Review index recensione:

InstaForex is a new generation electronic communication network (ECN) online broker belonging to Instant Trading Ltd. With offices in various locations around the world. It is a pioneer in development and introduction of modern technologies and trading tools. InstaForex has repeatedly been ranked as the Best Broker in Asia, Best Client Service, Best Broker in Western Europe, Best Retail Broker, and Best Broker in the CIS countries, among many other nominations.

Over 7,000,000 customers have become traders of InstaForex since its establishment in 2007 for its quality, security, innovative approach, and a wide selection of services and offers.

The InstaForex platform allows you to trade CFDs on over 400 financial instruments, including stocks, currencies, cryptocurrencies, commodities, stock indices, and futures.

In this review we will take a look at the services offered by InstaForex, the types of accounts available, the main platform features, the expected fees and costs, as well as the quality of its customer service.

At the end of the review we will provide the reader with an overall judgment of this online broker, and an objective, impartial opinion.

Safety

Security is the first element to evaluate when choosing an online platform to entrust with your capital for trading financial instruments.

Instant Trading Ltd, which provides investment services under the InstaForex brand, is an investment company authorized by the Financial Services Authority (FSC-SVI), under license number SIBA/L/14/1082.

InstaForex is therefore required to operate in line with international regulations governing the markets for financial instruments. The directives guarantee a series of benefits and protections that InstaForex customers will enjoy, confirming that InstaForex is a regulated and transparent broker.

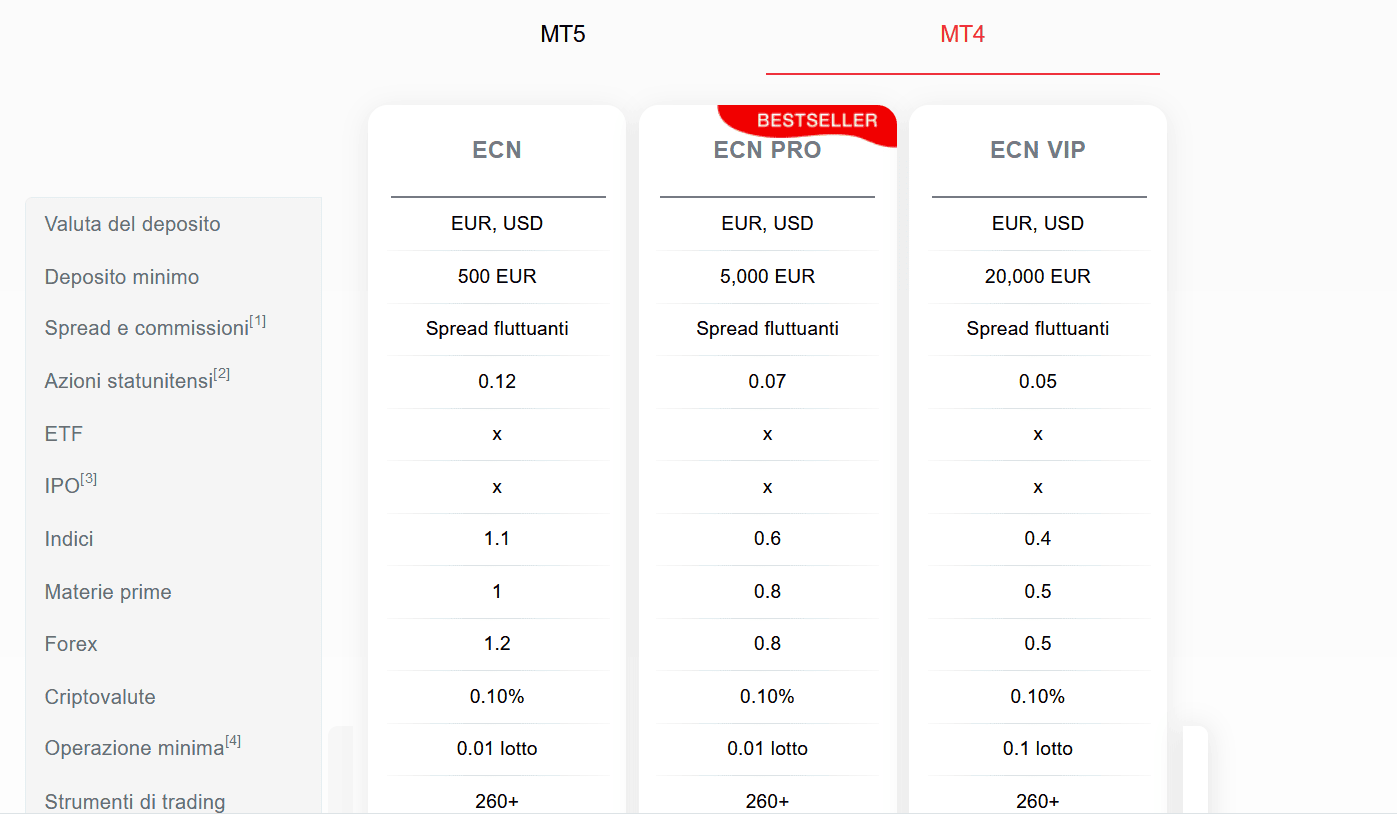

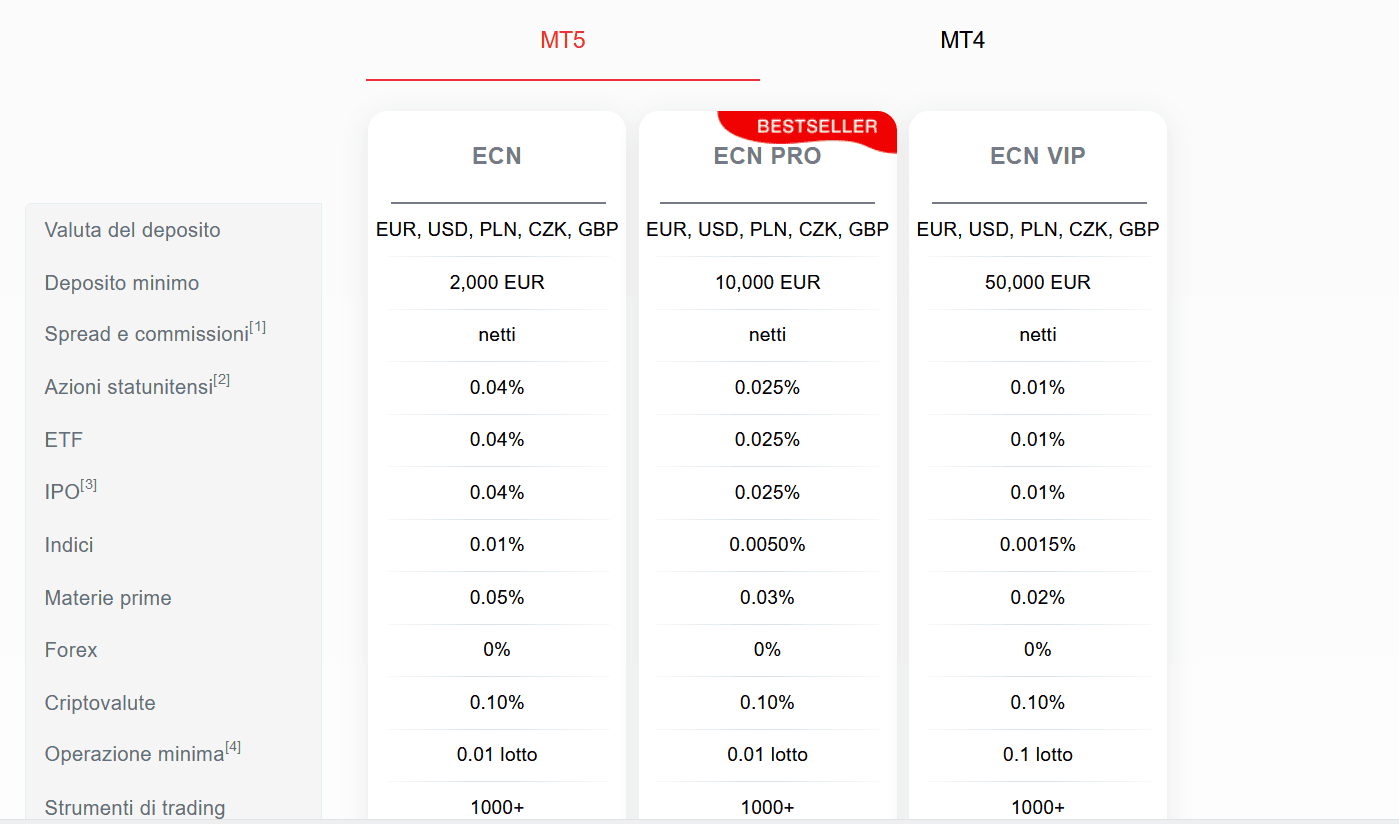

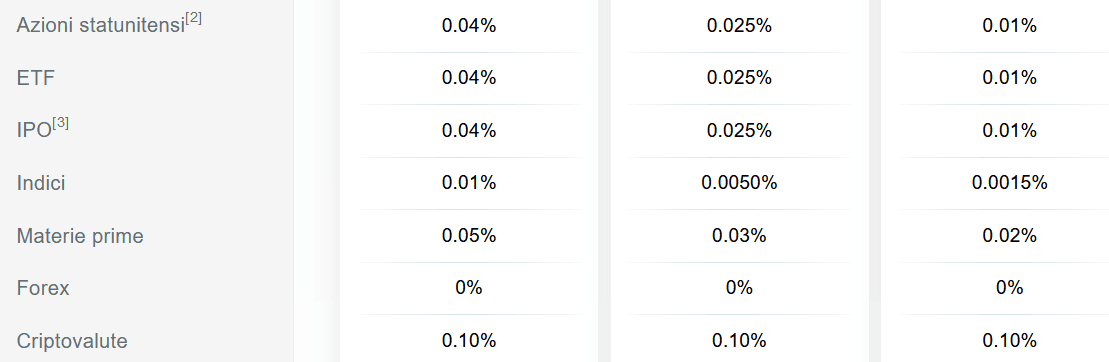

InstaForex Account

InstaForex offers five types of online trading accounts. Their features (minimum deposit, spread, commissions and costs, etc.) depend on the type of platform (MetaTrader 4 or MetaTrader 5) that the client chooses to uses:

In addition to the Insta.Standard and Insta.Eurica accounts, InstaForex offers two other types of accounts, the highly regarded Cent.Standard and Cent.Eurica.

InstaForex also offers an account dedicated to the diversification of customers' investments, called “OYS Portfolios” (On Your Side). This account allows traders to use the copy trading service to invest in assets selected by InstaForex specialists, without paying extra commissions.

Note: The minimum deposit to use the OYS Wallet service is £10,000.

In the next paragraphs, we will dive deeper into the aspects related to the financial instruments, currencies, costs and commissions of each account.

» How to Open an InstaForex Account

Creating an online trading account on InstaForex is quick and easy.

Here are the steps to follow:

Register your profile by filling in the fields with your information: name, surname, country, telephone number, email address

For the last identification step, you will be asked, as per legislation, to upload a document to verify your identity, one for residence (1st and 2nd level verification) and, depending on the deposit method, the relative proof of ownership (3rd level verification).

Lastly, you will need to make a deposit in order to start your online trading activities.

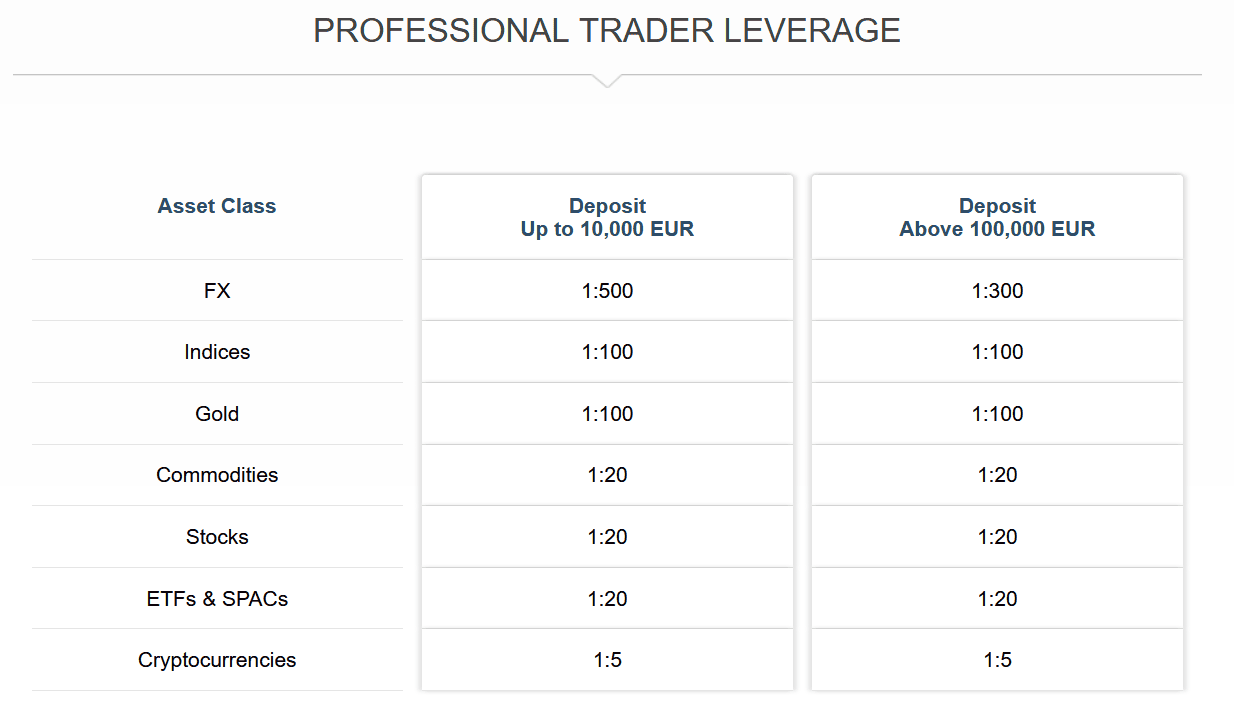

» Financial Leverage

Leverage trading can be chosen by the client in ranges from 1:1 to 1:1000. The client can change the leverage any time they want from the profile.

» PAMM and ForexCopy

InstaForex allows its customers to invest in Forex projects. Every customer of InstaForex can accept forex investments from other traders or invest funds in PAMM forex accounts and become a shareholder of an account. InstaForex PAMM forex systems include two categories of users, customers as investors and customers as traders.

Investors invest their funds in trader accounts with the purpose of taking a part of the profit made by traders. The investment can be of any amount depending on what share of the account each investor wants to hold.

ForexCopy is an InstaForex service that allows duplicate orders of successful traders even when the trading terminal is off. It takes just a few minutes to choose a trader and set up automatic copying of the chosen trader’s activity.

Alternatively, it takes a few minutes to set up an account for others to be able to copy trades from you. One of the advantages of the ForexCopy system is its reliability.

The service users can be followers and/or traders. The follower can fully control the situation, as the funds stay in their account and they can customize the settings and even manually cancel copied orders if they appear potentially unprofitable.

The account and funds are entirely under the customer’s control, which ensures that no action can be performed with the funds without the owner’s consent.

» Bonuses

InstaForex offers bonuses of various types and dimensions to its customers. A percentage of the deposit amount will be added onto the account.

This way the customer can trade with more capital. In addition to the bonuses referring to each deposit, there is also a no deposit bonus. The profit made using the bonuses can alternatively be withdrawn.

» Is there an InstaForex Demo Account?

Yes, InstaForex offers a demo account to carry out trading operations of financial products through virtual money.

Demo account is a very useful tool for traders who want to practice or test the platform before putting their capital at risk.

The demo account allows you to take advantage of the features provided on the platform:

- Transaction History

- Transaction Archive

- Trader Calculator

- History of Ticks

- Leverage from 1:1 to 1:1000

- Charts with variation of the balance

» Deposits/Withdrawals

The minimum deposit required by the broker to start trading is 1 USD/GBP.

The average deposit processing time is 20 minutes and 25 seconds.

The average withdrawal processing time is under 4 hours.

The client has different payment types available for deposits and withdrawals, including:

- Visa and Mastercard credit/debit card

- International bank transfer

- Bank transfer for local area SEPA, Southeast Asia, China, India, Middle East, Africa

- Cryptocurrencies: Bitcoin, Litecoin, BitcoinCash, Cardano, Tether, Dash, Ethereum, Dogecoin, BinanceCoin, Eos, Ripple, Neo

Products

InstaForex offers a total of over 400 securities for trading on CFDs:

- Currencies (over 100 currency pairs)

- American stocks (Google, Netflix, Facebook, etc...)

- Equity indices, such as the S&P 500, the NASDAQ 100 and the DAX

- Energy, Metals, Agricultural Commodities

- Cryptocurrencies, (Bitcoin, Ethereum, Cardano, etc...)

- InstaFutures, EURUSDweek and EURUSDmonth

InstaForex presents an interesting set of trading tools which help investors optimize their strategies. The main tools include:

- Trader calculator - allows you to calculate the cost of each trading operation

- Dividend Calculator - useful for traders interested in investing in the stock markets

- Economic calendar - to follow main economic and financial events as well as their impact on the markets

Platform

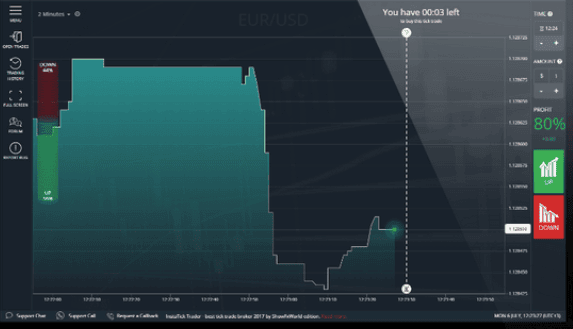

InstaForex offers the possibility to carry out online trading activities on MetaTrader4 and MetaTrader5, considered among the most complete and functional trading platforms on the market. The two platforms both require an application download.

Those who want to carry out their trading activities directly online, without having to download the application, can use the WebTrader platform, which has the following features:

- No download or installation required

- Access to all types of accounts

- Three GUI modes

- Detailed trading statistics

- All trading tools available on MetaTrader4

- Latest news and market analysis

There are also MT4 and MT5 mobile apps

» Mobile App

InstaForex also offers a trading platform for mobile devices, available for both Android and iOS.

You can download both the WebTrader app and the mobile version of MetaTrader4 and MetaTrader5.

InstaForex platforms for mobile devices have features and functionalities that are extremely useful for traders:

- Intuitive interface

- 9 time frame

- Extensive toolset for technical analysis

- Online business newsfeed

- Possibility of automatic trading

- Ability to lock positions

- Huge selection of free indicators and advisors

- Possibility of creating your own indicators and consultants (MQL4)

- Secure 128-bit encryption

- Trailing stop

On the trading platforms offered by InstaForex, it is possible to execute two types of orders:

Market Order: Orders are always executed at the price you see on the trading platform

Instant Order: The order is executed when a predefined price is reached; if the market price does not match the preset price, the order is canceled and a price change message appears to the trader.

Customer Support

The customers can request support through several communication channels:

Live chat on the website

Online form to be called by an operator, called the "callback form". The customer can choose the platform where he wants to be contacted: Telephone, Whatsapp, Viber, Telegram or Skype. An employee will call you back within five minutes.

Email:

FAQ section with frequently asked questions

Our experience with InstaForex customer service is positive and the company manages technical support in 19 languages.

There is an entire section on the website dedicated to beginner traders. New traders will have the opportunity to access educational material to increase their knowledge of online trading: a training course consisting of 16 lessons, video tutorials on swaps, technical analysis, futures, currency pairs, etc., including an introductory video explaining how to start trading. There are also periodic free online webinars with expert analysts, which can be useful for both beginners and more experienced traders. On the Instaforex YouTube channel one will find the recordings subtitled in many languages.

Market Analysis

InstaForex has a team of over 30 analysts who frequently provide economic news and market analysis. There is also a TV section to present market reviews, economic calendars and video analysis. In addition to the broker's website, due to the amount of information, a dedicated site for free consultations has been created.

Sponsorships

InstaForex supports both prominent athletes and sports teams such as eighteenfold champion of the English Premier League Liverpool FC and vibrant Sicilian Palermo football club, Formula E racing team "Dragon Racing" and Tatra rally team, that was later renamed «InstaForex Loprais», the winner of the Silk Way rally. Brand ambassadors of InstaForex included multiple European champion in basketball, Ilona Korstin, one of the most decorated athlete in winter sports, Ole Einar Bjørndalen, Norwegian chess grandmaster and current World Chess Champion, Magnus Carlsen, MMA Champion and actor, Oleg Taktarov, talented tennis player, Janko Tipsarević, as well as world No. 1 in singles and Olympic champion in tennis, Victoria Azarenka.

Overall rating

Our opinion on InstaForex is overall positive. It is a transparent and regulated broker offering over 400 financial instruments available for trading.

InstaForex provides customers with various services, from the demo account and no deposit bonus on a real account, useful for novice traders and/or to test, to multilingual customer support with which you can get in touch in less than 5 minutes after sending a support request.

We are satisfied with the trading accounts offered. It is confirmation that InstaForex is a broker for everyone. It is for both experienced traders and beginners, who want to use low leverage, and who want a higher leverage up to 1:1000. The investors can take advantage of PAMM and copy trading to maximize their portfolio earnings. It should not be forgotten that the traders who decide to use the bonus will see their availability for trading increased.

The choice of trading platforms is also excellent. The user can choose to trade using a software downloaded on a PC, directly online, or on mobile device, smartphone or tablet.

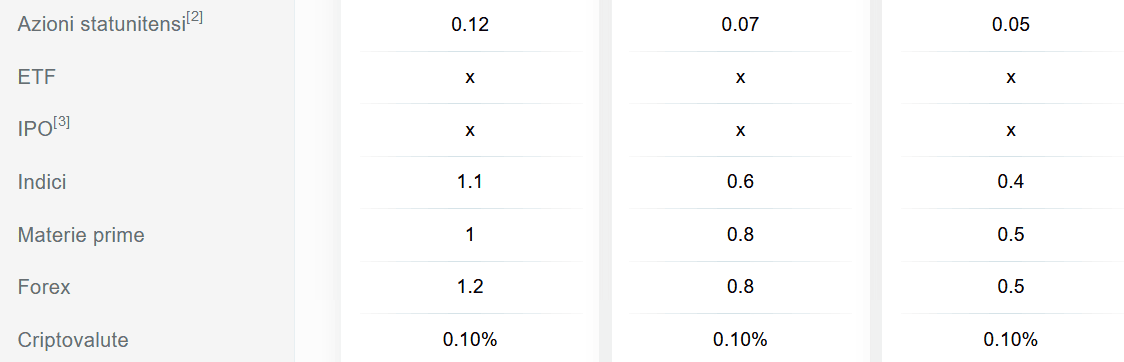

Equally positive is the opinion on commissions and costs. InstaForex is a transparent broker, which publishes all the commissions and costs applied on negotiations without hiding anything. The trader, therefore, will always have a clear understanding of the cost structure to be faced to carry out trading activities on InstaForex.

In conclusion, we advise traders to use InstaForex services to start trading online, but keep in mind the risks associated with investing through CFDs.