| |

Pros: | Cons: | |

| High level of safety and fund protection. | Platform not suitable for advanced technical analysis. | ||

| Low trading fees. | Non-customizable fees for sending cryptocurrencies. | ||

| Intuitive platform also suitable for beginners. | Lack of training and educational materials. | ||

| 24/7 customer service, 365 days a year. | Coinbase PRO available only in English. |

Pros:

High level of safety and fund protection.

Low trading fees.

Intuitive platform also suitable for beginners.

24/7 customer service, 365 days a year.

Cons:

Platform not suitable for advanced technical analysis.

Non-customizable fees for sending cryptocurrencies.

Lack of training and educational materials.

Coinbase PRO available only in English.

Review index:

COINBASE review and rating. Pros and Cons.

COINBASE is one of the most popular cryptocurrency exchanges in the world. Founded in 2012, the company can already brag with 30 million active customers. Headquartered in San Francisco, California, the US giant operates, to date, in 102 countries. What is its mission? Make crypto transactions safe and easy: purchase, management, trading and archiving.

To meet all customer needs, Coinbase has released four platforms, each with different features and functionality.

COINBASE.COM, also called COINBASE CONSUMER, is the main platform. It allows you to buy Bitcoin, Ethereum and other major cryptocurrencies by bank transfer and credit card. The purchase is very simple and the user, after completing the registration and the KYC, will not have to do anything but funding his account, select the crypto he prefers and buy it through a simple click. The service is instantaneous and user-friendly, commissions vary depending on the way you purchase. Coinbase Consumer also allows you to manage, store and sell your crypto;

COINBASE PRO is the Coinbase trading platform. Dedicated to more experienced users, it provides a set of tools that allow traders to buy/sell crypto and tokens and place orders (MARKET, LIMIT and STOP). All with very low spreads and commission-free;

COINBASE WALLET is Coinbase's mobile wallet. It allows you to keep your cryptocurrencies safe. Unlike Coinbase.com which holds private keys for users, Coinbase Wallet provides a mnemonic phrase (called SEED phrase) which allows you to extract the keys of each of the cryptocurrencies within the wallet;

COINBASE CARD is the prepaid Coinbase credit card. Through the app also called Coinbase Card, available on App Store and Google Play Store, you can request a Visa card that allows you to spend the cryptocurrencies held on Coinbase.com.

Safety

Is Coinbase safe? Coinbase is today one of the safest platforms for the purchase of cryptocurrencies. 98% of crypto funds are securely stored offline, therefore inaccessible for anyone who wants to try to jeopardize the Exchange. The funds are also divided into several wallets, whose backup copies are distributed around the world and protected in secure vaults.

Customer funds are also covered by the Coinbase insurance policy which, in the unlikely event of physical, IT or internal security breaches (e.g. theft by employees of the company), fully covers any customer losses. However, this insurance policy does not compensate for the losses deriving from the lack of attention by the users themselves. It is the responsibility of the user of the platform to choose a complex password and to keep control of all access credentials to use Coinbase.com and the services associated with it.

Each user is also obliged to set the two-factor verification (2FA) before to use the various platforms. Therefore, it is necessary to link your phone number to your personal Coinbase account to receive an SMS or a phone call from the automatic system. The possibility of adding an additional security system via an authenticator was also recently introduced.

Fees and Costs

As noted above, Coinbase is made up of various platforms, which have commissions for buying, selling and transferring different funds.

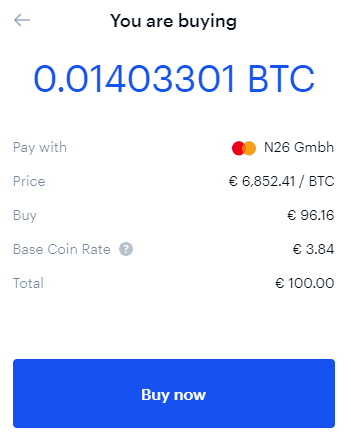

Let's start with the main platform, COINBASE CONSUMER. It is the fastest way to buy and sell cryptocurrencies. Coinbase applies a fixed spread of 0.50%. The following commissions are added to the spread:

- € 0.99 if the total amount of the transaction is less than or equal to € 10

- € 1.49 if the total transaction amount is between € 10 and € 25

- € 1.99 if the total transaction amount is between € 25 and € 50

- € 2.99 if the total transaction amount is between € 50 and € 78 (the equivalent of $ 100)

For transactions higher than € 78, Coinbase will apply a flat rate of 1.49% for purchases by bank transfer, a flat rate of 3.99% if credit card is used.

Note: To withdraw funds, you can choose between a transfer on your bank account or PayPal.

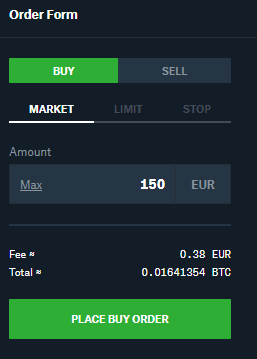

Coinbase also allows the use of COINBASE PRO for the purchase of cryptocurrencies. After depositing the funds on Coinbase.com by bank transfer, you can transfer them to Coinbase PRO for free and use the platform for advanced traders to buy bitcoins and other cryptocurrencies. By using Coinbase PRO, as mentioned, no spreads will be applied but only commissions based on the volume of the trades.

With regards to the transfer of cryptocurrencies, Coinbase applies fixed commissions which vary according to the currency to be transferred and network traffic. One of the weaknesses of the Coinbase tools is represented by the fact that the commissions for the transfer of the crypto-currencies are not customizable. However, the default fees are quite adequate and allow transactions to be carried out quickly and at low cost.

Finally, concerning the possibility of spending your own crypto with COINBASE CARD, the rechargeable card from Coinbase, the company applies a commission of 2.49%. The credit card has an issue cost of € 5, has no monthly fees and allows you to withdraw without additional fees up to € 200 per month. Beyond this amount, a commission of 2% will be applied, which added to the basic fee leads to a total of 4.49%.

Account types

To open an account on Coinbase you need to go to the website Coinbase.com and enter your email address. The registration process will start automatically.

Note: Through a single registration it will be possible to create a single account for the use of COINBASE CONSUMER, COINBASE CARD and COINBASE PRO.

Once the email has been entered, it will be necessary to fill in the forms related to Name, Surname and Password to create your own account. After confirming your email address and phone number, the KYC will start. Registration is very simple and takes a few minutes. Keep your documents and tax code at hand.

Once your documents are confirmed you will be enabled and you will be able to use the Coinbase platforms.

New users will only have a limitation regarding the purchase of cryptocurrencies by credit card. In fact, the platform applies initial limits for first purchases; initially, it will be possible to buy cryptocurrencies by card for a maximum of € 50 per week. This amount will gradually increase, reaching a maximum of € 6,000 per week. As for the purchase by bank transfer, the limit is € 25,000 per day.

What is the minimum deposit required?

The minimum deposit required is € 1.99.

To transfer funds from the main trading platform to Coinbase PRO, as previously mentioned, there are no commissions. With Coinbase PRO, currently, it is not possible to operate with leverage.

Promotions

By signing up for Coinbase from this link, after completing purchases over $ 100, you will receive $ 10 in Bitcoins for free.

Products

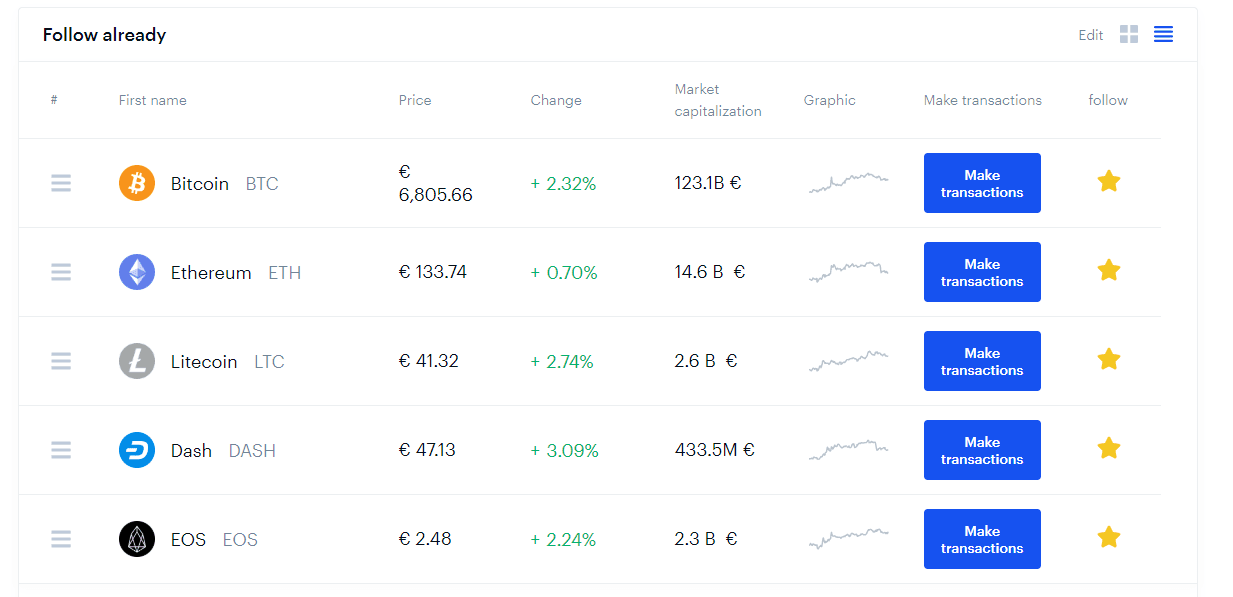

Currently, on COINBASE CONSUMER and COINBASE PRO platforms there are 10 cryptocurrencies and 5 tokens that use the Ethereum blockchain. Below you can find the list of crypto available:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- EOS

- Stellar Lumens (XLM)

- Tezos (XTZ)

- Ethereum Classic (ETC)

- Zcash (ZEC)

Tokens that can be purchased directly on Coinbase are Chainlink (LINK), Augur (REP), Basic Attention Token (BAT), 0x Protocol (ZRX) ) and the stablecoin USDC and DAI.

In 2018, Coinbase started constantly expanding the number of cryptocurrencies available on the platform. The main products of the crypto scene are already tradable on the exchange. However, are missing important products listed in the top 20 of the CoinMarketCap such as DASH, NEO, BNB, TRX e XMR.

As regards the COINBASE WALLET, the cryptocurrencies supported are the following:

- Bitcoin (BTC)

- Ethereum (ETH) and all ERC20 tokens

- XRP

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Ethereum Classic (ETC)

- Dogecoin (DOGE)

Trading platform

Coinbase has released four platforms, each of them having specific functions. Thanks to these four tools, users have everything they need to use, manage, buy and trade cryptocurrencies. In this review we will analyze and test the Coinbase platforms that allow you to buy and trade crypto: COINBASE CONSUMER and COINBASE PRO.

» COINBASE CONSUMER

COINBASE.COM, also commonly called COINBASE CONSUMER is the main platform of the US giant. It allows you to purchase cryptocurrencies by credit card and bank transfer. It also allows you to sell the same crypto, store them, receive and send them from/to friends, wallets or exchanges.

The platform looks user-friendly and intuitive and is available both on web and mobile.

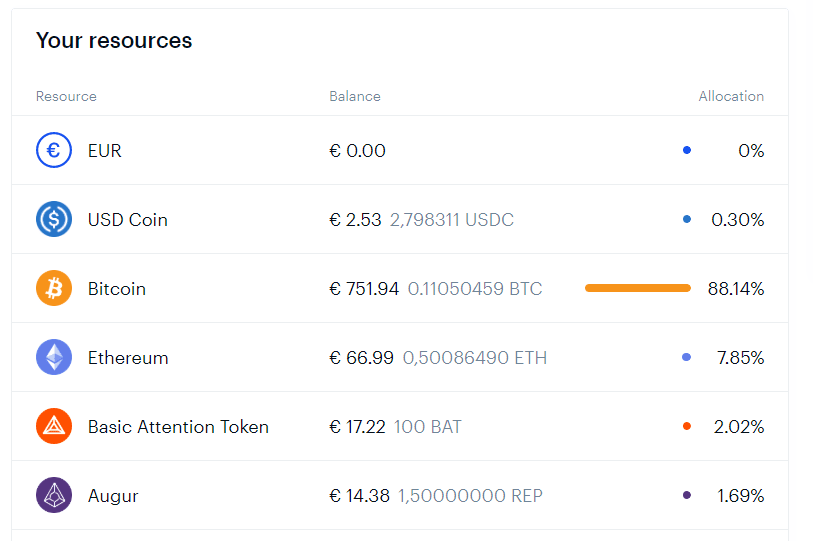

On the dashboard, you will find the total balance held on Coinbase and the graph relating to the performance of your investments, updated in real-time.

In the top menu, you will find 3 links that will lead you to the various sections of the website.

1. Prices

Here you can see the prices of cryptocurrencies that can be purchased on Coinbase, as well as those of the main currencies not yet present within the platform. You will also be able to add crypto that you are most interested in among the favourites, in order to stay up to date on their movements.

2. Accounts

In the Accounts section it is possible to view the cryptocurrencies we held on the platform, to carry out purchase or sale transactions and transfer our own coins.

Under each account two buttons will appear:

-

Send, in order to send cryptocurrencies to third parties;

-

Receive, to view your address of receipt (ADDRESS) that we have to share so we can receive cryptocurrencies.

To the right of each account will appear the list of all the transactions made. To buy one of the cryptocurrencies just select one of them and then click on the button Make transactions in the top right corner.

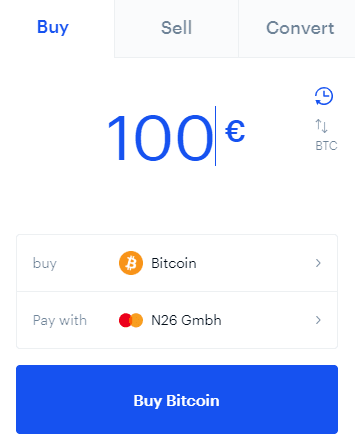

A form will then be displayed, where we will have to enter the amount we intend to purchase, to select the cryptocurrency involved and the payment method.

To proceed, in case we are purchasing Bitcoins we must click on Buy Bitcoin.

On the screen will appear now the total amount we are buying, the final fee and the total we will receive of that determined cryptocurrency.

To make purchases by bank transfer you must first select PORTFOLIO account, then click on DEPOSIT and finally enter the requested data. After the funds have been deposited on Coinbase it will be possible to carry out the purchase transaction.

As for the sale, the procedure is almost the same. Now we must click on the SELL button, enter the amount and select PORTFOLIO. As soon as this operation is completed, the funds will be in the account and it will be possible to withdraw them by bank transfer to our bank account or to our Paypal account.

3. Invite friends

The last menu button allows you to receive a unique link that will allow us to invite other people to join the platform. For every registered user who has purchased at least $ 100 in cryptocurrencies, we will receive a bonus of $ 10 in bitcoins.

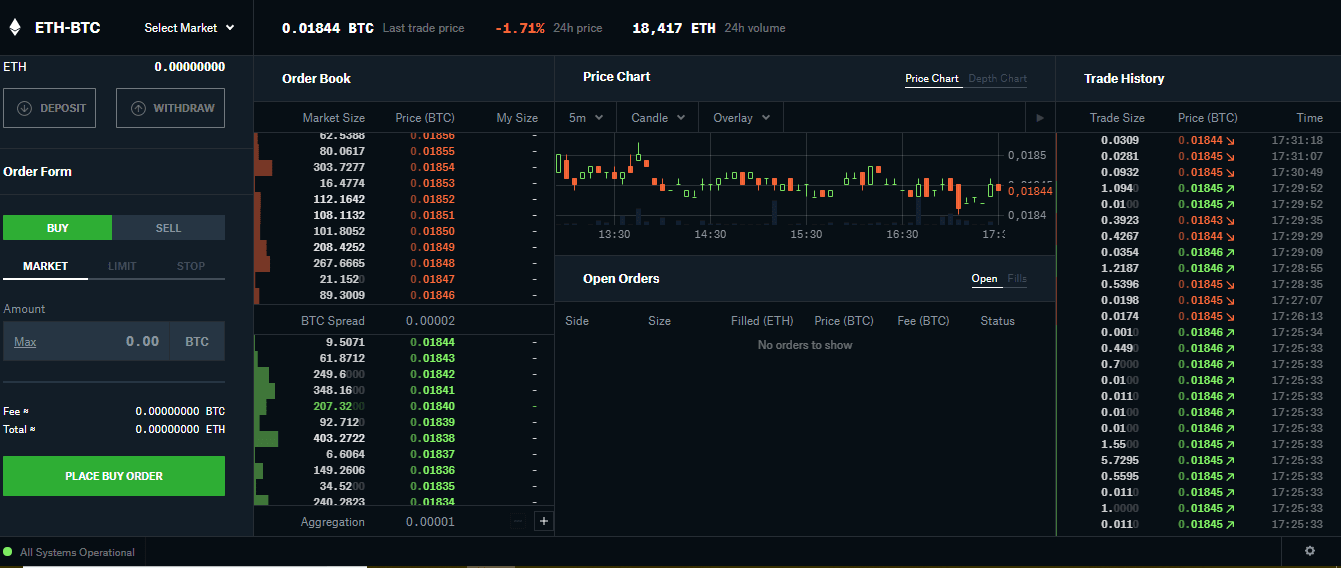

» COINBASE PRO

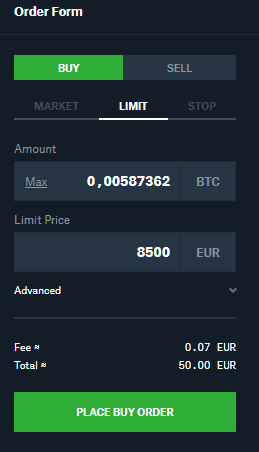

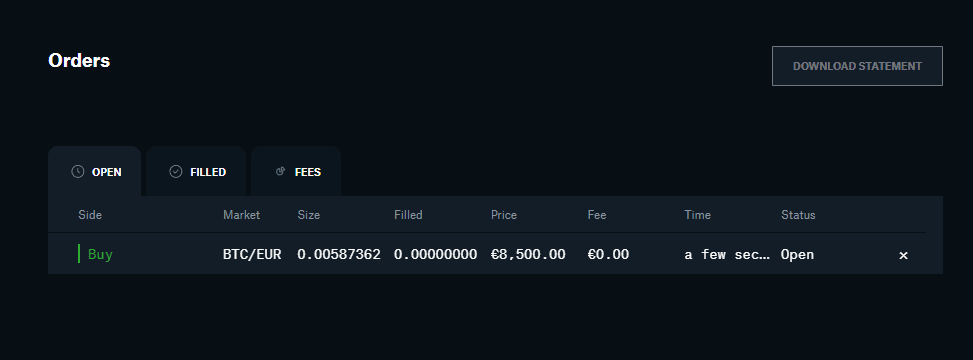

COINBASE PRO is the Coinbase trading platform. It has zero fees, is very intuitive and allows you to place MARKET, LIMIT and STOP orders.

Note: Currently the platform is available in its WEB version. An app for smartphones, desktops or tablets has not yet been released.

Coinbase PRO allows us to operate with five different markets: Euro (EUR), US Dollar (USD), Bitcoin (BTC), Ethereum (ETH) and the stablecoin DAI.

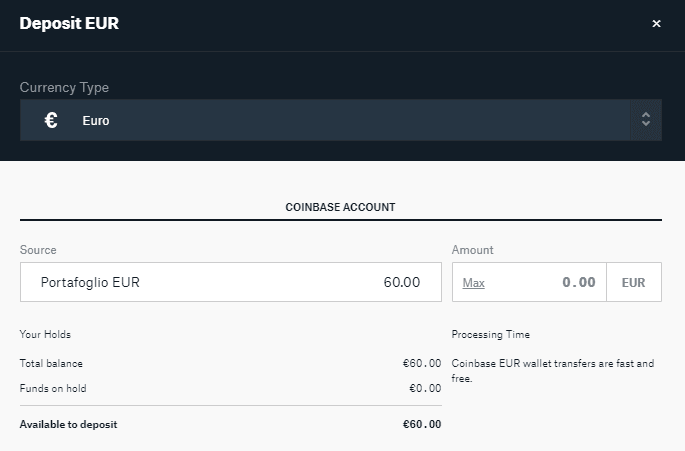

To deposit funds on the platform, go to My Wallets, select the currency you wish to deposit into your account and choose the deposit method. You can send funds for free from Coinbase.com to Coinbase PRO instantly.

To deposit one of the supported cryptocurrencies you can either send them via wallet to a dedicated address and transfer them from your account to Coinbase Consumer.

To deposit euros instead you must first deposit on the base platform, Coinbase Consumer, and then transfer them to Coinbase PRO. To do this, select PORTFOLIO EURO, enter the amount and click on DEPOSIT.

Once funds have been deposited into our trading account it will be possible to start trading. From the trade section, we select the pair we intend to trade and proceed by entering the order based on our trading strategy.

We select the order type among Market, Limit and Stop, then we enter the amount and, in case of limit or stop order, we set any limit/stop price. At this point we insert the order by clicking on the PLACE BUY ORDER button (or PLACE SELL ORDER in case of sale).

In MY ORDERS panel, we will find the list of orders made and check their status.

Nota: La piattaforma Coinbase PRO non è ancora disponibile in lingua italiana.

Customer Service

Coinbase customer service is currently available only in English. You can contact the support by calling +44 0808 168 4635 (United Kingdom) or via messaging through the dedicated portal.

Both services are available 24 hours a day, 365 days a year.

Education

Coinbase has recently released the COINBASE EARN centre. It allows you to earn cryptocurrencies by simply viewing some educational videos dedicated to some of the cryptos on the portal. In order to participate, you must sign up for the Whitelist on the website.

As soon as you receive your invitation, you can use Coinbase Earn and receive free cryptocurrencies directly on your account.

There is also a blog section where you can find a variety of posts, which allow you to find answers to the most common questions. However, educational material is quite scarce. Many competitors have created platforms dedicated to training and active communities thanks to which it is possible for users to approach other users and learn.

Overall rating

In conclusion, Coinbase, thanks to its four platforms, is today one of the best choices for trading and managing cryptocurrencies. The wide choice of tools allows both novices and experts to work easily in this new environment.

To further improve the level of services offered, Coinbase will have to expand the number of cryptocurrencies available, allow the commissions for transfers to be customized and pay more attention to the training of users, a fundamental element in this world, too often overlooked.

COINBASE is one of the most popular cryptocurrency exchanges in the world. Founded in 2012, the company can already brag with 30 million active customers. Headquartered in San Francisco, California, the US giant operates, to date, in 102 countries. What is its mission? Make crypto transactions safe and easy: purchase, management, trading and archiving. You will find all the crucial info about Coinbase within the official review.