Summary:

- 2 types of account available

- Stocks, ETFs, bonds and options are tradable

- Saving account with 3,89% (EUR) and 5,31% (USD) of daily interests

- Interest on cash not invested in the account

![]() Pros:

Pros:

- Company listed on NASDAQ and authorised in Europe

- Zero account opening, maintenance and closing costs

- D-account with interests of 3.89% (EUR) and 5.31% (USD)

- Deposits and withdrawals also by credit card

![]() Cons:

Cons:

- CFDs not available

- 18% margin trading fees

4.8

4.8

Freedom24: what is it and how does it work?

In this review, we have tested and analyzed Freedom24, a new online broker that has recently made its debut in the UK landscape. Freedom Finance is not a broker similar to other investing brands. It is true that, like many of its competitors, it allows you to trade shares, ETFs, bonds and derivatives. However, Freedom24’s range of services goes beyond the competition.

We can affirm that Freedom24 plays a crucial role in the ongoing process of democratization of finance, where investing is within everyone's reach and without barriers as in the past.

Another service offered by Freedom Finance is the D account. This is a savings account (denominated in EUR or USD) that offers fixed returns at a rate of up to 5,89% per annum.

In the next sections of this review, we will examine the topics briefly mentioned so far in more detail. We will see what Freedom Finance is and to whom it is aimed, what investment services it offers and which platforms it makes available for its users.

In the final paragraph, you will find our opinions on Freedom24, which will help you understand if this broker may be the right choice for you to invest.

Who is Freedom24 for?

Freedom24 is an online broker that allows you to access the main global markets to buy and sell financial instruments. A Freedom24 account is ideal for anyone who wants to:

Trade on stocks, ETFs, bonds, futures and options, listed on regulated markets

Get a fixed return in EUR or USD through the daily saving account (D-account)

Invest with minimal capital

The Freedom24 account is therefore aimed at investors who intend to invest independently. The latter will have to determine how and where to invest; Freedom Finance will simply provide cutting-edge tools to do so.

Given the degressive fee structure, users who invest large capital will be able to receive a reduction on the commissions of stocks and ETFs, against a fixed monthly fee. Those wishing to invest with low capital will start from the lowest commission band, which is still quite affordable ($/€0.02 for each share or ETF traded) when compared to the fees charged by the main brokers in the UK.

Why choose Freedom24 over another broker?

No minimum deposit is required to start trading

The platform is simple to use and requires no high-level skills

Unlimited free trades for the first 30 days after account activation

Safety

Freedom Holding Corp. serves its European users through the Freedom Finance Europe Ltd. branch. It is supervised by three regulatory bodies: CySEC (Cyprus), BaFin (Germany) and SEC (United States).

Freedom Finance Europe Ltd is based in Limassol, Cyprus. Therefore, it falls under the European Union MiFID II regulation for the regulation of financial markets.

Below is the note on the broker's website: "Freedom Finance Ltd provides financial services in the European Union in accordance with the CIF 275/15 license for all types of business required by companies, granted by the Cyprus Securities and Exchange Commission ( CySEC) on 20.05.2015 ".

Given that Freedom Finance is based in the European Union, UK investors can benefit from important protections for the investor provided for by European legislation, namely:

- The European deposit guarantee scheme, e. a guaranteed coverage to traders equal to an indemnity of up to €20,000 (in cash or financial instruments) in the event that the broker is unable to return them to users in person (for example in a case of default);

- The segregation of funds: the separation of user funds from those of the broker, so that, in the event of failure of the trading platform, no creditor of the broker will have the option to claim back funds deposited by users;

- Negative balance protection: this protection allows users to avoid generating a loss on their account that exceeds the cash balance (i.e. the total amount of money paid into the account).

Since October 2019, Freedom Finance has been listed on the NASDAQ under the ticker FRHC.

The security has a Standard & Poor's rating equal to B, that is, with a significant speculative characteristic and an issuer able to meet its financial obligations, albeit with uncertainties that could affect its financial commitment.

Freedom24 Account

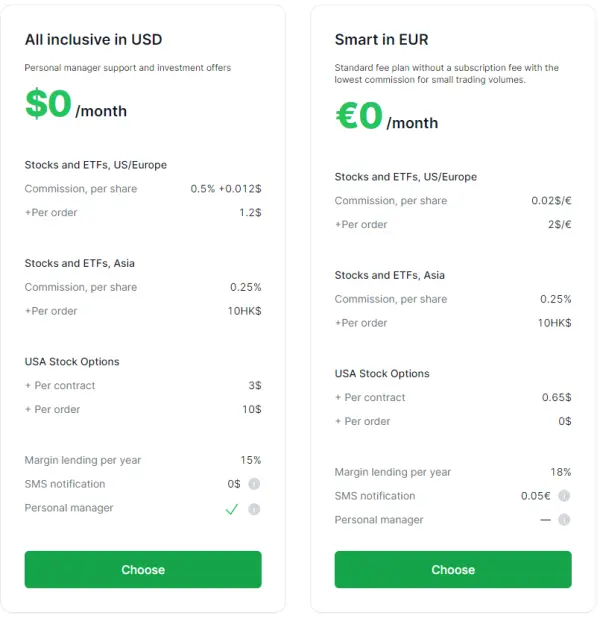

Freedom24 offers two types of account:

Smart account in EUR: 0€ monthly fee and no transaction discounts

All inclusive in USD: 0€ monthly fee and intermediate transaction discounts

Freedom24 also offers users the possibility to open a cumulative D-account denominated in EUR or USD, to keep their money at an interest of 3,89% (EUR) or 5,31% (USD) per annum and with interests calculated daily.

Freedom24 guarantees considerable flexibility in managing money and deposits to and from D-accounts. The user can easily transfer funds from the D-account to the trading account in a couple of clicks or carry out any trading operation.

On the other hand, if the trader has generated a profit and wants to wait for a possible market stagnation, he can transfer money from the trading account to the savings account and earn interest.

» Account Opening

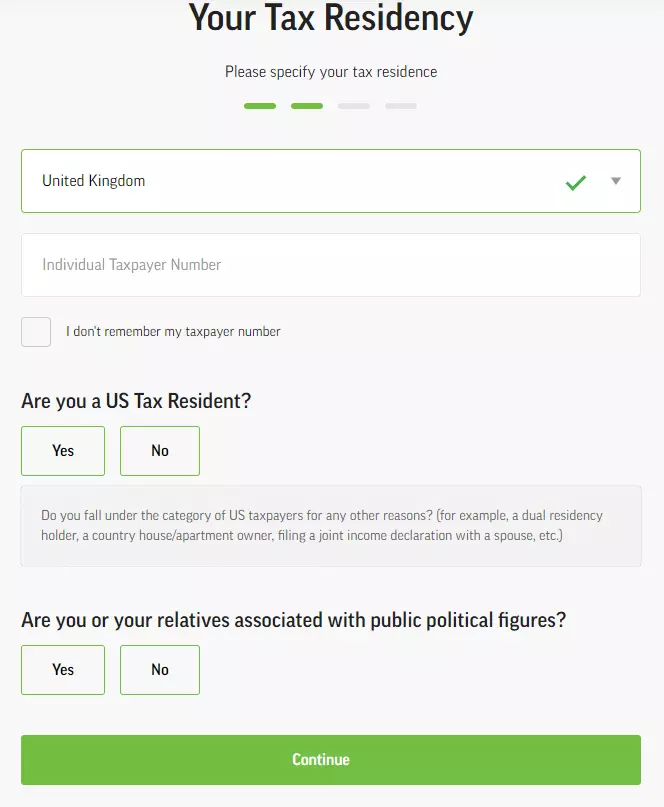

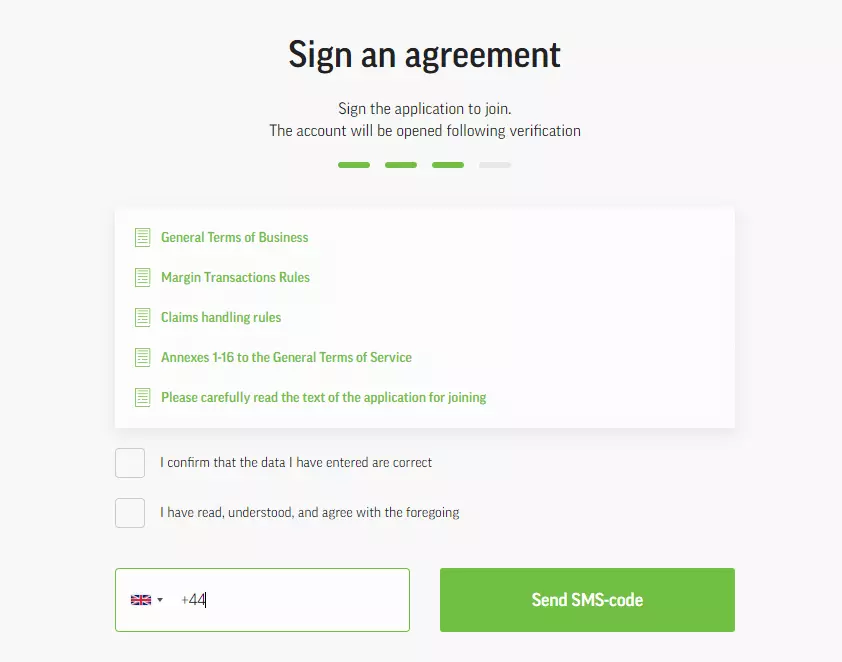

Opening an account on Freedom24 takes place entirely online and consists of the following steps:

1. Click on the Registration button at the top right of the menu and enter your data

2. Upload a scanned copy of an identification document as well as a document showing your residential address, plus the taxpayer number in the country where you have your tax residence.

Furthermore, the user will be given a risk tolerance survey questionnaire to define their investor profile, with questions related to the investment time horizon, investment objectives, knowledge and experience with various financial instruments, savings capacity, etc. The questionnaire complies with Mifid II regulations for the regulation of financial markets to protect investors.

The duration of the registration process for a Freedom24 account is approximately 10-15 minutes, at the end of which the platform will make a personal Private Area available to the user and he will be contacted by email with all the necessary information.

While the account opening is being formalized, the user can access the platform through a virtual account, using the credentials created in the registration phase for login.

» In which currencies can the account be opened?

It is possible to open a Freedom24 account with USD or EUR currency. Within the Personal Area, it will be possible to manually convert the deposited GBP into US dollars (and vice versa).

» Deposits & Withdrawals

Freedom24 users can make deposits and withdraw funds from their accounts by bank transfer or by credit/debit card. There is a 7e fee for each withdrawal as well as a $60 deposit fee for the reversal of securities.

No minimum deposit is required with Freedom24.

Products and Markets

Freedom24 allows clients to invest in more than one million financial instruments, including stocks from Europe and the United States, ETFs and OTC.

Here is the list of stock markets that you can invest in via the Freedom Finance trading platform:

NYSE

NASDAQ

Hong Kong Stock Exchange (HKEX)

London Stock Exchange

Deutsche Börse

Borsa Italiana

Kazakhstan Stock Exchange (KASE)

Moscow Exchange (MOEX)

Over 1,500 ETFs from issuers such as iShares, Vanguard and BlackRock are available with Freedom24.

Trading Fees and Costs

The commissions applied by Freedom24 have a degressive structure and depend on the type of account chosen by the client:

Smart account in EUR: 0.02€/$ per share, with a minimum fee of 2€/$ per order; SMS notification fee of 0.05€

All inclusive in USD: 0.5% + 0.012€/$ per share, with a minimum fee of 1.20€/$ per order; SMS notification fee of 0€

Additional Fees:

3% on payments made by bank card (provided for each user account)

€7 on every cash withdrawal

The custody of securities, on the other hand, is free.

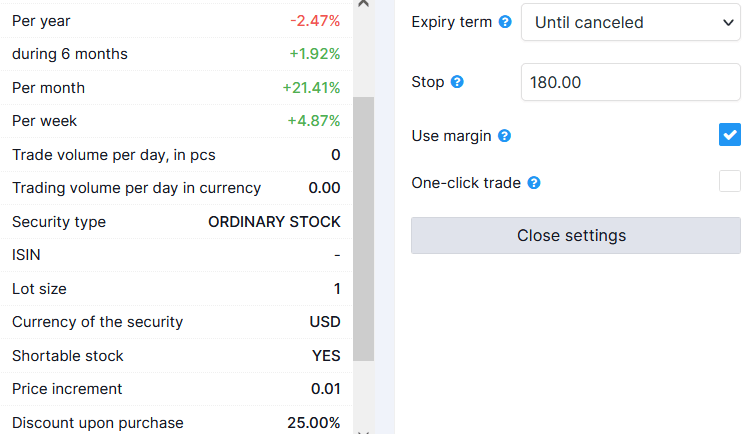

Freedom24 allows you to use margin (i.e. financial leverage). The annual interest rate applied to the margin used is 18%.

Trading Platform

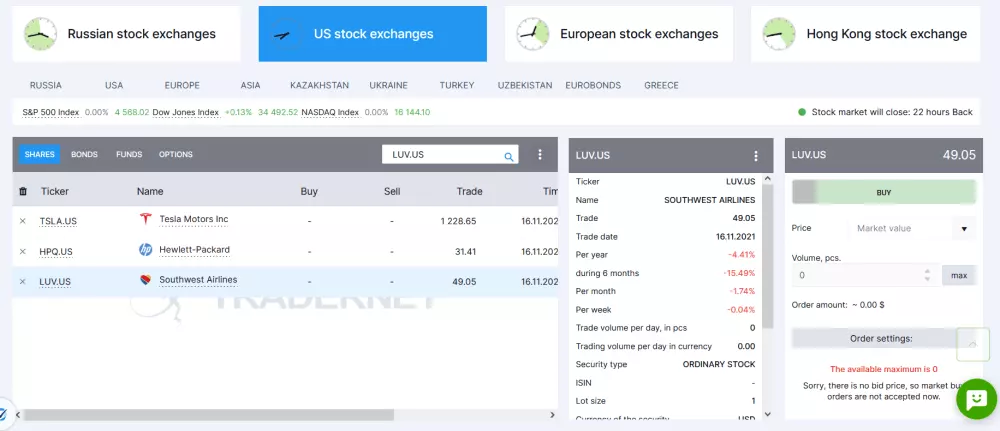

Freedom24 allows you to operate through two proprietary platforms: a web platform and an app available on iOS/Android/Huawei

We tested both platforms - here's what we found and our opinions on both.

To use the Freedom24 trading platform you will not have to download and install any software on your computer. To access the web platform, simply log into the Personal Area from the Freedom Finance website.

At this point, you will need to go to the Web Terminal section and you will already be inside the trading platform. The web platform that you will find yourself in front of appears immediately with a clean and easy-to-use interface.

In the upper section you find the available markets (American, European, Russian and Hong Kong).

The search can also be done through the search bar, through which you can find a product by entering its name, ticker or ISIN.

On the right side we find the interface for entering orders.

You can choose between a daily and a continuous order. The available order types are:

- Market Order

- Limit Order

- Stop Order

During this step you can also indicate the intention to use the margin, or a loan from the broker to execute the operation.

The offer of charts for each financial instrument on the platform is interesting.

In fact, on the dedicated page you can customize each chart, adding a multitude of indicators and/or geometric tools, thus having the ability to conduct a technical analysis of stocks.

Promotions

There are currently no active promotions.

Customer Support

Freedom Finance customers have several channels available to get in touch with the broker's customer service, which we list below:

- Live chat on the website

- Speak with an operator via Whatsapp, Viber, Telegram, Instagram and Facebook

- Telephone: +49 30 863 21 84 0 for German customers and +357 25 25 77 85 for international customers

- Email:

This email address is being protected from spambots. You need JavaScript enabled to view it. for UK customers - FAQ section with general questions and answers

Extremely interesting is the Freedom Finance training center made available to users, where it is possible to find investment ideas by asset, sector, market momentum. Each investment card will present valuable information that will help the user get an in-depth picture of the financial instrument, such as the potential return, risk level, target price, etc.

In this regard, Freedom Finance received a certificate of merit from Bloomberg for advice on Beyond Meat and Zoom Video shares, ranked by the popular financial newspaper at the top of the Bloomberg rating for the accuracy of the forecast.

Tax Regime

Not having its headquarters in the UK, Freedom24 for tax purposes is considered a foreign broker. As a result, the funds and securities held by Freedom Finance are considered financial assets held abroad.

Depending on the country in which you are a resident, there will be taxes to be declared and paid. For this matter, we suggest contacting a tax advisor to fulfil all your tax obligations.

Overall Rating

Within this review, we discovered the options of Freedom24, a new broker in the online trading landscape with great potential.

Also interesting is the offer of the D-account, a deposit account that offers returns in EUR or USD at an annual rate of up to 5,31%. This can be a good choice for those who do not want to take risks with investments but are satisfied with a lower but less risky return.

Freedom24 allows you to trade stocks, ETFs, bonds, futures and options. However, some tools such as CFDs are missing.

The markets to which you can have access are different: from Europe to the USA to Asia.

The platform through which to operate is decidedly user-friendly and intuitive. Due to its characteristics, it can suit both novice investors and those with experience in online trading.

Overall, therefore, our views on Freedom24 are positive. Although relatively new, this broker passes our tests, with flying colours, on safety, transparency and quality of the services offered.

We expect that over time it will be able to extend its offer to make it even more advanced and complete.

*Investments in securities and other financial instruments always involve the risk of loss of capital. Past performance does not guarantee future returns.