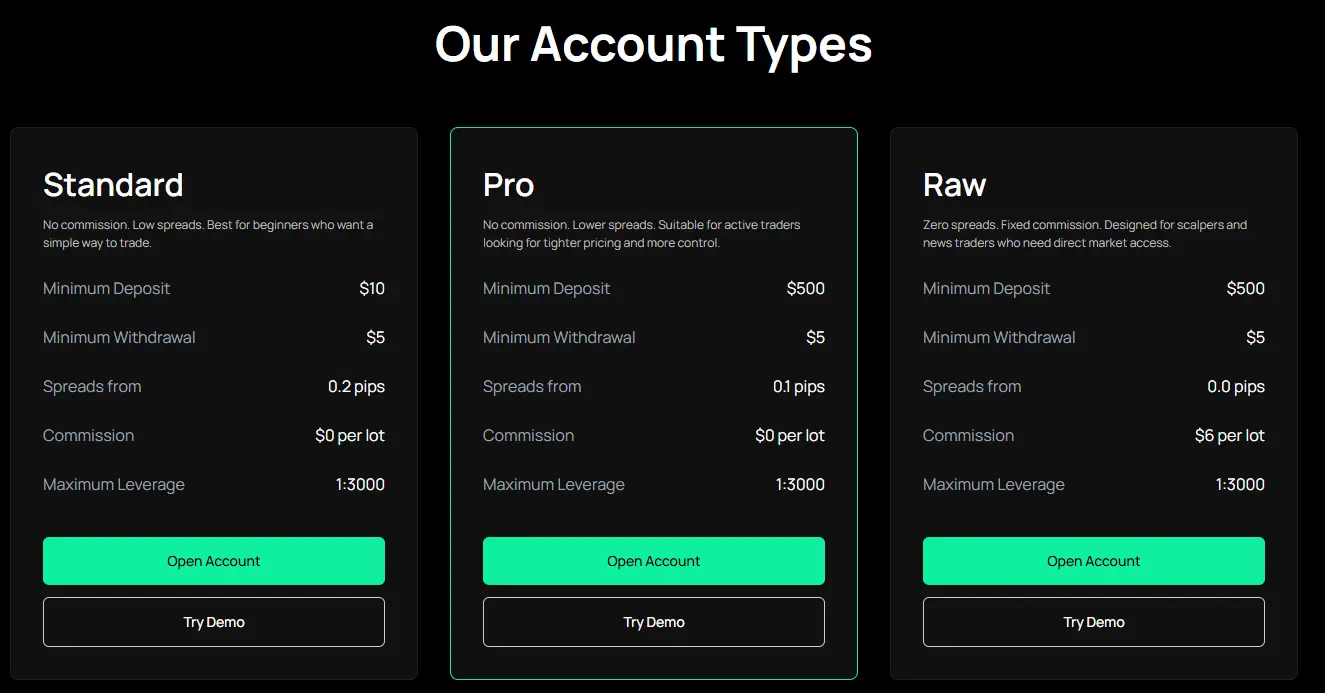

IUX offers three main account types: Standard, Pro, and Raw. The main differences are in the minimum deposit, spreads, and commissions.

| Standard | Pro | Raw | |

| Minimum deposit | 10$ | 500$ | 500$ |

| Maximum leverage | up to 1:3000 | up to 1:3000 | up to 1:3000 |

| Platforms | MT5 (desktop and app), IUX WebTrader, IUX App | MT5 (desktop and app), IUX WebTrader, IUX App | MT5 (desktop and app), IUX WebTrader, IUX App |

| Mobile trading | Yes | Yes | Yes |

| Server locations | London, Asia-Pacific | London, Asia-Pacific | London, Asia-Pacific |

| Available instruments | +120 | +120 | +120 |

| CFD trading | Yes | Yes | Yes |

| Stop-out level* | 0% | 0% | 0% |

| Margin call level | 30% | 30% | 30% |

| One-Click Trading | Yes | Yes | Yes |

| Islamic accounts | Yes | Yes | Yes |

| Demo account | Yes | Yes | Yes |

| Expert Advisor support | Yes | Yes | Yes |

*Level at which the broker closes the client's positions

The Standard account is suitable for beginner traders looking for a simple and straightforward trading experience. This means that CFDs should always be approached with a solid understanding of how they work and the variables that influence price formation. The execution type is market-based, which means that trades are executed with the broker.

The Pro account is designed for more experienced traders seeking tighter spreads and greater control over their trading activity. Execution is also of the market-based type.

The Raw account (with “raw spreads” or pure spreads, without markup) is more suitable for highly active and experienced traders. In exchange for a higher minimum deposit and fixed commissions of 7$ per lot, it offers spreads from 0 PIP on a wide range of currency pairs — including the majors — and on other selected assets. The Raw account claims to operate under the DMA (Direct Market Access) model, which means that trades are not executed with the broker but directly within the foreign exchange network.

Deposits can be made with Visa and Mastercard debit and credit cards, as well as with other unspecified cards, bank transfers, electronic wallets (e-wallets) and systems available in specific countries. The deposit must come from an account in the same holder’s name.

IUX does not charge commissions for deposits or withdrawals, which are processed instantly.

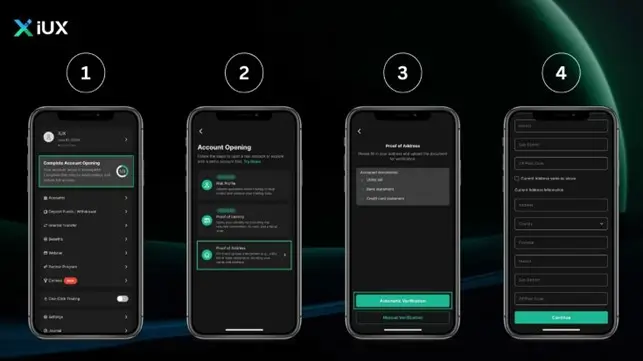

Accounts can be opened online, even from the app, and require the prior completion of three steps:

- Proof of Identity (POI): providing a valid identity document

- Proof of Bank (POB): providing a document confirming bank account ownership (for example, a bank statement)

- Proof of Address (POA): providing a document verifying the actual country of residence

The documents can be scanned in real time and uploaded automatically, or manually uploaded from the user’s device during the verification process, which usually takes between 10 and 15 minutes.

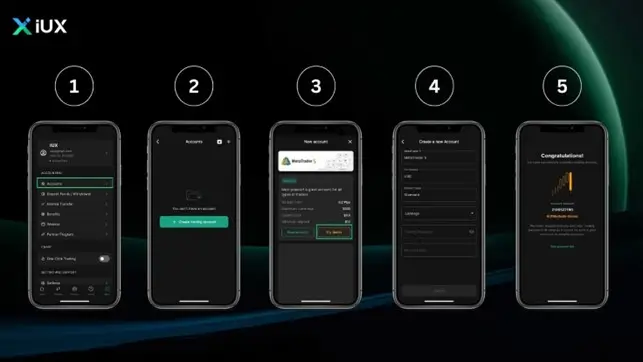

Demo Accounts

IUX offers the possibility to open up to 6 demo accounts for the Standard, Pro and Raw account types. The demo account is an account without real money but with 10,000 EUR/USD virtual, which allows you to practice with the platform and CFDs.

Demo accounts are available on all desktop platforms and the app. They have no expiration date but are automatically closed if not used for at least 90 days.

To activate a demo account:

- Log in to your account

- Go to the "Account" section in the main menu

- Click on "Create a trading account"

- Select "Try demo"

- Choose the account type you prefer (Standard, Pro or Raw)

- Set the financial leverage

- Fill out the form and submit it

Islamic Account

IUX offers the possibility to open all accounts (Standard, Pro and Raw) in “swap free” format, meaning without overnight commission charges, in compliance with Sharia rules, which prohibit Riba (interest) and Gharam (uncertainty, unforeseeable risk).

For residents in Islamic countries (e.g. Indonesia), the account is automatically opened as swap-free; otherwise, it must be configured after the opening.

Products and markets

IUX offers trading exclusively with CFDs, which means it does not provide access to real assets such as stocks, bonds or ETFs. In addition, order execution for the Standard and Pro accounts is of the “market-based” type, which implies that it is neither ECN nor DMA.

Without going into too much technical detail, this means that with these two account types, IUX does not technically act as an “intermediary”: it does not merely forward client orders to the market but becomes the trader’s direct counterparty.

This is not the case with the Raw account, which IUX claims to operate under a DMA (Direct Market Access) model.

IUX only offers CFDs, not real assets. Available instruments:

- 39 currency pairs (including majors such as EUR/USD)

- 5 commodities (gold, silver, oil, etc.)

- 48 US stocks

- 10 global and national indices

- 15 cryptocurrency pairs (BTC/USD, ETH/USD, etc.)

- 6 thematic indices

Commissions and Costs

IUX does not apply trading commissions on transactions made with the Standard and Pro accounts, while for the Raw account they are quite high: 7$ per execution. This amount is justified by the costs that IUX must bear with its liquidity providers under the DMA model.

In this case, however, the spread (that is, the markup applied between the bid and ask price) on many instruments —though not all— is zero.

For all accounts, spreads can be considered in line with the most competitive brokers.

| Standard | Pro | Raw | |

| Spread from | 0.2 PIP* | 0.1 PIP | 0 PIP |

| Commission (per lot) | 0$ | 0$ | 6$ |

| Micro-lot trading | 0.01 | 0.01 | 0.01 |

*1 PIP is the smallest possible price movement

Trading platform

One of the characteristics of the online broker IUX is that it directly relies on consolidated and high-level technology. In fact, IUX offers two advanced platforms:

The IUX WebTrader is a customized version of the MetaTrader Web Terminal, which allows web access to the functionalities of MT4 and MT5. It is suitable for monitoring positions on the go and for trading with low frequency, which is why it is recommended for less experienced or beginner traders. Nevertheless, this platform also offers One-Click Trading (order submission with a single mouse click), a feature used by scalpers but potentially risky for beginners.

The MT5 (MetaTrader 5) is a client (software installed on the computer) that is extremely advanced and professional, suitable not only for manual online trading but also for the use of automated strategies (trading systems). It is appropriate for experienced traders looking for a state-of-the-art platform in terms of technology and operational features.

A specific characteristic of MT5 is the advanced programming language for trading systems MQL5 (evolution of MQL4 available in MT4, but not compatible with it). It supports instant order execution, access to multiple price levels (level 2 market depth), allows advanced backtesting (testing of automated strategies), offers over 80 indicators and 44 charting tools for technical analysis, and much more.

| Functionality | IUX WebTrader | MetaTrader 5 (Desktop) |

| Access | Via browser (Chrome, Firefox); login from IUX panel | Installable software on Windows/macOS; login with MT5 credentials |

| Installation | None | Required (desktop or mobile app) |

| Supported accounts | MT4 or MT5, depending on account type | MT5 only |

| Symbol display | Market Watch window with product list; manual symbol search | Advanced Market Watch with filters and customizable groups |

| Charts | Interactive, with timeframes from 1 minute to 1 month | Multi-window charts, customizable timeframes and indicators |

| Order types | Market, Limit, Stop Loss, Take Profit | Market, Limit, Stop Loss, Take Profit, Trailing Stop, OCO (order cancels order), advanced order management |

| One-Click Trading | Activatable from chart; quick terminal at top left | Natively integrated; configurable for each symbol |

| Market depth (DOM) | 1 level | Available on selected instruments |

| Automated trading (EA) | Not supported | Supported via MQL5 language |

| Notifications and alerts | Not configurable | Sound, visual and email/SMS alerts |

| Advanced order management | Basic (manual open/close) | Order modification, Trailing Stop, multi-order management |

| Performance | Optimized for occasional use | High stability and speed, suitable for intensive and algorithmic trading |

| Recommended use | Occasional traders, manual operation, demo testing | Active traders, scalping, systematic trading, advanced technical analysis |

The IUX Trade App also offers full functionality, including interactive charts, market monitoring, deposits, withdrawals and internal transfers; enabling simple mobile trading with tools such as One-Click Trading and the verification of the trading history, as well as account information accessible at any time through the "History" and "Portfolio" menus.

The IUX Trade App is available for Apple iOS (version 12 or higher) and Android (version 5 or higher).

Customer support

IUX provides several contact channels, but not all are easily usable for those residing outside Mauritius.

This is the case of the physical address and the phone number; the latter appears on the IUX website simply as “028-216-698”, but it corresponds to a local number without the Mauritius country code.

In summary, the contact channels indicated by IUX for clients are:

- Phone: +230.028.216.698

- E-mail:

This email address is being protected from spambots. You need JavaScript enabled to view it. - Chat messages from the website, with an initial automatic topic selection and possible redirection to a conversation with an “agent”, with a guaranteed reply “within a few minutes”

- Live chat from the app, service always active, accessible from the main menu under Options

- Help Center on the website, very extensive, complete and well organized

- Physical address: Mauritius Office 713, 7th Floor, Nexsky Building, Ebene Cybercity, 72201 Mauritius

Final verdict

IUX is an online broker that offers an essential service based on CFDs, but provides one of the most powerful platforms on the market, competitive spreads, leverage of up to 1:3000, differentiated accounts and the possibility to choose between market execution and DMA.

It therefore appears as a broker suitable mainly for advanced and very active traders, who have several trading accounts with different brokers and do not wish to concentrate all their capital in IUX.

This is partly due to the choice of its legal headquarters in Mauritius, instead of in jurisdictions with stricter regulatory oversight, which may raise concerns for some investors.

Beginner traders can nevertheless benefit from IUX by using the demo account and, eventually, limiting themselves to the use of the WebTrader platform.

Discover the tools of QualeBroker: