Summary:

- Access to 50 global markets

- Fixed commission on all products

- Funds protected up to 100.000€ by the Compensation Scheme

- No minimum deposit for opening an account

![]() Pros:

Pros:

- Competitive fee structure

- Wide variety of products and markets offered

- High level of safety and solid corporate structure

- User-friendly mobile app

![]() Cons:

Cons:

- Web platform not suitable for advanced technical analysis

- Inability to connect API or external platforms (e.g. Multicharts)

- Forex and leveraged CFDs not available

- No in-depth education section

DEGIRO trading review

DEGIRO is a Dutch online broker, relatively new on the UK scene. It has been active for European investors since 2013. It boasts providing retail clients with institutional-level trading fees, having exclusively provided institutional services until 2013. DEGIRO started offering services to UK investors in 2015.

DEGIRO operates under the supervision of the Dutch Financial Markets Authority (AFM) and the Central Bank of the Netherlands (DNB). DEGIRO is also registered at the Financial Conduct Authority (FCA) in the UK under number 595455.

The Dutch legislation requires the segregation of clients' assets from the assets of the financial broker so, in the unlikely event DEGIRO defaults, customer investments/liquidity are not treated as recoverable assets by third parties. DEGIRO has over 1 million clients in Europe.

DEGIRO adheres to the German Investor Protection Scheme, which ensures every client of DEGIRO up to 100.000€.

The highly aggressive tariff structure makes DEGIRO one of the most convenient brokers to use for investing. There are numerous reasons why an investor would use DEGIRO.

In this review, you will find our official thoughts and rating on DEGIRO trading.

Not in the UK? Select your country →

Trading fees and Costs

In regards to costs, DEGIRO uses a fixed fee structure for stocks, ETFs, options, futures, and warrants. This means that you pay a fee for each trade you execute.

These conditions apply regardless of the number of transactions made during the month/quarter. Whether you execute one transaction per month or 1,000, you will always pay the same rate.

For this reason, DEGIRO is by far the most convenient for small and passive investors interested in holding financial instruments for the long term (buy and hold strategy).

Commissions on the UK stock market are fixed: £1.75 commission + €1.00 external costs.

Commissions for the US stock markets are €1.00 + €1.00 external costs, for a total of €2.00 per trade.

Use our tool to calculate trading fees on stocks with DEGIRO →

Commissions on ETFs are €2.00 commissions + €1.00 external costs, for a total of €3.00 per trade (both buying and selling).

There are around 200 commission-free ETFs (for the complete list of commission-free ETFs click here).

Use our tool to calculate trading fees on ETFs with DEGIRO →

Tariffs represent the most beneficial aspect for the investors who choose DEGIRO: with this broker you can drastically reduce trading costs, managing to save hundreds (or even thousands) of pounds a year.

A DEGIRO trading account can be considered an extension of your bank account, through which it is possible to have access to exchanges worldwide and to hold the purchased instruments in your portfolio.

The opening, maintenance and closing of the account are completely free. The custody and deposit of securities are free, as well.

There are no inactivity charges to your account. Another advantageous aspect of DEGIRO involves the extremely low financing costs when one makes use of Debit Money. it is possible to use both intraday and overnight Debit Money with an interest rate of up to 5.25% (6.90% with unallocated margin) on an annual basis.

To access global stock exchanges, there is a connectivity cost, called the DEGIRO exchange connection fee. Each calendar year you will pay a maximum of 0.25% of your account value (maximum charge is €2,50 per exchange) this cost is provided if you carry out an operation or if you maintain a position on an exchange other than the domestic one.

For example, if you open an account with DEGIRO UK, you won’t pay any connectivity fee for the London Stock Exchange; you will pay 0.25% of your account value (max. €2.50) for transactions or held positions on all other exchanges.

Real-time data are free on the domestic markets (except if you open an account with DEGIRO UK, where you have to pay a monthly fee of £4.50 for real-time data on LSE), Euronext and CHI-X; all other price feeds are delayed by 15 minutes.

For a monthly fee, it is possible to activate real-time data for other markets (except NYSE, Canada, Australia, Hong Kong and Tokyo, where real-time data is not available).

For all transactions in a foreign currency, you can choose between two options:

Perform a manual conversion from the base currency of your account (GBP) into nine other currencies (including USD, CHF and EUR). For the conversion, you will pay € 10 + 0.25% of the converted amount.

It is not possible to deposit dollars or any foreign currency directly into your DEGIRO account. You can set up a multi-currency account that allows you to convert your home currency into another currency.Use the default setting (Auto FX) that executes foreign currency transactions by widening the spot rate spread by 0.25% both at the time of purchase and sale.

Account types

Opening an account with DEGIRO is completely online and paperless. For the purpose of this review, we have followed all necessary registration steps.

To open an account, follow these steps:

- Register a free account online from the website.

- Upload your ID card or passport.

- Deposit funds to the account through the manual money transfer (minimum amount required £ 0.01).

Accepted bank accounts to open a DEGIRO account

DEGIRO accepts bank accounts registered in any one of the countries in which it provides its services

Once you have deposited your first funds, DEGIRO will allocate those into your account usually within 48 hours. Once the allocation has gone through, you will be able to login to your account and have access to the platform.

During registration (and only at this point) you will open a BASIC account.

Once you open a BASIC account, in order to use Debit Money, Debt Securities and to trade derivatives, it will be necessary to upgrade for free on the platform from BASIC to an ACTIVE or TRADER profile.

With the ACTIVE profile, DEGIRO finances the purchase of products up to a maximum of 50% of the amount invested by you.

With the TRADER profile, which is recommended for the most advanced traders, DEGIRO finances the purchase of products up to a maximum of 70% of the amount invested by you.

Regarding the margin required for trading futures, both ACTIVE and TRADER accounts require a margin equal to 15% of the contract value. This is a high margin and not in line with other brokers’ standards, which require lower margins.

For intraday operations, you can further upgrade your profile from TRADER to DAY TRADER. The margin required for intraday transactions on futures becomes 5%, while the intraday equity margin is up to three times higher than that granted with the TRADER profile.

» DEGIRO minimum deposit

DEGIRO does not require a minimum deposit for opening an account. Thus, you can transfer a minimum of £0.01 and open an account to test the platform before allocating a larger amount.

» DEGIRO demo account

Does DEGIRO offer a demo account? DEGIRO does not provide a demo account. However, as mentioned above, minimum deposits for opening an account and accessing the platform are not required.

Within a few minutes and with a deposit starting from £0.01 you can access the platform and review the various services offered.

» DEGIRO how to change the language

At the moment it is not possible to switch the platform language. However, DEGIRO has announced that this option will be available in the near future.

Products and Markets

By offering access to over 50 markets and a vast range of available securities, DEGIRO offers a vast and unique product range.

In addition to most European and US markets, DEGIRO provides access to stock exchanges in Hong Kong, Singapore, Australia, Japan, Turkey, Canada.

The markets and products currently unavailable are stock options listed on CME, forex and leveraged CFDs.

Trading platforms

DEGIRO offers two types of proprietary platforms: a web-based platform and an App for iOS/Android. In this review of DEGIRO, we tested both platforms that have very similar features and tools.

The web platform is accessible directly from the DEGIRO website via login with your credentials, while the App can be downloaded and installed on your smartphone or tablet.

It is not possible to connect to APIs, nor to external software such as Multicharts and ProRealTime.

As mentioned in the previous paragraph, a DEGIRO demo account is not offered. Given the ease of use and the lack of advanced tools for research and technical analysis, DEGIRO is most suitable for novice investors or those seeking an execution-only broker without additional accessory services.

If you wish to increase the security of your account and limit the risk of a data breach, you can enable Google's two-step verification (two-factor authentication) within the login process, in addition to the insertion of a username and password. We strongly recommend activating this security tool.

Web platform

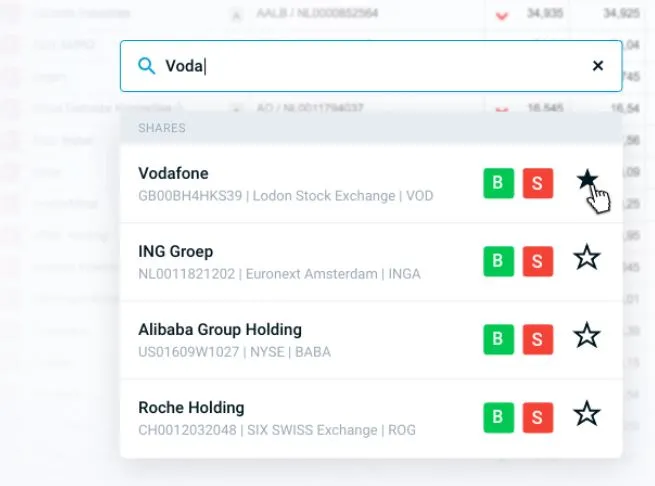

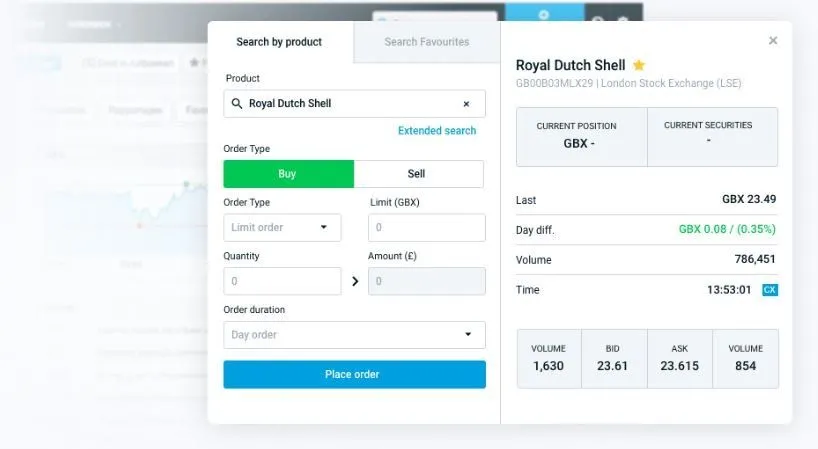

DEGIRO offers a basic, minimalist web platform. It allows you to quickly search for financial instruments through the search engine (top right-hand corner) by entering the name, ticker symbol or ISIN code of each product.

The Portfolio shows the open positions. For each open position, its quantity, current price, total value, average purchasing price (function recently added), daily result, as well as the theoretical P&L and the realized P&L are shown.

Order types

To enter an order in the platform, there are five order types available:

- Limit Order

- Market Order

- Stop Loss

- Limit Stop

- Trailing Stop (available only on XETRA)

Here is an explanation of the differences between Stop-Loss and Stop-Limit orders, as they have similar names, but are significantly different.

A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. This triggers a limit order when your chosen 'stop loss' level is reached.

For example, if Amazon.com, Inc. (AMZN) is trading at $3.000 and you want to buy the stock when it displays increased momentum. You would put in a stop-limit order to buy with the stop price at $3.100 and the limit price at $3.150.

If the price of AMZN moves above the $3.100 stop price, the order is activated and turns into a limit order.

As long as the order can be filled under $3.150, which is the limit price, the trade will be filled. If the stock gaps above $3.150, the order will not be filled.

Stop-loss is an order that is triggered when the stop level is reached by the underlying. For example, if you are long on a share whose price is 15 and you insert a Stop-Loss of 10, the share is sold if its price drops to 10, turning into a Market Order.

There is therefore the possibility that the order is executed at a price much lower than $10 (think of an opening of the markets in negative gaps or when there is strong volatility on order-books combined with low volumes).

The stop-limit order, therefore, serves to prevent a stop-loss from being executed at a price far from the entered stop.

In the example above, using a limit-stop order, setting a limit of 8 and a stop-loss of 10. This means that the order will be executed if the share drops to 10 but does not go below the value of 8.

This indicates a range of prices within which you want your order to be executed. If your share jumps from 11 and falls directly to 7, without trades between 8 and 10, your order will not be executed. The stop-limit order is a combination of the limit order and the stop-loss.

DEGIRO app

The DEGIRO app is designed primarily to keep track of your wallet and to place orders from smartphones and tablets when you are not in front of your computer.

The DEGIRO App is supported by all devices, including iPhone, iPad, Android smartphones and tablets. Once the app is downloaded and you first login with your username and password, the app will ask you to set up a 5-digit Passcode. This code is chosen by you and allows you to login simply by entering the Passcode instead of the classic credentials (username + password).

Overall, the DEGIRO app offers a pleasant mobile trading experience. Portfolio management is simple and the quick search for products placing an order is just as intuitive and efficient.

Not in the UK? Select your country →

Tax regime

DEGIRO acts as a withholding agent for some taxes, such as the Financial Transaction Tax (FTT), Stamp Duty, and income tax (dividends and coupons). For other taxes, such as the tax on capital gains, it is the duty of the client to declare and pay them, depending on where the client is considered a tax resident.

As a consequence, when you realize a capital gain with DEGIRO by buying and selling securities, no tax will be levied. Eventually, the sole taxes applicable are the FTT/Stamp Duty (where applicable) and the withholding tax on dividends and coupons.

At the end of the fiscal year, DEGIRO provides clients with a tax report, which helps the client to meet their tax obligations.

At the end of the fiscal year, DEGIRO provides clients with a tax report, which helps the client meet their tax obligations. DEGIRO does not provide any tax advisory services, thus we recommend contacting a tax accountant to better understand what the tax obligations generated by trading with DEGIRO would be.

At the time this review was developed, DEGIRO does not offer tax-advantaged ISA, JISA or SIPP accounts.

Customer support

To test the quality and speed of the DEGIRO Service Desk, we have conducted a series of phone and email tests, consisting of 10 calls and 20 emails, delivered over two weeks.

For 90% of the calls made between 08:00 and 22:00, the response took place within the first minute.

For 80% of the email tests, the response arrived within three hours (excluding the night time zone from 22:00 to 08:00) and the remaining 20% had a response time between three and eight hours.

Our opinions on DEGIRO's Customer Service are therefore overall positive.

Safety

DEGIRO does not have a banking background, therefore does not offer bank accounts, credit cards or other traditional banking services.

How are funds kept in DEGIRO?

Until the middle of 2020, DEGIRO was required by law to invest its clients’ liquidity in Money Market Funds (MMFs).

The MMFs are recognised funds with a duration of 60 days, 90% of which are invested in triple-A government bonds, such as in Germany, France and the Netherlands.

In the era of negative interest rates, which we are currently experiencing, MMFs also have negative returns. For this reason, DEGIRO offered compensation for the negative returns generated by the first £2,000 of the cash balance of each DEGIRO account. Above this threshold, negative MMF returns were transferred to the clients.

DEGIRO has recently been acquired by the German bank Flatex. One of the pivotal changes has been how DEGIRO holds its clients’ funds.

Starting in July 2020, clients are assigned a personal cash account with a German IBAN. The purpose of this account is for depositing and withdrawing funds from the DEGIRO account (thus, it cannot be used to make bank transfers to third parties, for example). To fund a DEGIRO account, you will have to make a transfer from a registered bank account to the German IBAN you have been assigned.

Clients’ liquidity is therefore no longer invested in MMFs but is held in Flatex Bank. For security, due to this new approach, DEGIRO accounts are guaranteed up to a maximum amount of 100.000€.

Therefore the use of Money Market Funds by DEGIRO ceases to exist.

Currently, there is no accrual of negative interests for Flatex cash accounts.

Due to the configuration described above, holding funds in the DEGIRO account is similar to depositing them in a real bank account, with all the resulting benefits in terms of security.

Education

DEGIRO has recently added on its website a section dedicated to education called “Knowledge.” Here, you can find educational contents, either for beginners or for advanced investors.

The section contains two categories:

- Investor’s Academy: covering a broad set of investing topics, such as investment goals, risk management, what is a broker, order types, etc.

- Investing with DEGIRO: 7 videos that explain how to use the platform, how to deposit and withdraw funds, how to purchase securities, etc.

Overall rating

In conclusion, based upon this review, we have found that DEGIRO is the right choice for all investors interested in cutting trading costs, especially for investors who perform a limited number of operations and have a medium-low capitalization.

The minimalist platform and absence of advanced tools make it suitable for novice investors, as well. On the other hand, more advanced traders will be compelled to work with external platforms and additional tools along with DEGIRO. Advanced traders may use this broker only for the final insertion of orders, taking advantage of the low commissions and the offer of various exchanges and instruments.

Our official rating on DEGIRO is therefore overall positive.

However, DEGIRO is a relatively new broker and is expected to raise the level of services it offers in the future, starting with a more robust web platform, up to training courses and financial education in line with other brokers in the industry.

Not in the UK? Select your country →

*Deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.

What is the next step now?

Open an account with DEGIRO:

Discover the trading tools of QualeBroker: