Summary:

- 7 tradable asset classes

- Virtual money demo account

- Micro-lots can be negotiated

- Competitive spreads and commissions

![]() Pros:

Pros:

- Highly competitive spreads and fees

- Investors protection scheme up to £1,000,000

- Platforms suitable for all types of traders

- Offering educational tools for clients

![]() Cons:

Cons:

- Broad product offering but limited to CFDs only

- No protection against slippage

4.9

4.9

Reviews and insights: online broker ActivTrades

With over 20 years of experience, ActivTrades is one of the pioneers of international online trading. It serves UK clients through ActivTrades PLC, a company registered in England and Wales and regulated by the FCA.

ActivTrades, in addition to its headquarters in London, has expanded its global presence: the broker, to meet the diverse demands of its clients, also has branches in Luxembourg, Italy, Bulgaria and the Bahamas.

In this review, we looked in depth at ActivTrades, starting with the level of safety it guarantees and moving on to the services and trading conditions offered. We examined the Client Agreement looking for potential clauses that are harmful to the investor.

You will also find our views on ActivTrades, the pros and cons, to help you decide whether you should choose it as your online broker.

Should I open an ActivTrades account? It's up to you to decide, after reading our analysis and opinions.

Safety

ActivTrades' headquarters are located in the financial heart of London. Over the years it has opened several branches worldwide such as in Italy, Luxembourg, Bulgaria and the Bahamas.

Despite its large size, to date, it is not a listed company and therefore its financial statements and financial data are not made public as per the regulations for listed companies.

However, what should interest you most is that ActivTrades serves:

UK clients through ActivTrades PLC, an investment firm authorised and regulated by the Financial Conduct Authority, registration number 434413

European clients through ActivMarkets, a Public Limited Company, authorised and regulated in Portugal by the Comissão do Mercado de Valores Mobiliários (CMVM) with the number 433 and a company registered in Portugal with the number 516 929 291.

ActivTrades is also regulated by other regulatory bodies such as SCB (Bahamas), BACEN & CVM (Brazil) and CMVM (Portugal).

Money deposited by clients is kept following the rules on the segregation of funds. It means that clients' assets must be kept legally separate from those of the broker. This keeps investors' liquidity safe from the possible aggression of third-party creditors who might want to retaliate against the broker's assets.

In the case of ActivTrades, the funds deposited by customers are placed in a segregated custodial account of one of its custodian banks.

The Financial Services Compensation Scheme (FSCS) covers up to £85,000 in client compensation claims against it. In addition, ActivTrades assigns by default a free policy that protects more than £85,000 for each client, reaching as much as £1,000,0000 of protection. No other online broker can do better in this regard.

ActivTrades account

Any user can initially decide whether to open a real account, or to test the platform first with a virtual account.

This second solution is always recommended, as it allows you to assess whether the services and conditions offered by the online broker are in line with your personal expectations.

On the other hand, for those who do not have much experience in online trading, thanks to the virtual account they can move more quickly along the learning curve, all at no cost.

Unlike all other brokers, ActivTrades allows you to test the proprietary ActivTrader platform in demo mode without having to register first: once you have made a request, you can use a demo account for 3 days, with €10,000 of virtual money at your disposal.

By registering online instead, the duration of the demo account is extended to 30 days.

Once you have tested (and most certainly enjoyed) the ActivTrader platform in the demo version, you will need to register a real trading account in order to get into the action with real money.

In order to complete the registration of a real account, you will need a copy of the following documents to be uploaded:

a valid ID

your TIN

a proof of residence issued within the last 3 months

ActivTrades offers one type of account to all its clients: everyone will receive the same trading conditions and opportunities, regardless of their volume, transactions, etc.

In which currencies can the account be opened?

ActivTrades allows you to open an account denominated in EUR, GBP, USD or CHF.

Deposits and Withdrawals

Deposits and withdrawals of money are always free and quite fast. The following payment methods are accepted:

- Bank transfer

- Credit/debit card Visa, Visa Electron, Mastercard, Maestro

- eWallets such as PayPal, Skrill, Neteller, Sofort.

Apart from depositing via bank transfer which takes 24/48 hours, with all other payment methods the funds are available within minutes of the transaction.

Withdrawals, on the other hand, take approximately 48 hours to be processed and credited into your account or card.

What is the minimum deposit to open an account?

No minimum amounts are required to activate the ActivTrades trading account. Funds can therefore be deposited as low as £/€/$ 0.01.

Financial leverage

As you probably already know, for several years now ESMA has been revising the leverage limits for all retail clients downwards, placing a maximum limit on leverage of 1:30.

To take advantage of higher leverage levels, you may consider contacting the separate group entity with a Bahamas branch ActivTrades Corp, which cannot directly advertise its services in the European territory as a non-ESMA broker.

Products and Markets

ActivTrades allows trading on 6 financial assets, via 1000+ CFDs. These assets are:

Forex: over 50 tradable currency pairs including major, minor and exotic. Maximum leverage 1:30

Indices: Cash and Forward indices of the major world indices (including the UK 100) are available. Maximum leverage 1:20.

Commodities: 12 commodities available. Maximum leverage 1:10.

Shares: over 500 shares listed on European and US stock exchanges. Maximum leverage 1:5.

ETFs: major global ETFs available. Maximum leverage 1:5.

Bonds: 8 fixed-income CFDs available. Maximum leverage 1:5.

Spread betting: tens of thousands of underlying markets available with leverage, tax-free.

With ActivTrades, you can also trade microlots (0.01 lot). This offers the possibility to trade even for those who wish to trade with small capital.

Fees and costs

As we specified in the section above on account types, ActivTrades offers a single account type for all its clients.

All traders will therefore benefit from a single fee structure, with the same swap rates and spreads.

Except for CFDs on shares, ActivTrades does not charge commissions on trading transactions: the transaction cost is charged exclusively on the bid-ask spread.

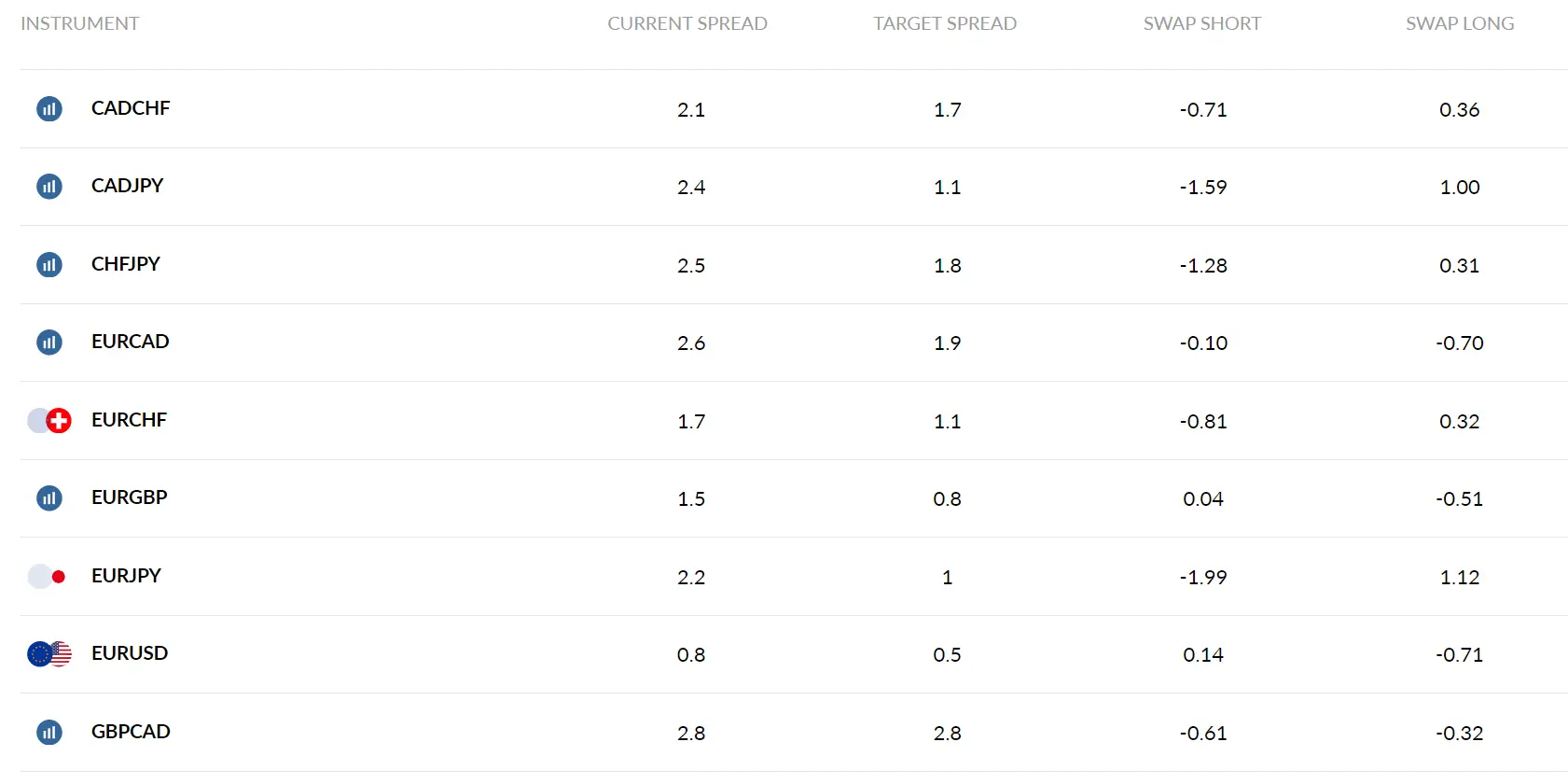

ActivTrades offers overall variable spreads depending on the underlying product. The target spreads that this broker aims to offer are generally narrower than most other online brokers (although in our test trades, we found slightly wider spreads than the target spread, as we will see later).

For Forex, the spread varies depending on the category to which the currency pairs belong:

for major currency pairs, the target spread varies from 0.50 pips (as for EUR/USD) to 2.60 pips

for minor currency pairs, the target spread varies from 0.60 pips (as for AUD/USD) to 5 pips

for exotic currency pairs, the target spread ranges between 5.90 and 27.90 pips, except for the USD/BRL and USD/RUB pairs, where it is 100 and 1,000 pips, respectively.

The spread for commodities is between 35 and 45 pips.

For indices, it varies between 0.01 and 0.5 pips.

As we mentioned at the beginning of the section, commissions only apply for CFDs on shares, while the spread reflects that of actual stock market prices. Commissions for European shares are 0.05% of the counter value (except for London equities where the commission is 0.1%), with a minimum of €1. For US equities, on the other hand, you pay $0.02 per share bought/sold.

There are inactivity fees for the account, but only from the thirteenth month in which no transactions have been recorded on your account. In this case, a fee of EUR 10 per month will be charged.

Trading platform

ActivTrades allows its client to trade through the following platforms:

-

ActivTrader

-

TradingView

-

MT4

-

MT5

While the ActivTrader and TradingView platforms are web platforms, appreciable for their practicality and user friendliness, the MT4 and MT5 are desktop platforms designed for more advanced traders looking for complex tools for analysis and automated trading.

All 4 platforms mentioned are available for mobile trading via apps.

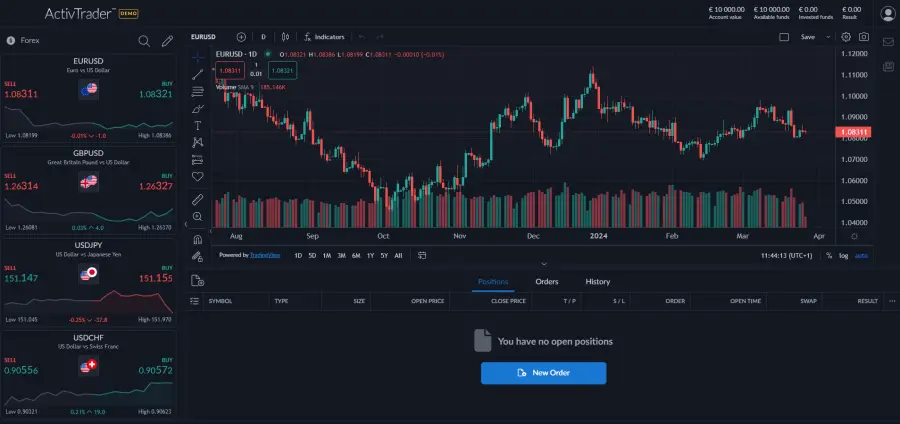

ActivTrader

ActivTrader is ActivTrades' proprietary platform. It immediately appears to be a streamlined platform designed for the trader looking for an easy-to-use platform.

The main interface is customisable according to your preferences. The layout of the sections can be changed from Settings, or each section can be zoomed in/out using the mouse cursor. You can also change the platform language from English to 10 other languages.

Once the platform is closed, the last settings are saved automatically and reloaded when the platform is accessed the next time.

The chart section can contain from 1 up to about 16 charts of your choice (although I recommend keeping no more than 4 open to keep the interface clean).

The watchlist, located on the left-hand side of the platform, can be set to our liking with all the financial instruments we want to monitor.

We liked the fact that each product included in the watchlist is integrated with the market sentiment on that specific product.

Research and analysis

Searching for instruments is extremely simple via the search bar at the top left. Here you only need to search for the name or symbol of the product (the ISIN will not give any results for stocks) to obtain the product sheet with the chart and the order entry mask.

Moving on to the technical analysis tools, more than 50 indicators and 30 drawing tools can be applied to the push chart.

ActivTrades keeps these sections very tidy, grouping indicators by type (trend/oscillators/volatility) and indicating in the first directory of the drop-down menu which ones are the most popular.

Within the ActivTrader platform, we did not find sections on financial news, the macroeconomic calendar, market analysis, etc. For this type of data and information, the trader must use an external provider alongside ActivTrader.

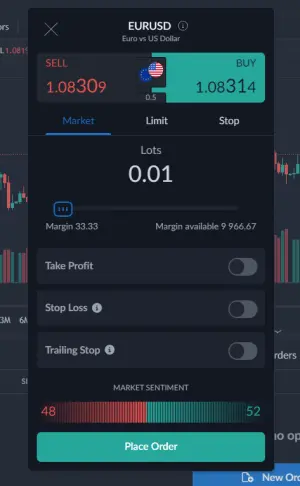

Order types

The order types available to purchase/sell a financial instrument are:

- Limit order

- Stop order

- Market order

The following conditional orders may be added to the main purchase or sell order:

- Stop loss

- Take profit

- Traling stop

There is no possibility to set a maximum slippage on the order.

To place an order, click on the "New Order" icon at the top of the screen. You will then need to fill in the order entry form, indicating the order type, quantity and any conditional orders to be integrated.

Alternatively, you can enter the order directly from the chart by right-clicking near the price at which you are interested in opening the position and choosing which type of order to execute at that value.

Once a position has been opened, it will be accounted for in the section at the bottom. Here we will find a summary of open positions, all pending orders and the transaction history.

Closing positions is done by clicking on the icon next to each currently open position. Upon confirmation, a market order of the opposite sign to that of the position opening will be placed.

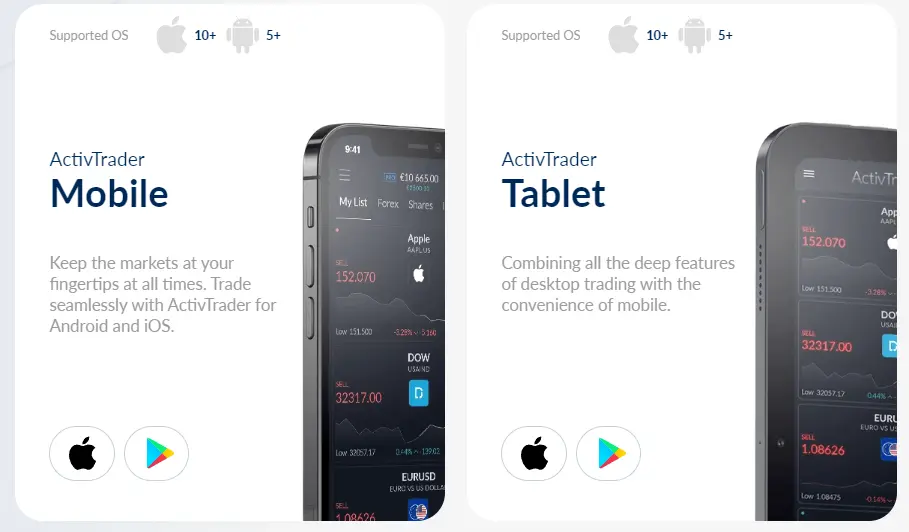

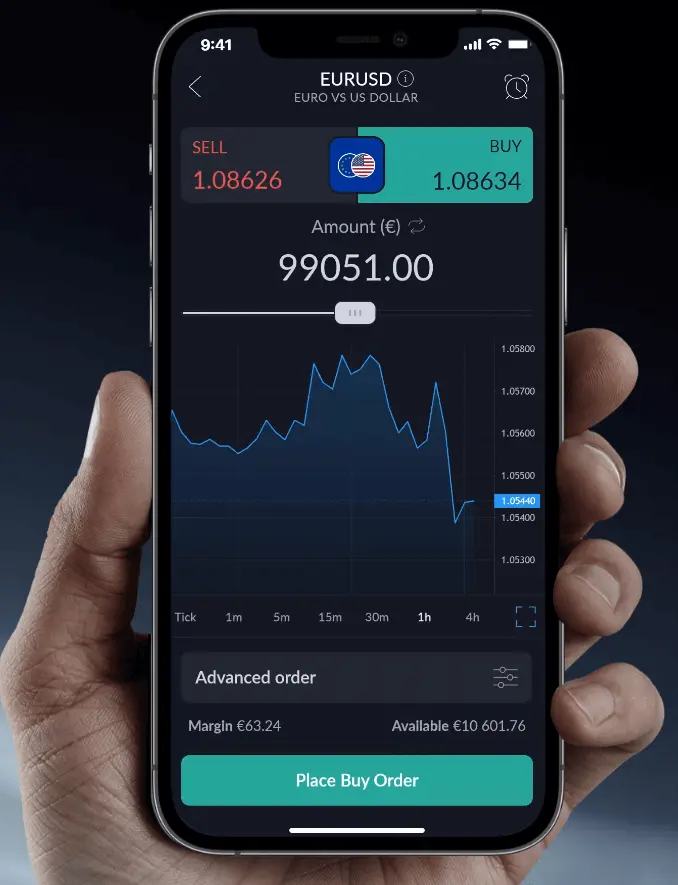

The ActivTrades App

The ActivTrader platform is also available in a mobile version for smartphones and tablets. This app can be downloaded on both iOS and Android devices.

Overall, the ActivTrades app retains the features of the web version, although some features are missing, such as 'one-click trading' or the customisation of various sections.

The same indicators and drawing tools can be applied to the graphs, but the usability of the mobile app decreases drastically compared to the equivalent web version.

In summary, then, the ActivTrades app is undoubtedly user-friendly and practical to use, however more demanding traders will have to consider using the more sophisticated MT4 or MT5 mobile apps.

The MT4 and MT5 platforms

As we have already mentioned, the MT4 and MT5 platforms meet the needs of the most advanced traders.

Through these platforms you will be able to trade automatically by creating strategies using the modern MQL4 language.

Within MT4 and MT5 there will be several features not present on the ActivTrader web platform. These are:

- a news section

- a section dedicated to education

- the SmartPattern: a tool that detects graphic patterns

- the SmartOrder 2: a tool that allows orders to be placed more quickly

- the SmartCalculator: a useful tool for calculating potential risks and gains from a position

- the SmartLines: a tool to automatically execute orders based on the trendline drawn on the chart

- the SmartTemplate (MT4 only): a decision support tool by monitoring the most important market parameters and certain indicators

- the SmartForecast (MT4 only): an advanced technical analysis tool that automatically calculates resistance and support as well as volatilities and market trends.

In conclusion, for the trader there is a wide choice of platforms available: web, desktop and mobile. The beginner will perhaps find it more convenient to use the ActivTrader web platform, while the more advanced trader will benefit more from the MT4 and MT5 platforms (it being understood that more than one platform can be used at the same time, linked to the ActivTrades account).

Our suggestion is therefore to test all the available platforms in demo mode, so that you can orient yourself towards the product that best suits your characteristics as a trader.

Customer Support

Customer Service is one of ActivTrades' main strengths. It is available 24 hours a day, Monday to Friday. We admit that we were pleasantly surprised by the speed with which our requests were taken care of, as well as by the quality of the support we received from the operators.

Support can be provided through the following channels:

Live chat

Email

Telephone

Of the three options, we particularly appreciated the chat with real operators: out of 20 chats initiated from the ActivTrades website, 100% of the time we got an answer from the operator within 60 seconds of starting the conversation. Within a few minutes we therefore had our questions answered, without having to call or email and wait.

Even before contacting ActivTrades Customer Service, we suggest that you first consult the comprehensive FAQ section, whose frequently asked questions cover most areas of interest: from opening an account to payment methods and trading platforms. You will then be able to find the answer to your query here.

Also very useful for the trader is the Glossary page, where you can find a collection of the most frequently used words with ActivTrades, and their relative meanings.

Equally impressive is the education and training service that ActivTrades offers its users. This free service is provided through the organisation of seminars, webinars, video tutorials, live trading sessions with professional traders and much more.

Final verdict

Having concluded this review, our verdict on the ActivTrades online broker is overall more than positive.

In some aspects, such as safety and customer service, it is difficult to find better. In other aspects, such as the proprietary app or the offer of tradable currency pairs, there is still room for growth for this online broker.

For this set of reasons, we believe that opening an account with ActivTrades may be a good choice for trading CFDs and Forex, as for all sections analysed in this review, the broker passes our tests with flying colours.

Discover the trading tools of QualeBroker: