Summary:

- UK-based organisation regulaed by FCA

- 2 account types available

- ISA and SIPP offered

- Highly rated Customer Support

![]() Pros:

Pros:

- Fixed account fees are very affordable for large portfolios

- First trade each month is free

- Free regular investing

![]() Cons:

Cons:

- Minimum account fee of £120 p.a is expensive for small portfolios

- Third-party support for charting or trading software is unavailable

- Forex and leveraged CFD products not offered

4.5

4.5

Interactive Investor review

Interactive Investor (“II”) is the second-largest dedicated stockbroker in the UK. The firm is privately owned and serves over 400,000 clients.

Interactive Investor’s spectacular growth has seen the business add over 50,000 new UK clients each year for the last few years.

Our review concludes that these clients are drawn to Interactive Investor in the search for rock-bottom fees. In 2019, the broker adopted a unique fixed-price model that caps the cost of investing regardless of the size of your portfolio.

Most brokers charge an account fee based upon a percentage of your account value. This means that as your investments grow, your account charges will grow with it. In stark contrast; Interactive Investor charges a monthly fee of £9.99, £12.99 or £19.99 for different account plans. These fees are expensive for tiny accounts but translate to an insignificant % for large portfolios, making Interactive Investor the natural home for cost-conscious investors with portfolios worth in excess of £100,000.

Interactive Investor is a stable UK financial institution that falls under the oversight of the Financial Conduct Authority. It was recently announced that Interactive Investor will be acquired by Abrdn, an asset manager based in Scotland that was founded in 1825. This is a further sign of confidence in the long term future of the broker.

In this broker review, we’ll uncover the features of Interactive Investor that have underpinned its success and explain which types of investors may find an Interactive Investor account to be their ideal investment platform.

Safety

Interactive Investor is a UK-based organisation. It currently operates from offices in Manchester, Leeds and London, with a total team of over 500 staff.

The firm was founded in 1995 and grew during the following decade which saw an explosion in share dealing online. This has meant that Interactive Investor has always been tech-focused and mindful of the future of wealth management.

Interactive Investor Services Limited, a wholly-owned subsidiary of Interactive Investor, is authorised and regulated by the Financial Conduct Authority. The register of the FCA states that as a firm with permission to handle client money; ‘This firm must protect the money it holds and/or controls on behalf of customers. It cannot lend this money or use it to finance its own business.’

This refers to ‘ringfencing’, the concept of separating the assets of clients from the assets used to operate the business activities. This process helps to ensure that in the event of bankruptcy, client assets should remain intact and available for outward transfer to another stockbroker after fees.

As a client of a fully regulated FCA broker, you would also be entitled to up to £85,000 in compensation from the Financial Services Compensation Scheme were you to lose money directly as the result of the failure of the firm.

At the time of writing, Interactive Investor is set to be acquired by Abrdn, a modern asset management stalwart that oversees £465 billion of assets. This transaction will provide further peace of mind to clients that Interactive Investor is a sustainably-run organisation that will be around for the long term.

Interactive Investor Account

Interactive Investor has recently refreshed the account types and pricing plans available for UK investors. With a simpler range and more features packed in each account plan, choosing the ideal account for you has never been easier.

The account types available are:

- General investment account

- Stocks & Shares ISA

- Junior ISA

- Self-Invested Pension

All of the accounts have a similar range of investment options available, such as domestic and international equities, funds and bonds.

With the exception of the Self-Invested Pension (also known as a SIPP), you can open one of each account type without attracting any additional fees. That’s because your charges are paid as a subscription plan based on your trading activity across all of your accounts, rather than on a ‘per account basis’. More details on pricing will follow in our ‘Fees and costs’ section.

Interactive Investor does not offer a cash ISA or Lifetime ISA option, unlike some large UK competitors such as AJ Bell [See our full AJ Bell review for more information]

Finally, the broker offers joint accounts and corporate accounts for more complex ownership scenarios. If you’d like to jointly own a portfolio of shares with your spouse, or better utilise company cash then you may want to consider one of these specialist options.

Charges for these accounts are entirely separate because they are not operated by a single individual.

» Interactive Investor minimum deposit

An Interactive Investor account may be opened with as little as £1, or via the setting up of a regular direct debit from your bank account for £25 per month.

Once opened, you can invest as little as £25 a time with your account.

This low deposit minimum makes the Interactive Investor accounts one of the easiest to open, however, it’s worth remembering that the minimum account fee of £9.99 per month would make it unaffordable to manage a portfolio of less than £1,000.

» Interactive Investor demo account

A demo account is not currently offered by Interactive Investor. This is not necessary because all the relevant information about platform fees charges and investment options is publicly visible on their website.

This allows potential clients to make their decision to open an account with confidence using all the information readily available.

Products and Markets

Interactive Investor offers trading in an impressive range of publicly traded stocks & shares from around the world. In fact, they claim to offer the widest range of international shares.

That’s because Interactive Investor is a member broker that can directly place trades on many global stock exchanges. This allows them to provide wide access to these markets to their own clients.

Many other retail investment brokers actually rely on third parties for access to the stock market. This naturally leads to restrictions on what they can and cannot offer their clients.

If you consider that the UK’s stock market only represents approximately 4% of the value of the world’s listed companies, you will begin to appreciate why it’s so important for you to have easy access to US and other international businesses.

Interactive Investor offers hundreds of funds for investors to purchase. It does an excellent job in narrowing down this vast list into its Super 60 Investments shortlist of funds, designed to cover a variety of best-in-class funds in a variety of asset classes. II also publishes a shortlist of ethical funds called ‘Ace 40’ for investors who want to only put their money to work in companies that are creating positive impacts on the environment and civil society.

» Advanced investments

Interactive Investor provides access to high-risk investments that are not widely available on most investment platforms. These include Venture Capital Trusts and direct investment in fixed-income investments such as corporate bonds.

These investments are labelled as ‘high risk’ because:

- You may be ‘locked into’ the investment for an indefinite period rather than being able to sell on the open market at a time of your choosing

- The underlying investment strategy of the fund could be high risk and therefore carry a reasonable risk of high losses

- The market for the resale of such investments may be small, and therefore may not be ‘liquid’ enough to guarantee a fair offer price at all times for your investment.

While these investments may be unsuitable for many investors, their presence on the menu of investment options helps to build up Interactive Investor’s brand as a one-stop shop for private investors.

Trading Fees and Costs

Interactive Investor calculates your account and dealing fees based upon the ‘plan’ you pick.

There are two core plans; a £9.99 per month ‘Investor’ plan with great value features, and a £19.99 per month ‘Super Investor’ plan that contains additional perks and discounts.

Because these fees are capped, they represent a bargain for investors with large pots.

On a portfolio of £100,000, even the Super Investor plan equates to less than 0.3% per year. The more you deposit, the smaller the fee will become as a % of your holdings. It’s difficult to find a broker charging less for this range of financial services.

Below, we’ll list what you’ll receive for each plan to allow you to compare the offering against the price:

£9.99 Investor plan

- 1 free monthly trade

- Online trading fees:

- UK shares and funds, US Shares: £7.99

- Other International Shares: £19.99

- Free regular investing

- Dividend reinvestment: £0.99

£19.99 Super Investor plan

- 2 free monthly trades

- Allows 5 friends & family to set up accounts for no monthly account fee

- Online trading fees:

- UK shares and funds, US Shares: £3.99

- Other international shares: £9.99

- Free regular investing

- Dividend reinvestment: £0.99

Investors who aim to keep their portfolio simple with one or two funds will love the no-frills Investor plan, which comes with one free trade each month. Savvy fund investors may limit the number of transactions to use these free trades efficiently and avoid paying any dealing charges altogether.

The Super Investor plan costs £10 more each month but comes with a host of benefits such as bargain trading fees of £3.99 for US shares, and the option to enable friends and family to invest with zero account fees.

We conclude that the Super Investor account is a great deal for the head of a financially-savvy family or investors who want to deal regularly to manage a portfolio of UK & US company shares.

» Dealing fees

The UK & US share dealing fees specified above of £7.99 and £3.99 are comparable to other UK stockbrokers. But we suggest you pay close attention to the offer of free regular investing, which is available with both account plans.

Regular investing is where Interactive Investor will place pre-ordered trades on a fixed day each month on behalf of all investors. This allows the broker to group together similar orders and save on its own costs at the exchange.

Interactive Investor’s free regular investing offer means that you could invest in a wide variety of instruments without paying a penny in transaction fees. This is a market-leading offer, as most other UK stockbrokers charge between £1.50 and £5 for this service.

» Other charges

Interactive Investor charges an incremental account fee of £12.99 per month if you add a Self-Invested Pension.

It also levies foreign exchange fees (1.5% maximum) when converting your own currency into foreign currency. II allows you to manage your foreign exchange fees better than other stockbrokers by allowing you to hold 9 currencies in cash at any time. This may allow you to sell US shares and use the US Dollar proceeds to buy other US shares without needing to convert between currencies.

Urgent UK withdrawals attract a fee of £15, but withdrawals are free if you can wait 1-2 working days for the transfer to process.

Interactive Investor currently offers no interest rate paid on cash balances held in your account. This isn’t a fee, but represents an opportunity cost if you could have earned a return on that cash if it was deposited elsewhere.

Trading by telephone costs £49 in addition to the basic dealing charge for the trade.

Promotions

If you are a new customer, you can open an Interactive Investor SIPP before 30 April and pay no SIPP fee for 6 months – saving you a total of £77.94. Terms apply.

Interactive Investor does not offer any short-term promotions beyond this pension offer.

Trading Platform

The trading platform of Interactive Investor is a basic web browser interface that offers little information to the investor beyond the essential prices and statistics needed to make a simple trade.

As Interactive Investor appeals to cost-conscious investors looking for a simple buying experience, this comes as little surprise and doesn’t undermine the overall offering.

» How to trade with Interactive Investor

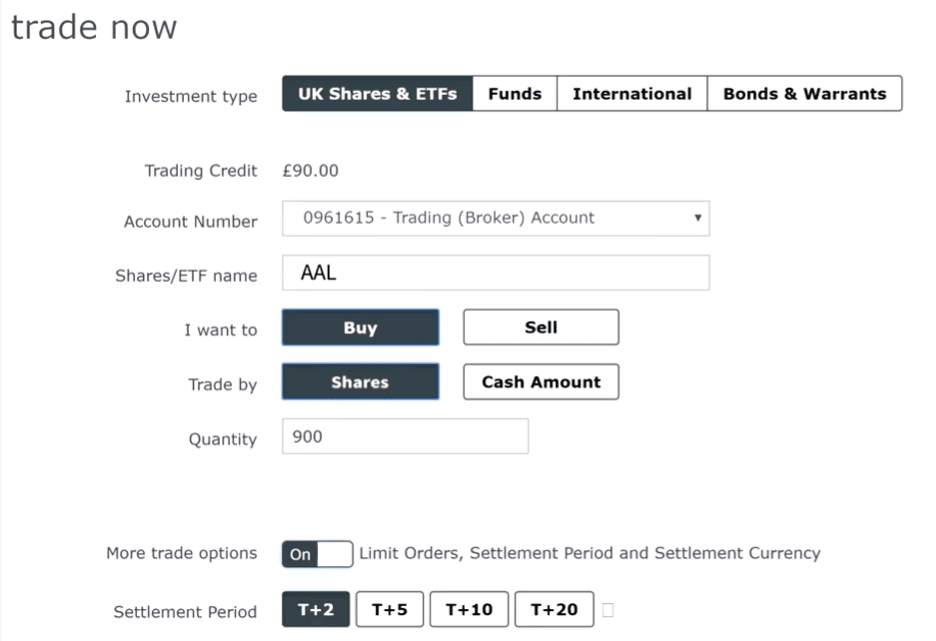

Placing a trade with Interactive Investor is as easy as filling in a short form, as shown below.

You’ll initially select the ‘market’ your investment belongs to, then select the account you wish to use to make the trade.

After using the search bar to identify your investment by name, ticker symbol or ISIN number, you’ll clarify whether you wish to buy or sell.

When selling, you may wish to specify the number of shares you want to sell, rather than a currency amount. However, investors making a buy trade will usually have a specific budget and therefore they can use the ‘cash amount’ feature to let Interactive Investor calculate how many shares this equates to using the latest available market price.

If the quantity of shares is selected, then you’ll enter the number of shares to buy or sell. If you had selected ‘cash amount’, you’ll be asked to enter the total value of the transaction instead.

Advanced settlement options are available (shown above) for users who wish to use them. Please be aware that longer settlement periods may attract extra charges. The default T+2 settlement period will ensure that your trade will conclude as quickly as the system will allow.

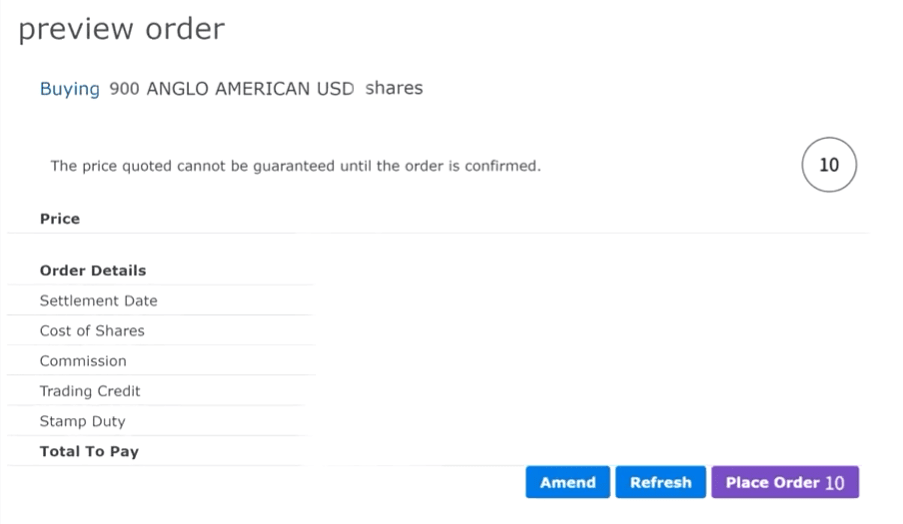

After entering the order, you’ll be shown a final preview that will confirm the total price and quantity of instruments to be traded. This will provide a ten-second window (during open stock market hours) for you to double-check the details of your trade before clicking ‘place order’ to seal the deal.

Your order receipt will be emailed to you and will be available as an electronic document within minutes of the trade being placed. While it will take from 2 working days for the order to fully ‘settle’, your investment account history will be immediately updated to show the cash impact of a buy trade. This will reduce the room for misinterpretation of what cash is available in your account to use for further trades.

Customer Support

Interactive Investor is one of the highest-rated stockbrokers in the UK with regard to the quality of service.

Its Trust Pilot score at the time of writing is 4.7 / 5.0 based on 20,000+ reviews. This is a whole-hearted endorsement of the broker from real customers.

The Interactive Investor support team can be contacted via phone, online message, email or written post. A host of helpful guides covering topics from making a trade to accessing your account are also available on the official II website.

Education

Interactive Investor produces a weekly stream of stock market news and analysis from an award-winning team of financial journalists and market analysts.

We have counted publications from over 12 unique contributors in the last 14 days at the time of writing this review.

The comprehensive II Knowledge Centre is publicly accessible on the website and includes quick start fund suggestions and insightful guides such as; ‘A plain English guide to corporate jargon’ and ‘How to invest using ETFs’.

Other useful sections include ‘Risk and you’ and ‘Finance for kids’ which each host a library of answers to your burning questions on those topics.

Overall Rating

Interactive Investor is quite possibly the cheapest stockbroker for large investment portfolios in the UK.

It could be your perfect match if you are a cost-conscious investor with a lump sum of over £50,000.

Those with smaller pots may find other brokers such as AJ Bell to be cheaper, although you may not notice the difference unless your portfolio is worth less than £10,000.

The II trading platform is basic and predictable, giving investors unparalleled access to shares and funds in domestic and international markets.

For adventurous types; II also offers some advanced investments such as Venture Capital Trusts which leaves the door open to some exciting (but high-risk) private equity opportunities in the future.

With a dominant market share and an imminent acquisition by Abdrn Plc, clients can trust that Interactive Investor will remain a competitively priced broker for the long term.

*Investments in securities and other financial instruments always involve the risk of loss of capital. Past performance does not guarantee future returns.