Summary:

- Regulated broker based in the European Union

- Minimum investments starting from €1

- Automatic investments offered

- Bitpanda Card to spend cryptocurrencies

![]() Pros:

Pros:

- Regulated broker based in the European Union

- The minimum deposit starts from £1

- Fractional shares offered

- Bonuses and promotions for customers

![]() Cons:

Cons:

- No option to invest with leverage

- Limited cryptocurrency portfolio compared to other brokers

- Forex and leveraged CFDs not available

- Can invest in stocks and ETFs only through derivative

Bitpanda is an Austrian broker based in Vienna. Founded in 2014, Bitpanda has established itself in international markets as a smartphone app to trade cryptocurrencies, stocks, bonds, commodities and ETFs. Initially, it was possible to trade only cryptocurrencies on Bitpanda. In 2021, this popular Austrian broker managed to reach 2.7 million users as well as a company valuation of over 4 billion dollars.

In this review, we will take a look at how the Bitpanda platform works, along with all assets available for trading and the costs and commissions applied by the broker. Additionally, we will analyze customer reviews and opinions on the services offered by the Austrian broker, including our opinions and final judgment on the convenience of trading with Bitpanda.

Safety

Let's start with security, one of the most important aspects to analyze when choosing a broker.

Since it is based in Vienna, Bitpanda operates in compliance with the MiFID II legislative framework that regulates the capital market. The legislation provides a set of protections guaranteed for the UK retail investor:

- The European deposit guarantee scheme, which guarantees coverage to traders equal to compensation of up to £20,000 (in cash or in financial assets) in the event the broker is unable to refund its clients (for instance in case of default)

- Segregated Fund: the separation of client funds from those of the broker; thanks to this, if the broker defaults, no creditor will have the opportunity to claim against client funds

- Negative balance protection: this allows clients to be protected from a loss on its account that exceeds the cash balance (i.e. the total amount of money into the account).

Bitpanda operates under the supervision of the Austrian Financial Market Authority (FMA), the Austrian financial market supervisory body.

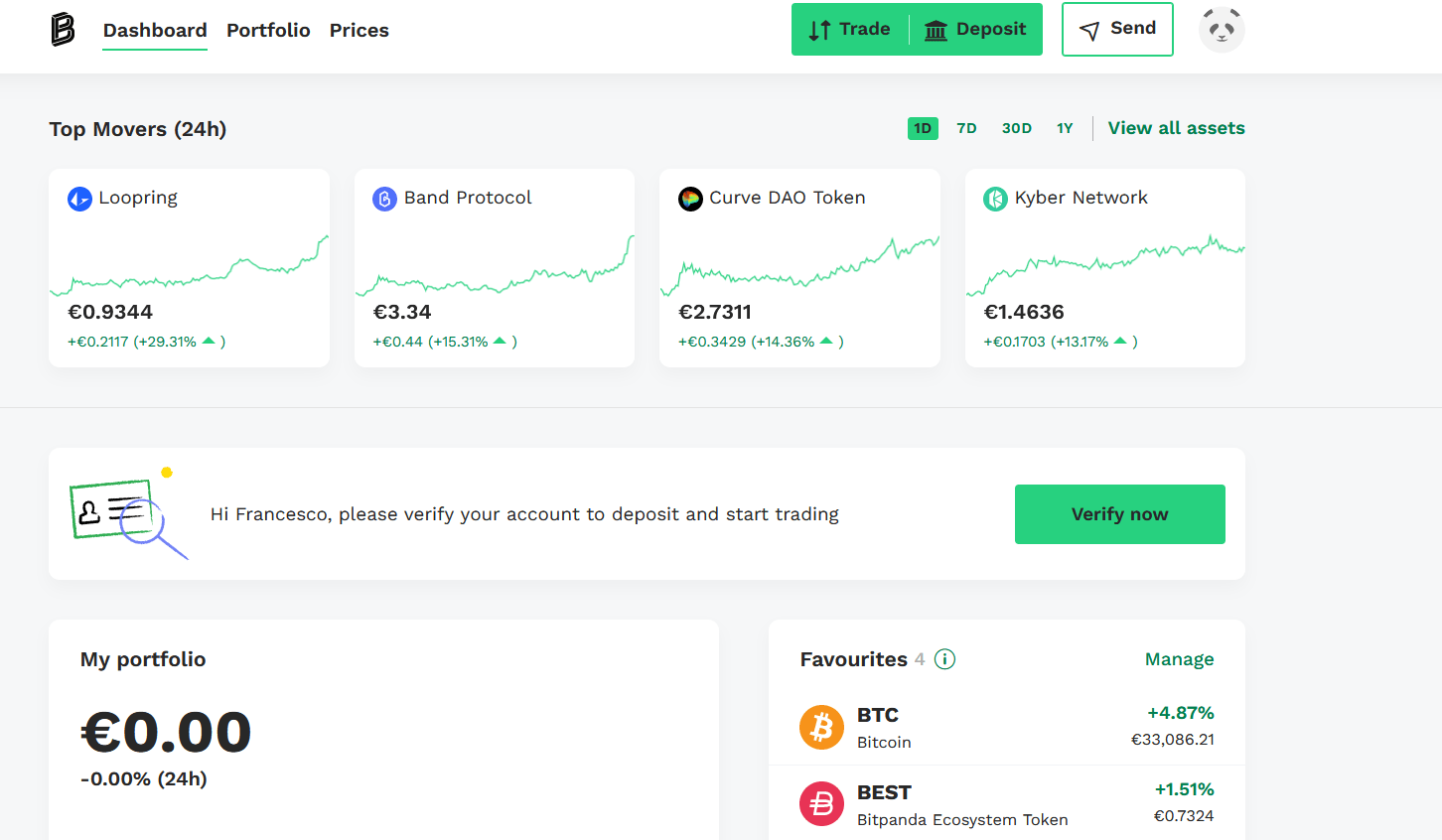

Bitpanda Account

Let's see how to open an account on Bitpanda

Opening a Bitpanda trading account involves three simple steps:

- Enter personal details: name, surname, telephone number, etc.

- Fill out a short questionnaire (6 questions) required by European anti-money laundering legislation; in the questionnaire, the user will be asked questions about their employment, monthly income, investment objectives, etc.

- Confirm your identity through facial recognition and identification card/passport

After account confirmation, the user can make their first deposit of funds and start trading with the financial assets available on the platform.

The minimum deposit required by the platform is 25 GBP (the same minimum amount required for withdrawals).

Here are the payment methods accepted by the platform:

- Wire transfer

- Credit card (VISA and Mastercard circuit)

- Money/cryptocurrency transfer via Bitpanda

The last bullet point refers to Bitpanda Pay. Bitpanda Pay allows you to send money to any IBAN in the UK and European Union through a Bitpanda verified account. In addition, with Bitpanda Pay it is possible to pay bills and send money.

Last, below are the currencies accepted by the broker for payments:

- Euro (EUR)

- Dollar (USD)

- Swiss Franc (CHF)

- British Pound Sterling (GBP)

- Turkish Lira (TRY)

Products and Markets

On Bitpanda, the trader has a variety of financial assets available for negotiation.

Let's have a look at them:

- Cryptocurrencies: it is possible to invest in Bitcoin, Ethereum, Polkadot and other cryptocurrencies starting from £1 (with a minimum deposit of £25)

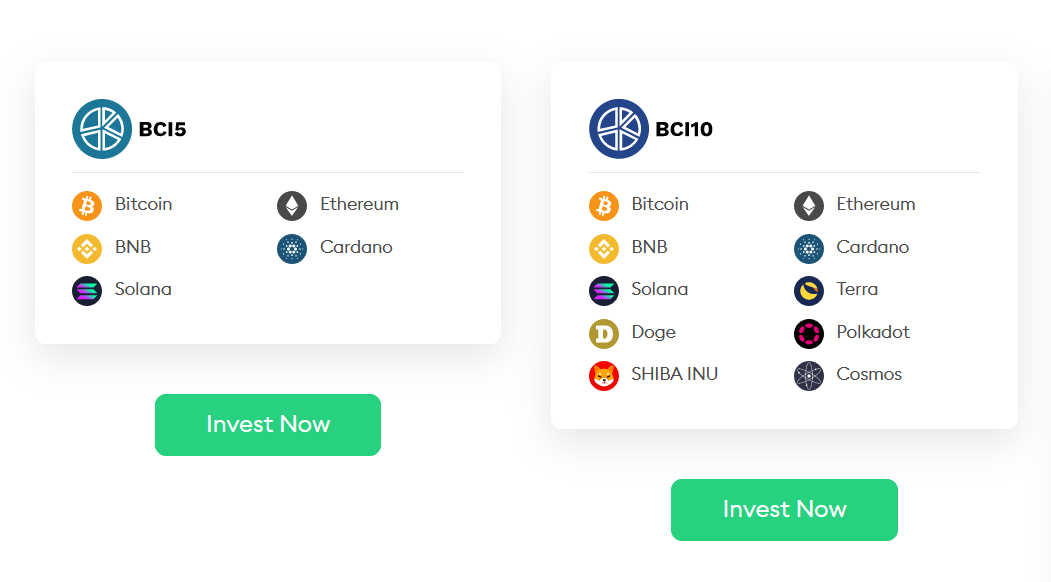

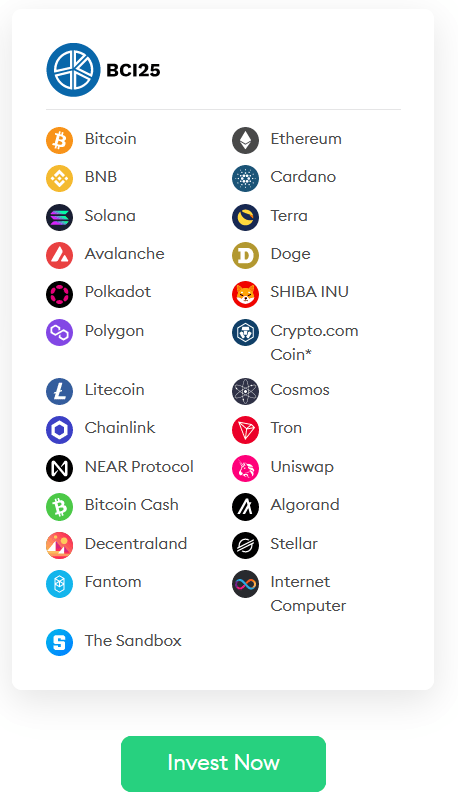

- Cryptocurrency Indexes*: on Bitpanda it is possible to invest in the entire cryptocurrency market thanks to Bitpanda Crypto Index, which allows the user to invest in a diversified crypto portfolio containing 5 (Bitpanda Crypto Index 5), 10 (Bitpanda Crypto Index 10) and 15 (Bitpanda Crypto Index 15) different cryptocurrencies

- Shares and ETFs: with Bitpanda Stock, the user can invest in fractional shares, enabled by entering into a contract that replicates the underlying share or ETF (therefore it is a derivative instrument). Equities and ETFs are also available for trading starting from £1

- Metals: Users are able to invest in gold, silver and other precious metals starting from £1. The purchased bars are stored in a highly protected vault in Switzerland.

At the time of this review, it is not possible to invest using leverage on Bitpanda.

* Here is the composition of the cryptocurrency indexes offered by Bitpanda:

Trading Fees and Costs

Bitpanda applies maker fees (when the trader opens an order that is not yet on the market) of 0.1% maximum, and taker fees (when the trader opens an order that corresponds to another on the market) of 0.15%.

Zero commissions on trading stocks and ETFs.

Commodities, on the other hand, have "storage" fees of 0.0125% on gold and 0.0250% on silver, palladium and platinum (on a weekly basis).

There are no deposit fees, but there is an ATM withdrawal fee of £1.50. For payments and ATM withdrawals in other currencies, Bitpanda charges an additional foreign exchange fee of 2.5%.

Last, there is a 0.95% commission on payments made with Bitpanda Pay.

Trading Platform

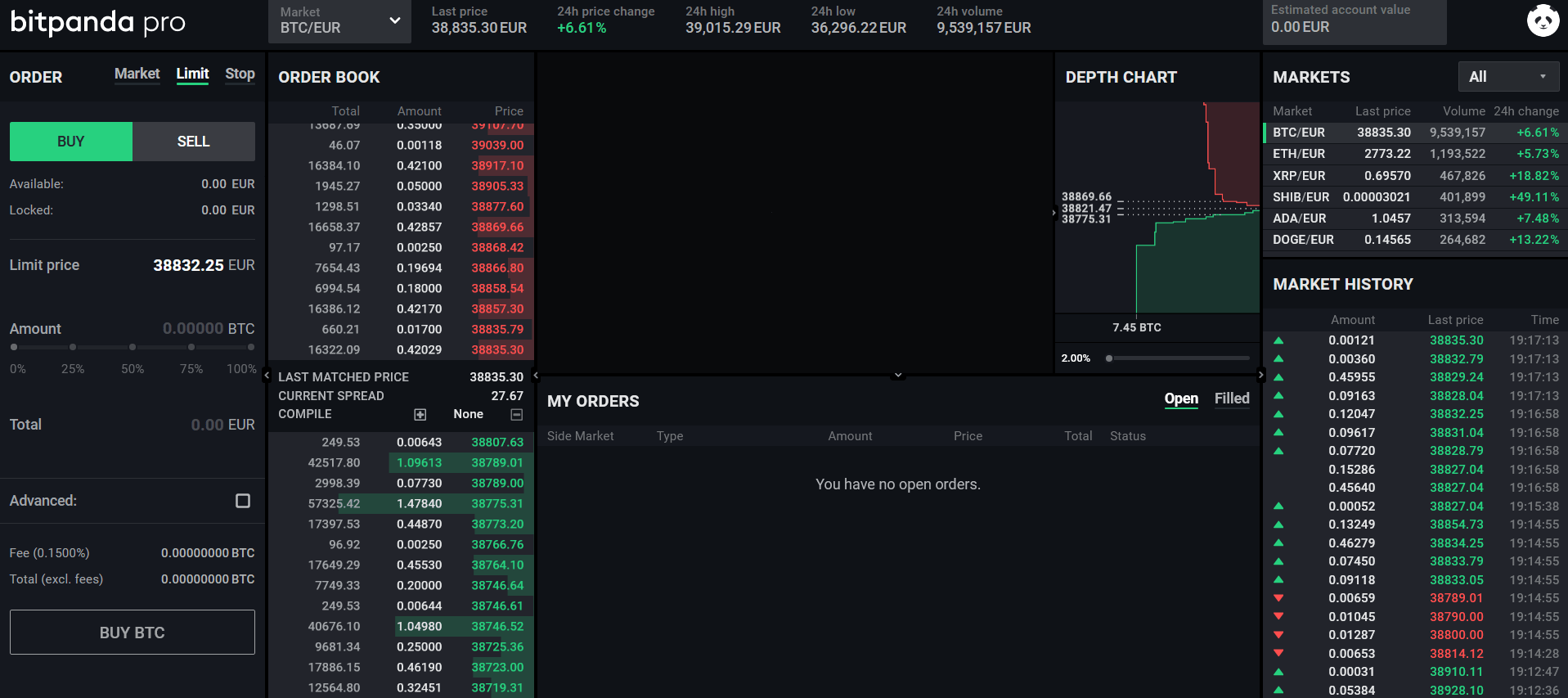

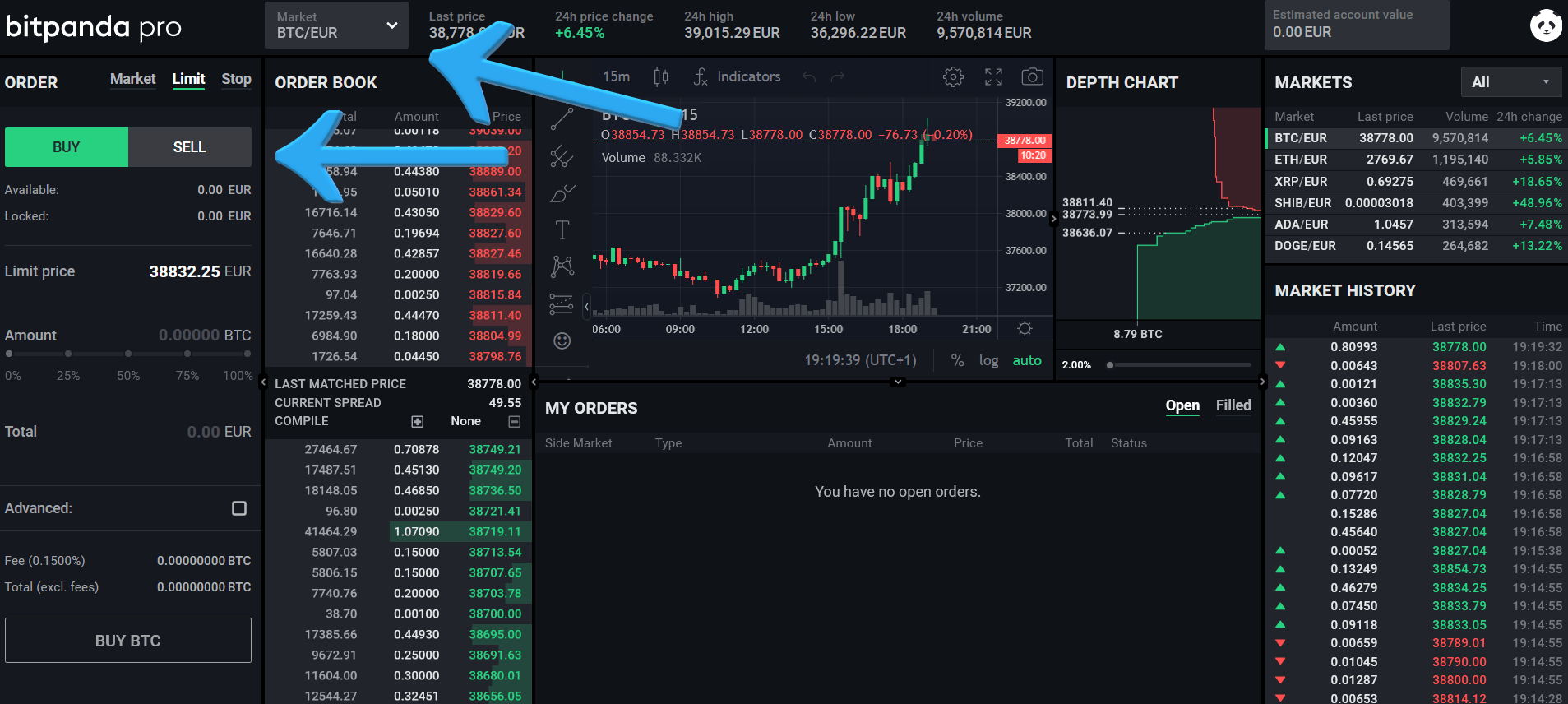

Bitpanda provides the user with two different types of online trading platforms: Bitpanda and Bitpanda Pro.

Bitpanda is the basic platform. Simple and intuitive, this platform is designed for investors with little experience or those who are entering the world of online trading for the first time.

Bitpanda Pro, on the other hand, is the platform dedicated to more experienced traders, investment professionals as well as financial institutions.

» How to Place an Order on Bitpanda Pro

Placing an order on Bitpanda Pro is very simple. Just select the financial product you intend to invest in, indicate the investment amount, choose the type of order and confirm the operation.

» Order Types Available on Bitpanda Pro

- Stop orders

- Limit Orders

- Market Orders

Customer Support

Here are the channels available to users to communicate with the broker:

- A form through which it is possible to make a request for assistance classified by the specific problem encountered

- A help desk with articles on procedures, commissions, deposits and withdrawals, etc.

- An FAQ section divided into two columns: one dedicated to Bitpanda users and one dedicated to users who use the Bitpanda Pro platform

- Bitpanda customer support is available in seven languages: English, Italian, German, French, Spanish, Polish and Turkish.

Bitpanda Bonuses and Promotions

Bitpanda offers three interesting promotions available to users:

- Tell a friend: the user invites friends and/or relatives through a dedicated link and earns £10 for each subscription generated

- BEST: the user fills out a questionnaire on financial knowledge and, if they answer correctly to most of the questions, they earn £5 in BEST, a cryptocurrency that can be traded on the market

- Become an affiliate: the user invites others to Bitpanda and earns commissions with each new registration

Overall Rating

We are now at the end of our review of the services offered by Bitpanda.

Bitpanda is a transparent and regulated broker that operates under the supervision of the Austrian Financial Authority and acts within the framework of European legislation.

We really like the offering of two platforms, a simpler and more intuitive one for beginners, and a professional one for more experienced traders, professional investors and institutions.

We find the option to invest in fractional shares through Bitpanda Stocks (albeit derivatives and not real shares), as well as the offering of three cryptocurrency indices to ensure diversification within the market a very interesting option. The minimum investment threshold is also very inclusive: £1 (with a minimum deposit of £25).

Bitpanda has well-structured customer service, allowing users to find a plethora of information to resolve any issues, and the help desk to contact Bitpanda assistance by filling out a form.

Last, the promotions offered by Bitpanda represent a great example of customer loyalty and customer advocacy, with excellent marketing leverages that allow the Austrian broker to differentiate itself from other competitors in the market.

In regard to customer reviews of Bitpanda, we highlight three platforms where you can find feedback and reviews about Bitpanda services:

- Trustpilot: Bitpanda scores 4.4 out of 5, with 86% of customers expressing satisfaction with the services offered by the Austrian broker, with over 7,000 reviews

- App Store: Bitpanda's 4.8 out of 5 score on the Apple Store, which has over 9,000 reviews

- Google Play Store: The lowest score for Bitpanda is on Google Play Store: 3.4 out of 5, with 26,000 reviews

*Investments in securities and other financial instruments always involve the risk of loss of capital. Past performance does not guarantee future returns.