Summary:

- Australian CFD broker with European branch

- 5 external platforms that can be connected to the account

- 7 tradable asset classes

- Efficient customer service

![]() Pros:

Pros:

- Quick and easy account opening

- Low spreads and fees

- No minimum deposit

- No inactivity fees

![]() Cons:

Cons:

- Small number of tradable assets

- CFDs on British and European stocks not available

- Broker not suitable for long-term investments

- Maximum leverage available 1:30

Pros:

Quick and easy account opening.

Low spreads and fees.

No minimum deposit.

No inactivity fees.

Cons:

Small number of tradable assets.

CFDs on Italian and European stocks not available.

Broker not suitable for long-term investments.

Maximum leverage available 1:30.

Pepperstone review: pros and cons uncovered

Pepperstone is an Australian broker founded in 2010, specializing in Forex and CFD trading. Its global presence and a large number of clients make it one of the leading brokers in the online trading landscape.

Pepperstone offers its trading services to European investors through a branch office based in the United Kingdom. In this review we have taken a look at Pepperstone`s trading account and services, paying particular attention to costs, security, and platforms.

Is Pepperstone the right choice for Forex and CFD trading?

Safety

Pepperstone Group Limited is an Australian investment company with license No. 414530 issued by the Australian Securities and Investment Commission (ASIC). In the UK, it operates through its UK branch, where it holds an additional license (684312) issued by the Financial Conduct Authority (FCA).

For UK clients, opening a Pepperstone account is therefore done through the UK branch.

This implies that European investment regulations will be adopted for UK clients.

Among the most important European legislative measures to protect the investor we have:

- The European Deposit Guarantee Scheme. This is a true trading account insurance that in the case of UK brokers (and thus Pepperstone EU Limited) covers up to €20,000 per client.

- Segregation of funds. According to this principle, client funds must be kept separate from those of the broker. In the unlikely event of the broker`s bankruptcy, no creditor of the broker could try to retaliate against funds deposited by clients.

In Pepperstone`s case, customer funds are segregated in Barclays accounts in the United Kingdom. - Negative balance protection. As a result of this legislative requirement, no customer can generate a loss on his or her account greater than his or her cash balance (i.e., what he or she has deposited in the account). Even in the event of unfavourable events for the trader, the broker is obliged to put in place a number of measures to prevent the generation of losses in excess of what is available in the account.

Pepperstone Account

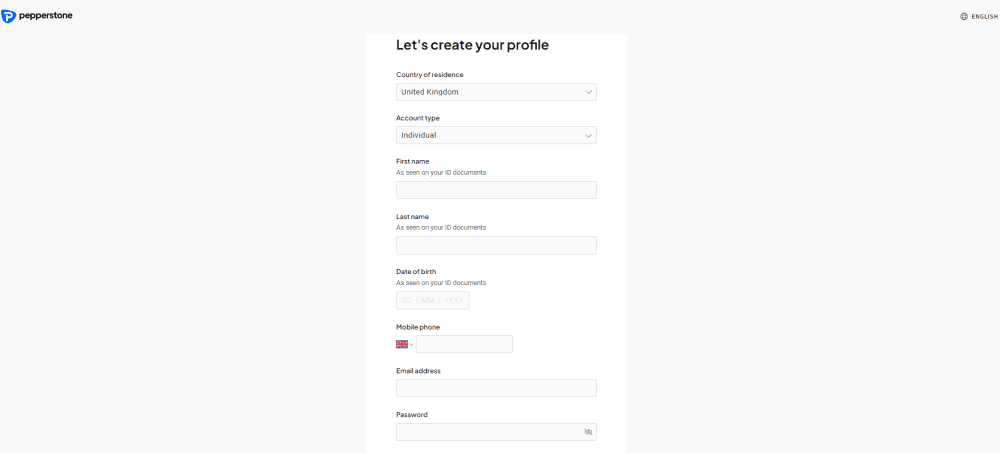

Opening an account is done in 10 minutes from Pepperstone`s website. The website is definitely well maintained, which simplifies the registration process.

The account opening process consists of the following steps:

1. Entering your biographical data in the online form.

2. Completion of the appropriateness questionnaire (to check whether we meet the minimum requirements to be able to trade online)

3. Uploading an ID and proof of residence no older than 3 months

» In what currencies can the account be opened?

You can open the account in 4 different currencies:

- Sterling (GBP)

- Euro (EUR)

- US dollars (USD)

- Swiss francs (CHF)

If you decide to open the account in one currency, let's assume GBP, and you make a deposit in another currency (e.g. dollars), the broker will convert and credit those dollars to GBP, additionally charging you a conversion fee. It is important, therefore, that the funds deposited are of the same currency as the Pepperstone account denomination.

» How many account types are there?

During registration, you will also have to decide what type of account to open. Pepperstone allows you to choose between two account types:

- Razor Account: an account that charges a fixed fee starting at $3.50 per execution plus a reduced spread.

- Standard Account: which has no commission but only an increased spread of 0.77 pips.

» Is a virtual account available?

Yes. Even before opening a real account, Pepperstone offers the possibility to quickly activate a

virtual account, so you can access one of the three platforms provided by the broker. In the demo account, you will be able to have €50,000 of virtual money, so you can simulate real trading operations.

The demo account expires 30 days after its activation. However, by contacting the help desk or your account manager, you can request to change both the base currency and the amount of virtual money in the simulated account.

» Money Deposits/Withdrawals

The payment methods accepted by Pepperstone are:

- Visa or MasterCard debit/credit card

- Bank Transfer

- PayPal

Money transfers by bank transfer can take up to 3-4 days to be credited, while those by credit card are instant.

» Is there a minimum deposit with Pepperstone?

Whether at the opening stage or at any time after account activation, Pepperstone does not require minimum amounts to fund your account. This is a point in Pepperstone`s favour if we consider that on average other Forex/CFD brokers impose a minimum deposit starting from at least 200 GBP.

It would still be advisable, however, to provide a consonant deposit for trading activity.

Products and Markets

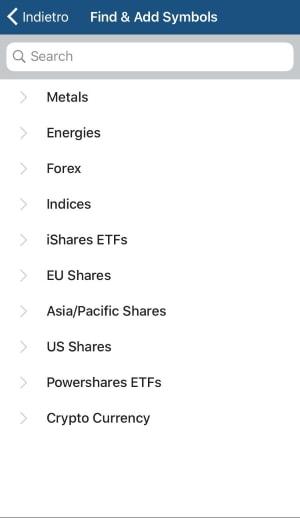

What financial assets can one trade on with Pepperstone? The broker allows five assets to be traded, exclusively through CFDs. These are:

- Forex: More than 61 tradable currency pairs, divided into major, minor and exotic. The maximum leverage allowed is 1:30.

- Indices: 25 of the world`s major indices, including DAX, NASDAQ and S&P. The maximum leverage allowed is 1:20.

- Stocks: more than 900 stocks (US, UK, AU, DE, HK) tradable only through MetaTrader5. European stocks are not present. The maximum leverage allowed is 1:5.

- Commodities: major commodities available including precious metals, energy products and soft commodities. The maximum leverage allowed is 1:30.

- Cryptocurrencies: you can trade Bitcoin, Bitcoin Cash, Ethereum, Dash and Litecoin. Other cryptocurrencies are available through CFDs. The maximum leverage allowed is 1:2.

We report the possibility with Pepperstone to trade micro-lots (0.01). Thanks to micro lots, it is possible to trade even with small capital (to open a micro lot on the EUR/USD currency cross, for example, will be enough to have a margin of about 330€).

Pepperstone also allows both scalping and hedging.

» Financial leverage

As Pepperstone Limited is a UK-licensed broker, in accordance with ESMA rules, the maximum leverage offered to European clients is 1:30.

Only should you qualify as a professional client, then the maximum leverage can go up to 1:500 for Forex and up to 1:200 for other asset classes.

To qualify as a professional client you have to meet certain requirements such as having a portfolio of financial instruments of at least 500,000 euros and having made at least 10 transactions per quarter, in the last four quarters.

Trading Fees and Costs

We have thoroughly analyzed both Pepperstone's commission and cost structure and have come to the conclusion that this broker offers particularly advantageous economic conditions to its clients, especially when compared with those of other leading CFD brokers.

When choosing a broker, a trader should pay special attention to both the costs of trading operations and the costs of maintaining an account.

For trading, the day trader and scalper will need to turn their attention to the commissions and spread charged by the broker.

The trader, on the other hand, who maintains overnight positions will have to consider -in addition to commissions and spreads - the swap rates.

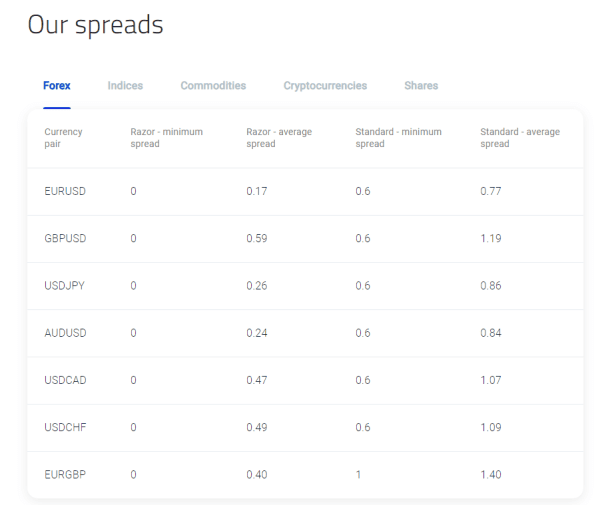

As mentioned in the section on account types, Pepperstone allows a choice between an account with tight spreads but an entry/exit fee (Razor account) and an account with wider spreads but no fees (Standard account).

If we consider the Standard account, the average spread found on the EUR/USD currency pair is 0.77 pips. On the EUR/GBP currency pair, on the other hand, it is 1.41 pips.

These spreads are lower than the industry average and show that Pepperstone is particularly competitive on the commission side.

The Razor account has different commission costs depending on whether you use the MT4/MT5 platform, cTrader, or TradingView.

Using MT4 or MT5 the commission for 1 lot is $3.50 or €2.60 depending on the currency of the trading account.

With cTrader, on the other hand, the commission is 7 units of the first currency of the pair you are trading on (e.g. on EUR/USD the commission will be €7).

If you are trading equity CFDs the above does not apply. Pepperstone charges a fixed commission of $0.02 per share traded, whether buying or selling.

For swap rates, on the other hand, Pepperstone applies tom next rates, procured from a top-tier global investment bank. The swaps adopted by Pepperstone are thus in line with the market with other brokers.

It should be remembered that while for short positions the swap rate is favorable to the trader, for long positions the swap is negative and is a cost to be taken into account for overnight trading.

What, on the other hand, are the costs of maintaining a Pepperstone account? Recall that opening and closing the account is free of charge.

There are no inactivity fees on the account (unlike many CFD brokers that charge fees on dormant accounts).

Withdrawals and deposits of money are also free. Thus by using credit cards or wire transfer, no fees will be charged and there will be no limit of any kind.

In light of the above, Pepperstone offers a zero-fee account with no hidden fees. The commission structure is equally convenient.

Overall then, Pepperstone is one of the most convenient brokers with which to trade transparently.

Trading Platform

Pepperstone allows trading through 4 trading platforms. These are platforms developed by third-

party software houses and they are the cTrader, TradingView and MetaTrader 4 or MetaTrader 5.

In our opinion, of the three platforms the best performing is the cTrader and it is this one that we

tested in this review.

» The cTrader

The cTrader is the trading platform developed in-house by Spotware. It exists in both web and desktop versions. It is also designed in the form of an app for iOS and Android operating systems.

The discriminating factor in choosing either the web version or the desktop version essentially lies in the fact that the desktop version is the most comprehensive version and is highly customizable.

The web version is a streamlined version and not very customizable, but it has the advantage of being launched from any browser, without having to be installed on the computer.

From both web and dekstop, cTrader allows the following activities to be performed:

- Doing manual trading

- Doing automatic trading

- Doing copy trading

The cTrader presents itself as a comprehensive yet intuitive platform. Although there are many tools and features, after only a few sessions you already gain some mastery with it. From our point of view, cTrader has far better graphics than MT4 and MT5, plus it is definitely more user-friendly.

In the upper left part is the Watchlist, where you can create your own list of favorite tools.

As a platform language you can set English or 20 other languages.

In the middle part we find the area for charts. On each chart we can apply indicators or geometric tools, as well as set a timeframe from 1 minute up to 1 month.

Right-clicking on the chart and choosing Create New Order will open a new position.

Again by right-clicking on a particular value, Alerts can be entered. If the price is reached, a popup window will appear on the computer screen.

At the bottom we find the Portfolio summary. Here we will find the open positions, pending orders, order history, available balance, and P&L.

For each open position there is an option to make a quick close by clicking on the Close button.

» Research and analysis

Searching for tradable instruments can be done in the following ways:

- By searching for the name, ticker or ISIN of the instrument in which we are interested

- By consulting lists of instruments, broken down by asset.

A limitation of cTrader can be seen in the lack of a section with the best/worst of the day or market

movers. Instead, if you want to use a screener on the cTrader you will need to download specific

plugins from the official ctrader.com website.

» Order types

Order entry can be done in three ways:

- Right-clicking on the chart of the instrument we want to trade and choosing to Create New Order.

- By completing the order entry form on the right side of the platform, after searching for the

instrument we want to trade. - By single-clicking or double-clicking by activating the QuickTrade mode.

The order types available are:

- Market order

- Limit order

- Stop order

- Trailing stop order

- Limit Stop Order

Both a Take Profit and Stop-Loss order can be linked to the main order. The system will show the potential gain/loss and the change in the cash balance, upon the occurrence of each of the conditional orders.

» cTrader Copy

One of the most interesting features of cTrader is the cTraderCopy, a copy trading service. The service allows both to make one's own strategies available and to copy those of other traders.

In the latter case, once we have identified the strategy we intend to replicate, we will need to transfer funds from the main account to a secondary account.

In this secondary account, the strategy we have chosen to copy will be replicated.

The main advantage of this service lies in the fact that at any time we can abandon the strategy, with the funds being able to immediately return to our main account.

» cTrader Automate

More advanced traders can connect external APIs to cTrader through the cTrader Automate feature.

Using the c# language, one can create automated strategies for algorithmic trading but not only.

Through a robot, one will be able to backtest trades, create custom indicators, and automate the

entire trading activity.

» Trading from mobile

The cTrader is also available as an app for smartphones and tablets. The app can be downloaded on both iOS and Android devices.

It basically retains all the functionality of the web and desktop versions, although in our opinion it

loses some intuitiveness, probably due to the fact that the app is not customizable in any way.

In any case, the main functions are replicated on the app as well: from order types to alerts and

chart analysis.

For those who do not have the ability to connect from the computer, the app is an excellent alternative.

Customer Support

Pepperstone provides customer support through 3 channels:

- Chat

- Phone

In all three cases, assistance is provided in English (or other languages of your choice) and the service is available 24 hours a day, Monday through Friday.

Of the three channels available, the fastest one is definitely the live chat service. In a matter of

seconds, one gets in touch with one of the operators and is able to receive assistance and have our questions answered.

Less rapid but equally efficient is the service via telephone. One can choose to contact a toll-free number or a landline number with a UK area code. In all 5 of our attempts to phone Customer Service, we received an answer within the first two minutes.

In contrast, email requests take several hours to be processed by Customer Service. At worst,

the response is obtained within 24 hours of sending the email.

One aspect in Pepperstone`s favour is the possibility of being supported by an Account Manager, who will provide any kind of personalized assistance to the client and will follow the client throughout the investment process.

Overall Rating

Pepperstone is an STP broker specializing in Forex and CFDs. Being an STP broker means not acting as a counterparty in transactions: Pepperstone simply forwards clients' orders to its liquidity providers in search of the best price conditions.

This setup allows the broker to act with transparency and not find itself in situations of potential conflict of interest.

At the safety level, Pepperstone is licensed and supervised by seven very strict bodies, including Australia`s ASIC and FCA. This means that the broker must comply with a set of regulations designed to ensure transparency and soundness.

Ease of use is one of the most favourable aspects of Pepperstone: The website is certainly user-friendly, the account opening is quick and easy, and the platforms are suitable even for novice traders.

Cost-wise, Pepperstone is undoubtedly one of the most affordable brokers around. Commissions stay below average, while the account has no fees, even in case of inactivity.

One limitation of Pepperstone can be seen in the small number of assets and products that can be traded, only through CFDs. Because of the presence of swap rates, it is ideal for short-term trading.

In conclusion, we consider Pepperstone a transparent and reliable broker to trade with. The absence of a minimum deposit and the possibility of opening a virtual account allows you to try the Pepperstone account without any strings attached.

*Investments in securities and other financial instruments always involve the risk of loss of capital. Past performance does not guarantee future returns.