Pros:

Authorized and transparent DMA broker.

Over 600,000 tradable financial instruments.

Simulated account with 1,000,000 virtual money.

Professional Account Manager assigned for each client.

Cons:

Minimum deposit of 10.000€.

Deposits and withdrawals by bank transfer only.

Commission on withdrawals of 30€.

Inactivity costs after 6 months without transactions.

EXANTE review: pros and cons uncovered

EXANTE is a DMA broker - active since 2011 - launched for professional clients and advanced traders. With ten offices in Europe and Asia (headquartered in Cyprus), EXANTE provides access to more than 50 global markets and more than 600,000 financial instruments including stocks, ETFs, bonds, futures and options.

What makes EXANTE a broker aimed primarily at advanced clients? First of all, its minimum deposit is set at € 10,000 (€ 50,000 for corporate accounts). This limit can certainly represent an entry barrier for undercapitalized or novice investors, interested in starting to trade with lower amounts.

EXANTE then proves to be a broker whose main services are aimed at a target of experienced traders: access to the OTC market, derivatives trading, short selling, integrated margining and margin trading.

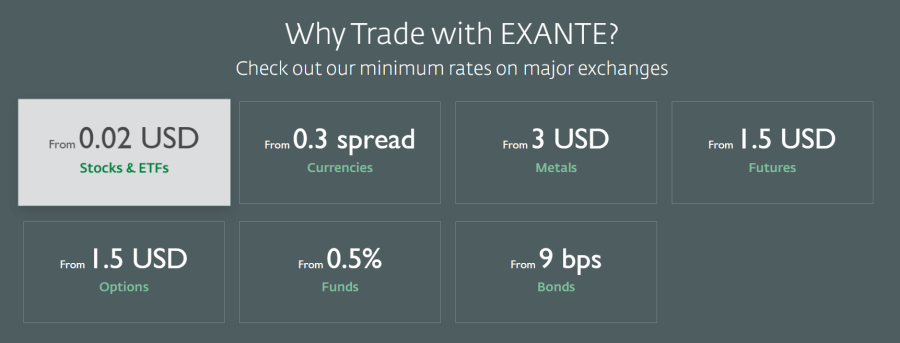

Alongside these advanced services, through the EXANTE platform you can trade shares, ETFs and Investment funds on terms that are nothing short of advantageous: US shares at $ 0.02 per share or those of the London Stock Exchange with a commission of 0.05%.

So can trading with EXANTE be a good choice? Can this be the right broker for your investor profile? Find out in the next sections of this review.

Review index:

Safety

Who is behind EXANTE and how secure are the funds deposited in the EXANTE trading account? EXANTE is the property of EXT LTD. This is an investment company authorised by CySEC (licence No 165/12). In the UK EXT LTD is authorized by the Financial Conduct Authority (FRN: 589898).

As an investment firm within the European Union, EXANTE complies with MiFID II.

It follows that the guarantees to protect customers are many, including the most important:

1. The European Deposit Guarantee Scheme, i.e. compensation of up to €20,000 (in cash or financial instruments) for each client, in the event that the broker is unable to return them himself (e.g. in the event of bankruptcy).

2. The segregation of funds: the separation of client funds from those of the broker, whereby, in the event of failure of the trading platform, no creditor of the broker will have the opportunity to retaliate against the funds deposited by the clients. In the case of EXANTE, the UK client funds are segregated at Alpha Bank or Bank of Cyprus.

3. Negative balance protection: this protection allows customers not to generate a loss on their account greater than the cash balance (i.e. the total amount of money deposited into the account). This protection, in the specific case of EXANTE, applies when trading on margin or through leveraged derivative instruments.

EXANTE is therefore a regulated and transparent broker.

THE EXANTE Account

Now let's move on to the analysis of the type of account offered by EXANTE and its features, starting with the registration process.

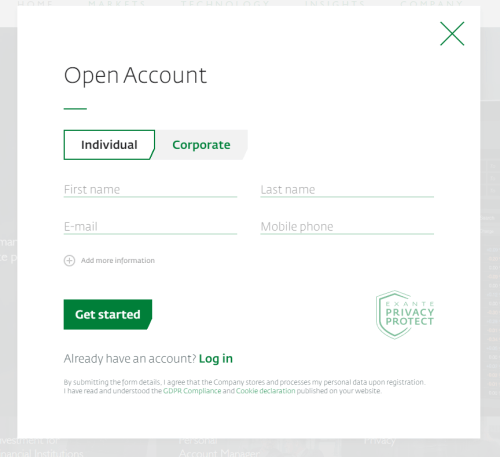

» Account opening

Opening an EXANTE account takes place entirely online from the broker's website. Both natural and legal persons can register an account.

To open an individual account the steps to follow are as follows:

1. Enter your personal details in the registration form (name, surname, nationality, address, tax residence, tax code, etc.)

2. Upload an ID

3. Upload proof of residence no older than 6 months (bank statement or a user is sufficient)

Once you have completed the process and uploaded your documents, you will need to wait for the EXANTE evaluation team to approve your request.

Once approved, you can proceed with the first deposit to feed the trading account

» Deposits and withdrawals

The only payment method accepted by EXANTE for both deposits and withdrawals is bank transfer. Therefore, credit cards or electronic wallets that allow you to instantly deposit funds are not accepted.

It follows that once the deposit has been made, it will take about 2-3 working days for the transfer to be credited to your trading account.

EXANTE allows you to set up a Multicurrency account: if you wish to deposit funds in currencies other than GBP, such as EUR, USD, AUD, CAD, CHF, JPY, NZD, PLN or RUB, you can arrange a transfer in that currency to fund your EXANTE account.

We point out that within the personal area it will then be possible to make currency conversions without surcharges on the exchange rate.

» What is the minimum deposit with EXANTE?

The minimum deposit required by EXANTE is set at €10,000 for individual customers and €50,000 for corporate clients.

Deposits after the first one do not require minimum amounts.

» Virtual account

Even before activating a real account, EXANTE offers the opportunity to open a simulated account with €1,000,000 of virtual money. In this way it will be possible to test the trading platform and carry out simulated operations, so as to evaluate the services and quality of the broker and then proceed with the possible opening of an account with real money.

You can continue to use the virtual account at any time after registering your real account, for example if you wish to carry out trading simulations.

» Debit card

By opening an account with EXANTE you can receive a free debit card for free, thanks to the partnership with GBXP. This card can be used to spend the funds in your EXANTE trading account.

This can be a good way to avoid – or at least reduce – withdrawals of funds whose commission is 30€.

Products and Markets

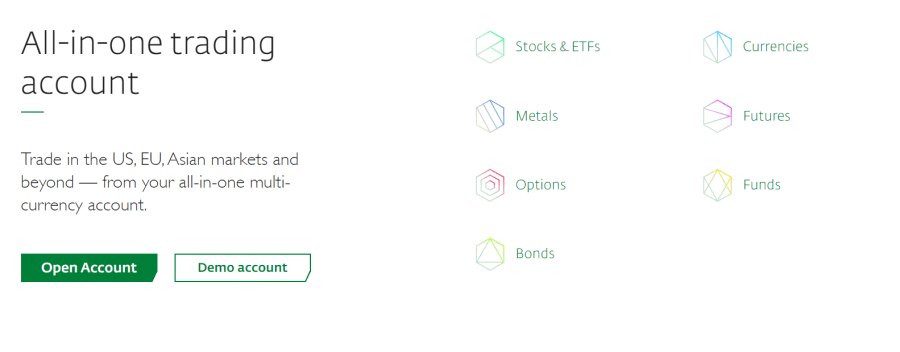

EXANTE provides broad access to the markets, over 50 global, through which more than 600,000 financial instruments can be traded.

What assets can be traded with EXANTE? Here they are listed:

1. Stocks and ETFs: more than 24,000 stocks and ETFs listed both in Europe (including Borsa Italiana) and in the USA or in exotic markets such as Singapore, Australia, Japan are tradable.

2. Futures: Futures of over 30 exchanges including CME, NYMEX and Eurex are available. IDEM futures are not available.

3. Options: Over 500,000 options available on numerous underlying assets. Again, the IDEM options are not available.

4. Bonds: both exchange-listed and OTC bonds are tradable.

5. Forex: More than 60 leveraged tradable currency pairs. Forward and Swap are available for each pair for strategy development.

6. Investment funds: About 450 funds issued by hedge funds are available on the platform.

EXANTE offers the option to invest in Bitcoin, as well as Altcoins - the latter through the XAI fund. It is a regulated and transparent product, which replicates the trend of the main cryptocurrencies including Ethereum, Cardano, Litecoin etc.

Now let's see what are the costs related to the account.

The EXANTE account does not have an opening, maintaining and closing costs. The custody of securities is also free of charge.

There are inactivity costs if there are no trading activities for 181 days. In this case, a monthly fee of 50 euros is applied.

Deposits of funds are free, while withdrawals have a fee of 30€.

An element of great advantage with EXANTE is the possibility of converting currency from GBP to USD without spreads on the exchange rate. Other brokers charge a flat fee, such as Interactive Brokers of $2 and MEXEM of $5.

Trading Platform

EXANTE allows you to trade either through a proprietary web platform, accessible directly from the browser, or through a desktop platform. With the web platform there is no need to download and install the software on your computer.

With the desktop platform, on the contrary, you need to install the software on your computer. This second option is more advisable for those who want to trade in a more professional environment rich in advanced features.

Alternatively, there is the app version, available for smartphones and tablets.

The EXANTE web platform is simple and user-friendly but at the same time full of advanced features.

On the left side we find the list of tradable financial instruments. As an alternative to the list we can use the search bar to quickly get to the product we are interested in.

If we click on a product, we will open its tab. Here we will be able to access the chart with technical analysis indicators and geometric figures. We will also find the specifics of the contract in case of derivatives.

In the right part of the platform, we find the interface for placing orders.

» Order types

The order types available to buy/sell a product are as follows:

1. Market order

2. Limit order

3. Stop order

4. Stop-limit order

A subordinate take profit and/or stop-loss order can be linked to the main order

Customer Support

With EXANTE you can count on a Service Desk in English, which can be reached, 24 hours a day and 7 days a week, through the following channels:

1. Telephone, by calling +357 2534 2627, or by requesting to be called by writing to

2. General email

It lacks a live chat service, but it must be said that the waiting times to get in touch with an operator are really short.

We emphasize the presence of a professional Account Manager for each EXANTE customer, available for every need or to be assisted on the use of the platform.

If you would like to receive more information and schedule a call with the account manager,

we recommend that you write

Overall Rating

EXANTE is an online broker with great potential. The advantages of trading with EXANTE are several: it's a DMA broker with wide access to the markets, competitive commissions and customer service in English always available.

EXANTE is authorized by CySEC and registered in the FCA list of foreign investment firms. Each client is covered by the European deposit guarantee scheme for up to 20,000€.

On the safety side, therefore, EXANTE is an authorized and transparent broker. Account opening takes place in a short time directly online. An account in virtual mode is also available, while the minimum deposit set at € 10,000 risks cutting off those investors who intend to operate with low capital.

Account costs and trading fees are clearly stated on the EXANTE website, so there is no risk of being charged hidden fees.

Trading fees are among the lowest. The trading account is at zero expenses, but pay attention to the costs of inactivity (50 euros per month starting from the 181st day if you do not make operations) and the costs of withdrawals (30 euros per withdrawal).

Overall, therefore, EXANTE can prove to be an excellent solution for those traders with good experience and well capitalized, willing to operate in an advanced trading environment and in the face of good conditions.

Our views on EXANTE are therefore positive. We recommend using this online broker both for online trading and for medium-long-term investments.

*Investments in securities and other financial instruments always involve the risk of loss of capital. Past performance does not guarantee future returns.